As General Motors concludes the Cruise robotaxi saga, a cloud of controversy dissipates, complicating matters with a mandated recall of 1,200 robotaxis in compliance with an ongoing government investigation. This development spurred a modest rally in Thursday’s afternoon trading session.

Under the scrutinizing lens of the National Highway Traffic Safety Administration (NHTSA), GM’s Cruise division yielded to requests for recalling the vehicles due to reported instances of “hard braking,” effectively laying to rest the NHTSA’s inquiry into Cruise’s autonomous driving systems.

Although Cruise debated the necessity of a recall, it opted to acquiesce in order to appease the NHTSA. Cruise affirmed its dedication to fostering trust and transparency concerning autonomous vehicle technology.

Charging Ahead with Big Battery EVs

On another front, GM is fervently striving to establish supremacy in the realm of “big battery EVs.” These vehicles boast notably large battery capacities—around 200 kilowatt-hours or higher—to extend their driving range. However, this pursuit presents unique challenges, prompting competitors like Ford to explore alternative methods of enhancing vehicle range.

Notably, Ford is redirecting focus towards smaller vehicles that eliminate the need for such extensive battery power, potentially heralding a paradigm shift in the industry landscape.

Investor Outlook on GM Stock

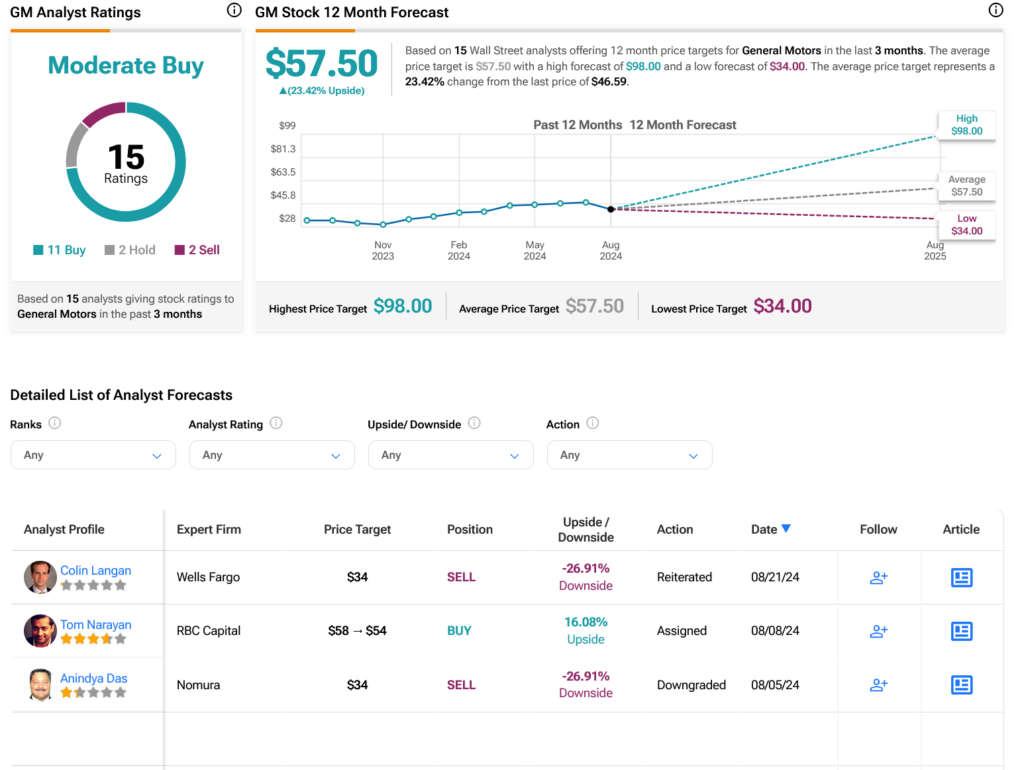

Shifting towards Wall Street sentiment, analysts confer a Moderate Buy consensus on GM stock, supported by 11 Buy ratings, accompanied by two Holds and two Sells over the last three months. Following a commendable 40.16% surge in its stock price over the past year, the average GM price target now stands at $57.50 per share, suggesting a promising 23.42% upside potential.