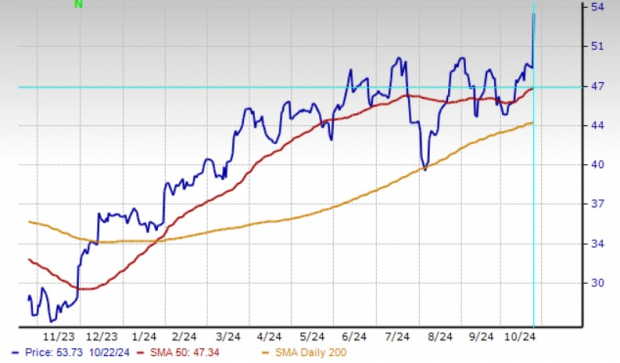

U.S. legacy automaker General Motors GM delivered stellar third-quarter results yesterday, propelling its shares to a 52-week high. The stock surged almost 10%, marking its most significant daily percentage gain since 2020. The market reacted enthusiastically to GM’s quarterly performance, which exceeded Wall Street’s predictions and prompted the company to boost its full-year 2024 guidance for the third time this year. Currently trading above its 50 and 200-day moving averages, GM’s stock exudes bullish sentiment, reflecting positive investor attitudes towards the company’s financial stability and future prospects.

General Motors Experiences Positive Momentum Above Moving Averages

Image Source: Zacks Investment Research

At its current $54 level – the highest in a year – investors are faced with the decision to delve deeper into GM’s fundamentals to assess the viability of retaining the stock or capturing profits. Before exploring further, let’s delve into the key highlights of General Motors’ recent quarterly performance.

Breakdown of General Motors’ Strong Q3 Results

Surpassing Earnings Expectations : General Motors reported adjusted third-quarter earnings of $2.96 per share, surpassing the Zacks Consensus Estimate of $2.49, marking the ninth consecutive quarter of beating expectations. Revenues of $48.75 billion also outperformed the Zacks Consensus Estimate of $44.29 billion, making it the ninth successive quarter of beating revenue predictions. Year-on-year, the company’s third-quarter earnings and revenues grew by 30% and 10.5%, respectively.

Positive 2024 Forecast: Fueled by robust performance in the first three quarters of 2024, sustained vehicle demand, and effective cost management, General Motors revised its adjusted EBIT expectations to $14-$15 billion, up from the earlier range of $13-$15 billion. Adjusted EPS is projected to be between $10-$10.5, higher than the initial forecast of $9.50-$10. Adjusted automotive free cash flow is set to fall between $12.5-$13.5 billion, an increase from the prior estimate of $9.5-$11.5 billion.

Success in GM’s North America Segment: General Motors’ North America division (GMNA), the company’s largest and most profitable unit, continues to shine. Pretax earnings in the segment surged by approximately 14% to $4 billion, with revenues climbing 14% to a record of $41.2 billion. The exceptional performance is attributed to strong demand for GM’s full-size and midsize pickups, along with strategic pricing strategies. GM retains its position as the leading automaker in the United States, managing inventories adeptly and offering below-average incentives.

Challenges in China: GM’s operations in China present challenges, with the company reporting a $137 million equity loss in the region in the September quarter, compared to a $192 million profit in the same period last year. Sales from GM’s joint ventures in China with SAIC Motor Corp. and Wuling declined by 21% to approximately 426,000 vehicles in the quarter, illustrating heightened competition from domestic automakers offering lower-priced EVs. While CEO Mary Barra affirmed ongoing efforts to restructure Chinese operations for inventory reduction and sales improvement, a concrete strategy for recovery remains elusive. The tough operating environment in China has posed substantial hurdles for GM in recapturing market share amidst intense local competition.

Cautious Outlook for Q4 Earnings: GM CFO Paul Jacobson issued a cautionary note for the fourth quarter, pointing to factors that could impact earnings, including seasonality, reduced wholesale volumes for ICE vehicles, and the company’s shift towards electric vehicles (EVs). Supply chain disruptions and model transitions are expected to affect production rates for GM’s profitable full-size SUVs. Moreover, reduced production days during the holiday season could contribute to lower-than-expected fourth-quarter results. Mounting EV volumes and increased seasonal incentives pose profitability challenges.

Emphasis on Shareholder Value: General Motors remains dedicated to enhancing shareholder returns through its stock buyback program. In the third quarter alone, the company repurchased $1 billion worth of shares, retiring 23 million shares in the process. An additional 25 million shares are slated for retirement in the fourth quarter of 2024 under the $10 billion accelerated share buyback program, bringing the total retired shares to nearly 250 million. This commitment underscores GM’s focus on elevating shareholder value while maintaining a robust balance sheet. By the end of the third quarter, the company boasted $40.2 billion in automotive liquidity.

