Decoding Brokerage Recommendations for Cava Group

When considering investment decisions, the advice of Wall Street analysts carries weight in the minds of investors. These sell-side analysts influence stock prices through their recommendations on whether to buy, hold, or sell a stock. Such is the case with the current sentiment surrounding Cava Group (CAVA).

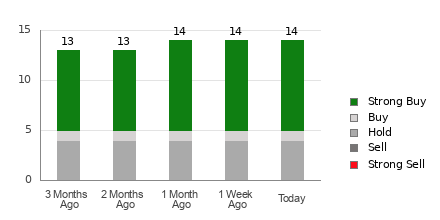

As per data aggregated from 14 brokerage firms, Cava Group has an Average Brokerage Recommendation (ABR) of 1.61 on a scale of 1 to 5, indicating a position somewhere between a Strong Buy and Buy. Among the total recommendations contributing to this ABR, 64.3% are Strong Buy and 7.1% are Buy recommendations.

Brokerage Recommendation Trends for CAVA

While these recommendations may turn the heads of investors, relying solely on them for investment decisions may not always yield desired outcomes. Studies suggest a limited success rate in using brokerage recommendations as the sole basis for stock selection.

Validating with Zacks Rank

Amidst the biased optimism of brokerage recommendations, the Zacks Rank emerges as a beacon of reliability. Contrary to the ABR, the Zacks Rank is a quantitatively-driven model that leverages earnings estimate revisions to predict stock performance.

The Zacks Rank, ranging from #1 (Strong Buy) to #5 (Strong Sell), offers investors a tool that can potentially outperform traditional brokerage recommendations. While analysts tend to issue more favorable ratings under brokerage pressures, the Zacks Rank focuses on earnings estimate trends, a key indicator of stock price movements.

Comparing ABR with Zacks Rank

While both ABR and Zacks Rank use a similar numeric range of 1-5, their methodologies vary significantly. ABR derives from brokerage recommendations, often influenced by vested interests, whereas the Zacks Rank hinges on earnings estimates, providing a more objective outlook for investors.

The Zacks Rank maintains a timelier and more balanced approach, aligning with changing business trends and reflecting amendments in earnings estimates promptly, unlike the somewhat dated nature of ABR.

Is CAVA a Sound Investment?

Considering the positive earnings forecast for Cava Group, with a 2.9% increase in Zacks Consensus Estimate for the current year to $0.25, analysts’ growing optimism toward the company’s earnings performance holds promise for potential stock appreciation in the near future.

Driven by favorable earnings estimate revisions and a Zacks Rank #2 (Buy), Cava Group stands as a potential investment opportunity for those seeking growth.

Historical Trends and Future Projections

Reflecting on the past performance of investments like Bitcoin during presidential election years offers insight into the potential returns for investors. With notable increases in recent years, Zacks predicts a further surge in the coming months, presenting an advantageous outlook for investors.

Investors aiming for significant returns should consider the historical trends and future projections provided by research firms like Zacks to make informed decisions.