Ford experienced a setback in its second-quarter sales growth due to an unexpected cyberattack that disrupted a critical software system utilized by its dealerships. Despite this obstacle, the automaker managed to sell 536,050 vehicles in Q2, reflecting a modest 1% increase compared to the previous year. The deceleration in growth was primarily attributed to heightened borrowing costs and prevailing economic uncertainties, leading to a slump in consumer demand.

Breaking Down Ford’s Q2 Sales Performance

Notably, Ford’s growth in sales was spearheaded by its robust performance in the truck segment, with sales reaching 308,920 units, marking a commendable 5% increase year-over-year. This achievement represented Ford’s best Q2 sales figures for trucks since 2019, with the company selling 199,463 units of its renowned F-Series trucks during this period.

Furthermore, Ford witnessed a notable uptick in electric vehicle (EV) sales, registering a remarkable 61% surge year-over-year, totaling 23,957 units sold. The company remains bullish about the future prospects of its EV lineup, particularly highlighting the promising reception of models like the Mustang Mach-E and F-150 Lightning, which are successfully luring in new customers.

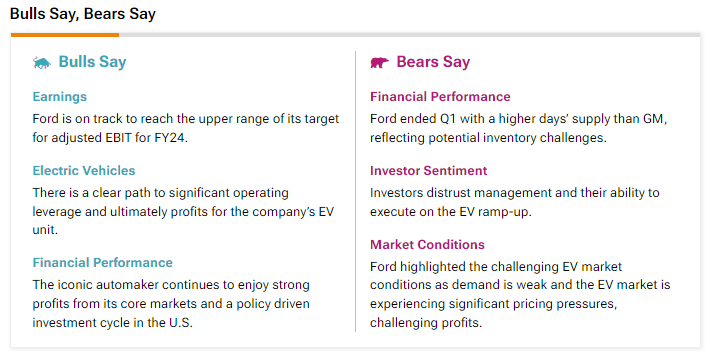

According to assessments from TipRanks, analysts optimistic about Ford’s trajectory express confidence in its EV division, foreseeing a clear pathway to substantial operational efficiency and, ultimately, profitability within the company’s EV unit.

Simultaneously, Ford witnessed a robust 56% surge in sales of hybrid vehicles, reaching 53,822 units, thereby setting a new record in quarterly sales for the hybrid vehicle segment.

Assessing Ford’s Investment Potential

Despite the recent challenges, analysts maintain a cautiously optimistic stance on Ford stock, culminating in a Moderate Buy consensus rating comprising seven Buy recommendations, four Hold ratings, and one Sell rating. Over the past year, Ford’s stock has undergone a decline exceeding 9%, and the average price target for Ford stands at $15.36, indicating a potential upside of 19.5% from its current valuation.