Evaluating General Motors’ Strategic Direction

General Motors is strategically positioned for sustained growth by meticulously managing inventory, controlling costs, and optimizing profitability across traditional gasoline vehicles and EVs. By maintaining low inventory levels and introducing frequent vehicle redesigns, GM has upheld strong pricing, particularly for its ICE vehicles, bolstering margins. The company aims to achieve profitability for its EVs on an EBIT basis by the close of 2024 and intends to manufacture approximately 200,000 electric vehicles this year.

During its recent investor day, GM outlined plans to trim EV losses by $2 billion to $4 billion next year, showcasing progress in cost reduction and production efficiency enhancements. On track to meet a $2 billion net cost reduction goal by the end of 2024, GM is also set to reduce its outstanding shares to below 1 billion by early 2025, reinforcing its commitment to driving shareholder value in tandem with operational growth.

Guidance for Investors Holding General Motors Shares

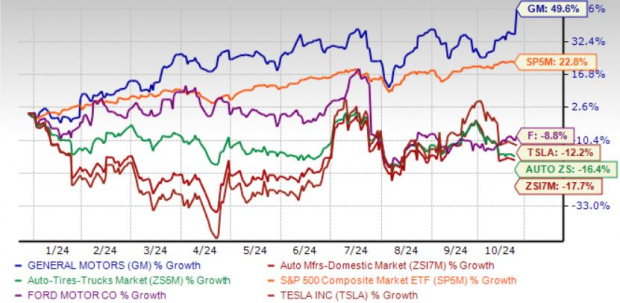

As of 2024, General Motors’ stock has surged by almost 50%, outperforming industry benchmarks, the sector, and the S&P 500. In contrast, GM’s competitor, Ford F, witnessed a 9% decline during the same period. EV giant Tesla TSLA, expected to disclose results later today, experienced a 12.2% year-to-date decrease.

Comparing Year-to-Date Stock Performance

Image Source: Zacks Investment Research

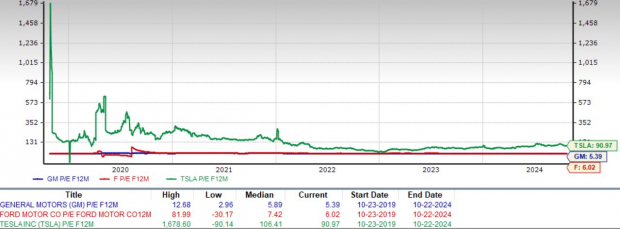

Despite the remarkable rise in General Motors’ stock, the current trading levels stand at a modest 5.39X forward earnings multiple, lower than its closest competitor Ford’s 6.02X. However, Tesla’s stock price remains at a significant premium.

General Motors: Unveiling the True Value

General Motors (GM) is currently trading at a P/E ratio of 90.97X, reflecting the undervaluation of the company’s stock.

The Case for Undervaluation

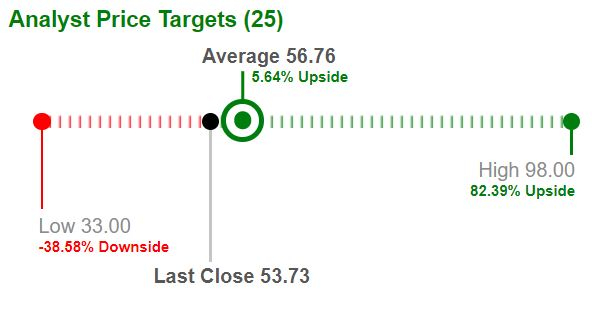

The strong fundamentals and value of General Motors are evident, leading to a post-earnings rally that could potentially continue. Wall Street’s average price target of $56.76 suggests there is still room for the stock to rise. Investors are advised to hold onto their shares to capitalize on GM’s growth drivers rather than selling prematurely.

Image Source: Zacks Investment Research

Potential Growth Ahead

The Zacks Consensus Estimate for GM’s 2024 EPS and sales predicts a significant uptick of 29% and 3%, respectively, compared to the previous year. With a Zacks Rank of #3 (Hold) and a stellar VGM Score of A, General Motors shows promising signs of future growth.

Image Source: Zacks Investment Research

A Look at Future Potential

According to Zacks’ Research Chief, General Motors is among the top stocks likely to experience substantial growth in the near future. With a focus on innovation and a rapidly expanding customer base, GM is poised for significant gains. While not all top picks prove successful, GM could surpass previous high-performers like Nano-X Imaging, which surged over 129.6% in less than 9 months.

Conclusion

General Motors’ recent performance and future growth prospects indicate a promising outlook for investors. With a strong foundation and potential for further upside, GM stands as an undervalued asset in the market. Investors are encouraged to consider holding onto their GM shares to reap the benefits of the company’s growth trajectory.