Ford F is making a bold move to revive its struggling European business. The U.S. legacy auto giant plans to inject up to €4.4 billion ($4.8 billion) into its German operations, aiming to reduce debt and improve competitiveness. Its German arm, Ford-Werke, has €5.8 billion ($6.3 billion) of debt, making this cash infusion crucial. This move comes at a time when the European auto industry is under pressure from rising costs, weak demand and growing competition from Chinese EV makers like BYD Co Ltd.

Ford has been losing money in Europe for years and has been cutting costs to survive. In November, it announced plans to cut another 4,000 jobs by 2027, blaming slow EV demand and fierce competition. Now, with this fresh investment, the company hopes to stabilize its German operations and push forward a multi-year recovery plan.

Ford isn’t the only one struggling. Germany’s auto biggie Volkswagen VWAGY is also downsizing and even considering closing plants as it fights to stay competitive. Chinese EV brands are rapidly expanding, forcing traditional automakers to rethink their strategies. Can Ford’s capital injection revitalize its European business and should you place your bets on the stock on this development?

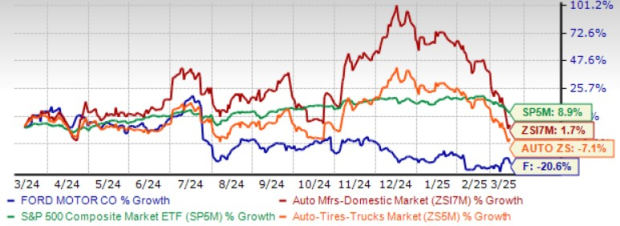

F stock has dropped 20% over the past year and is now hovering around $10. Investors might be wondering if they should buy Ford now, or stay on the sidelines as tariff wars and economic uncertainty lingers? Let’s find out.

1-Year Price Performance Comparison

Image Source: Zacks Investment Research

Ford’s Model e & Blue Units Suffering, Pro Thriving

Ford’s segments are facing a mixed outlook. While its Model e and Ford Blue segments are under pressure, Ford Pro remains a bright spot.

The Model e division, Ford’s EV unit, continues to struggle. The company lost $5.07 billion in the segment in 2024, even worse than the $4.7 billion loss in 2023. Intense competition, pricing pressure and high investment costs for next-generation EVs are weighing on profits. Ford expects another $5-5.5 billion loss this year, while its closest peer General Motors GM is cutting EV losses and improving profitability.

The Ford Blue segment, which includes traditional gas-powered vehicles, is also showing signs of weakness. Ford projects 2025 EBIT of $3.5-4 billion, down from $5.3 billion in 2024. Lower ICE vehicle sales, a shift in product mix and foreign exchange headwinds are expected to drag down profits.

However, Ford Pro, the company’s commercial vehicle business, is thriving. In 2024, revenues rose 15% to $67 billion, and EBIT jumped from $7.2 billion to $9 billion, with a 13.5% margin. Strong demand for Super Duty trucks and Transit vans, along with growth in software and service subscriptions, is driving this success. Ford’s focus on software, technology and services could be a key growth driver moving forward.

F’s Strong Liquidity & Generous Dividend Boost Confidence

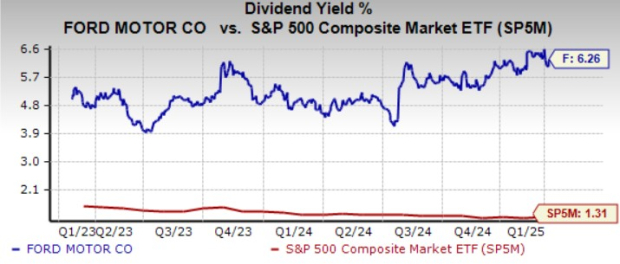

Ford ended 2024 with $47 billion in liquidity (including $28 billion in cash), providing a strong financial base for its Ford+ strategy. The company is focused on cutting costs. In the second half of 2024, it saved $500 million and targets $1 billion in product design cost reductions for 2025. The automaker offers a more than 6% dividend yield, far above the S&P 500’s 1.31% average.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

With plans to return 40-50% of free cash flow to investors, its dividend provides stability amid stock volatility. Strong liquidity and cost-cutting efforts could support Ford’s turnaround, but market uncertainties remain a key factor.

Tariff Woes & Weak Outlook Could Hurt Ford Stock

Ford is bracing for challenges as Trump’s 25% tariffs on Mexican and Canadian imports, set to take effect on April 2, threaten to disrupt operations. CEO Jim Farley warned that tariffs would bring “a lot of cost and a lot of chaos” to the U.S. auto industry. Higher raw material costs could push up vehicle prices, hurting demand, sales and profits.

Adding to concerns, Ford expects first-quarter 2025 adjusted EBIT to break even, a steep drop from $2.7 billion and $2.1 billion recorded in the first quarter of 2024 and the final quarter of 2024, respectively, due to lower volumes, a 20% production cut and plant launch costs. Full-year adjusted EBIT is forecast at $7-$8.5 billion, down from $10.2 billion in 2024. Rising warranty costs and incentives will put further pressure on margins.

Notably, Ford’s weak guidance doesn’t even factor in potential policy changes from a Trump administration, meaning things could get even worse.

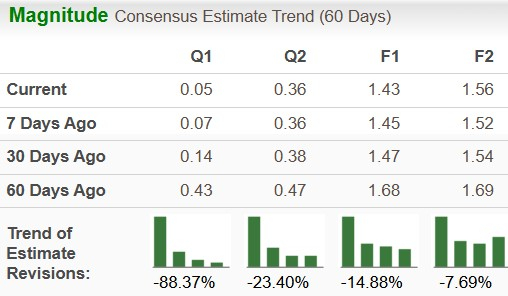

What Do Zacks Estimates for Ford Say?

The Zacks Consensus Estimate for 2025 sales and EPS implies a decline of 4% and 22%, respectively. But for 2026, the consensus mark for sales and EPS points to year-over-year growth of 2% and 9%, respectively. Discouragingly, Ford has seen its EPS estimates move south in the past 60 days.

Image Source: Zacks Investment Research

Buy, Hold or Sell F Stock Now?

Ford’s restructuring efforts in Europe and strong Ford Pro performance bode well, but near-term headwinds remain. Weak demand, rising competition and steep EV losses are expected to weigh on its profitability. Additionally, Trump’s proposed tariffs, production cuts and lower 2025 earnings guidance add to the uncertainty.

For existing investors, Ford’s strong liquidity and more than 6% dividend yield provide some cushion, making it worth holding. However, for new investors, waiting for more clarity on tariffs, EV profitability and overall market conditions seems wise. The stock could face further pressure before a real turnaround takes shape.

Ford currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Volkswagen AG Unsponsored ADR (VWAGY) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).