Opportunities often lie where others fear to tread. The oversold financial sector unveils a landscape ripe with undervalued gems awaiting savvy investors, akin to a hidden trove buried beneath the market’s surface.

The Relative Strength Index (RSI) serves as a dynamic compass, guiding traders through the turbulent seas of market volatility. A stock’s RSI below the 30-mark signifies potential undervaluation, hinting at a possible uptick in the near future.

Apollo Commercial Real Estate Finance Inc ARI

- Amid the ebbs and flows of the market, Apollo Commercial Real Estate Finance reported robust quarterly earnings on August 6. Despite a recent dip of 13%, the stock stands resilient near its 52-week low of $8.76.

- RSI Value: 25.60

- ARI Price Action: In Friday’s session, Apollo’s stock showcased resilience, closing at $8.89 despite the recent market turmoil.

- Insightful as ever, Benzinga Pro’s newsfeed remains a beacon in the tempest of market fluctuations.

Ready Capital Corp RC

- Ready Capital Corp weathered the storm, as Piper Sandler analyst Crispin Love maintained a Neutral stance on September 16. Despite a recent slump of 7%, the stock remains anchored near its 52-week low of $7.23.

- RSI Value: 29.84

- RC Price Action: Closing at $7.31 on Friday, Ready Capital’s stock held firm amid market turbulence, showcasing resilience in uncertain times.

- Charting the way forward, Benzinga Pro’s tool illuminates the path in the darkness of murky market trends.

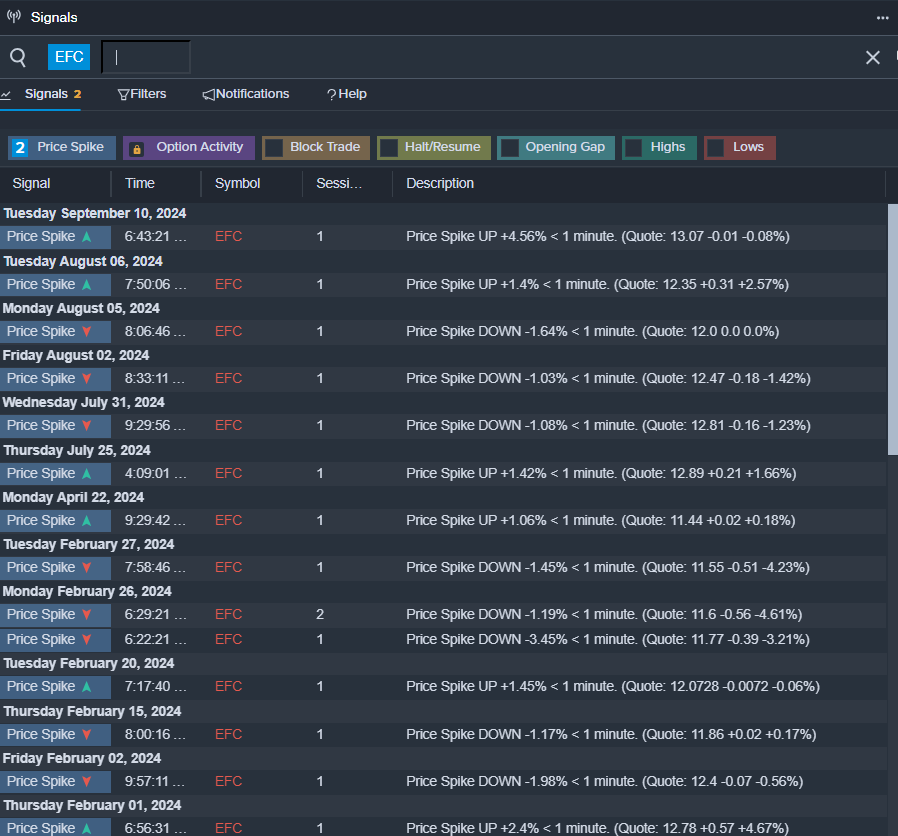

Ellington Financial Inc EFC

- Ellington Financial faced headwinds with weaker-than-expected quarterly results on August 6. Despite a recent downturn of 5%, the stock remains poised near its 52-week low of $10.88, awaiting a potential resurgence.

- RSI Value: 29.38

- EFC Price Action: Wrapping up Friday’s trading at $12.46, Ellington Financial’s stock held steady amidst market volatility, showcasing resilience despite recent challenges.

- Guiding investors through the haze, Benzinga Pro’s signals feature beckons towards the hidden potential in Ellington Financial’s shares.

Read Next:

Market News and Data brought to you by Benzinga APIs