FedEx FDX will give updated insight into the state of the delivery services market this week, with the leader in express shipping set to report results for its fiscal first quarter on Thursday, September 18.

Like UPS UPS, FedEx has experienced increased pressure on volume and costs as tariffs have weighed on shipping operations and demand.

Cross-border shipping has seen pronounced weakness in particular, and Wall Street will be looking for insight from FedEx in regard to how delivery services are faring following the termination of the de minimis trade exemption at the end of August, which allowed low-value imports under $800 to enter the country without paying duties or taxes.

FedEx & UPS’s Lackluster Stock Performances

With their stocks falling sharply this year, investors are certainly on edge about whether FedEx or UPS are still portfolio-worthy investments. To that point, despite the stellar +100% returns of the broader indexes in the last five years, FDX shares are now down a very subpar 7% during this period, with UPS stock dropping a grizzly 40%.

Image Source: Zacks Investment Research

FedEx’s Q1 Preview

Aforementioned, analysts will be closely monitoring the effects that the end of the de minimis exemption may have on FedEx, as UPS slightly missed its Q2 earnings expectations in July, stating the U.S. small package market was already unfavorably impacted by consumer sentiment that was near historic lows.

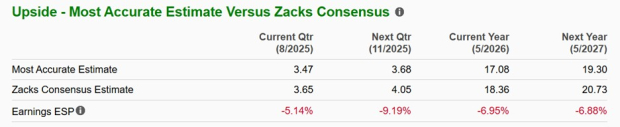

Based on Zacks’ estimates, FedEx’s Q1 sales are thought to have increased 1% to $21.78 billion compared to $21.58 billion in the comparative quarter. On the bottom line, FedEx’s Q1 EPS is expected to be up 1% as well to $3.65 per share versus $3.60 a year ago. However, it’s noteworthy that the Zacks ESP (Expected Surprise Prediction) suggests FedEx could miss earnings expectations with the Most Accurate and recent estimate among Wall Street having Q1 EPS pegged at $3.47 and 5% below the underlying Zacks Consensus (Current Qtr Below).

Image Source: Zacks Investment Research

Tracking FedEx & UPS’s Outlook

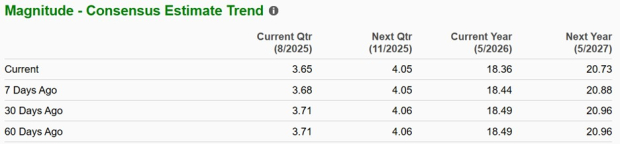

Despite slower growth, FedEx’s total sales are projected to increase 1% in its current fiscal year 2026 and are forecasted to increase another 4% in FY27 to $92.91 billion. FedEx’s annual earnings are also expected to rise 1% in FY26 and are projected to spike 13% in FY27 to $20.73 per share. That said, it’s noteworthy that FY26 and FY27 EPS estimates have continued to trend lower in the last 30 days.

Image Source: Zacks Investment Research

As for UPS, its FY25 sales are now slated to dip 4% to $87.51 billion from $91.07 billion last year. Optimistically, FY26 sales are projected to stabilize and slightly rise to $88 billion. UPS’s earnings are forecasted to fall 15% this year to $6.51 per share, although FY26 EPS is projected to stabilize and rebound 13% to $7.38. EPS revisions are slightly down for UPS in the last month as well, and are noticeably lower over the last 60 days.

Image Source: Zacks Investment Research

FDX & UPS Valuation Comparison

Trading under $100 a share, UPS stock may stand out compared to a price tag of over $220 for FDX, but both trade at around 12X forward earnings. Despite their lackluster stock performances, this is a steep discount to the benchmark S&P 500’s 25.5X, with FDX and UPS also trading at discounts to their decade-long medians of 13.9X and 16.8X forward earnings, respectively. Furthermore, both trade at less than 1X forward sales with the S&P 500’s average of 5.6X.

Image Source: Zacks Investment Research

FDX & UPS Dividend Comparison

What may be peaking investor interest in UPS stock is at current levels, it has a 7.81% annual dividend yield that towers over FedEx’s 2.57%. Still, both have yields that are well above the S&P 500’s 1.11% average.

Image Source: Zacks Investment Research

Bottom Line

Near its 52-week low, UPS stock looks enticing but has started to make the case for being a value trap amid its recent struggles. In contrast, FedEx shares have swiftly rebounded off their one-year low of $194, but more short-term risk could lie ahead for FDX as well.

Unfortunately, UPS and FDX land a Zacks Rank #4 (Sell) at the moment in correlation with the trend of declining EPS revisions and have become less portfolio worthy in recent years, as prolonged patience and a higher risk tolerance have been needed.

3 Stocks Poised to Lead the AI Software Race

The software market is expected to witness a remarkable growth trajectory worldwide. Advancements in AI, increased demand for cybersecurity, and the rapid expansion of automation and robotics is offering investors an opportunity to unlock significant growth right now.

Which software stocks will soar? Which will fizzle out? Find out in our urgent special report, Software is Eating the World. It examines where the software industry stands now and reveals three favorite software stocks to own

Access the report free today >>

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).