We are all acutely aware that legacy automakers, exemplified by the likes of General Motors (GM), have been cautiously advancing their green goals. The road to widespread acceptance of electric cars and infrastructure is still a winding one, marred by detours and potholes. Despite modest strides, investors have appeared blind to these advancements. GM faced a 3% dip in share value during Monday’s trading session.

Recent data on electric vehicle sales paints a more optimistic picture as GM witnessed a surge in EV sales extending from July to August. The figures speak their truth – with roughly 21,000 electric vehicles sold during these two months, nearly matching GM’s Q2 performance. Yet, realism tempers this optimism when we juxtapose these numbers with GM’s sale of around 903,000 vehicles to dealers in the second quarter of 2024. The overwhelming disparity is evident. However, the tide turns as GM’s EV sales inch closer to Ford’s (F) EV numbers, albeit both still treading lightly in this arena.

Challenges on the Horizon

These signs of progress are juxtaposed against the sobering news of impending layoffs at GM’s Fairfax Assembly plant in Kansas. A Worker Adjustment and Retraining Notification (WARN) notice rang the alarm, signaling the imminent departure of 1,695 employees. The layoffs will materialize in two waves – the first axing 250 temporary staff and temporarily laying off 686 full-time workers on November 18, 2024. Following in the new year, the second wave will see another 759 workers temporarily displaced on January 12, 2025. The cloud of uncertainty looms, with reports hinting at production halts for the Cadillac XT4. Yet, the plant’s future seems to shift towards manufacturing not just XT4s but also the Bolt EV by the end of 2025, possibly rendering these layoffs a temporal blip as GM readies the plant for its new chapter.

Investor Sentiment: Buy, Hold, or Fold?

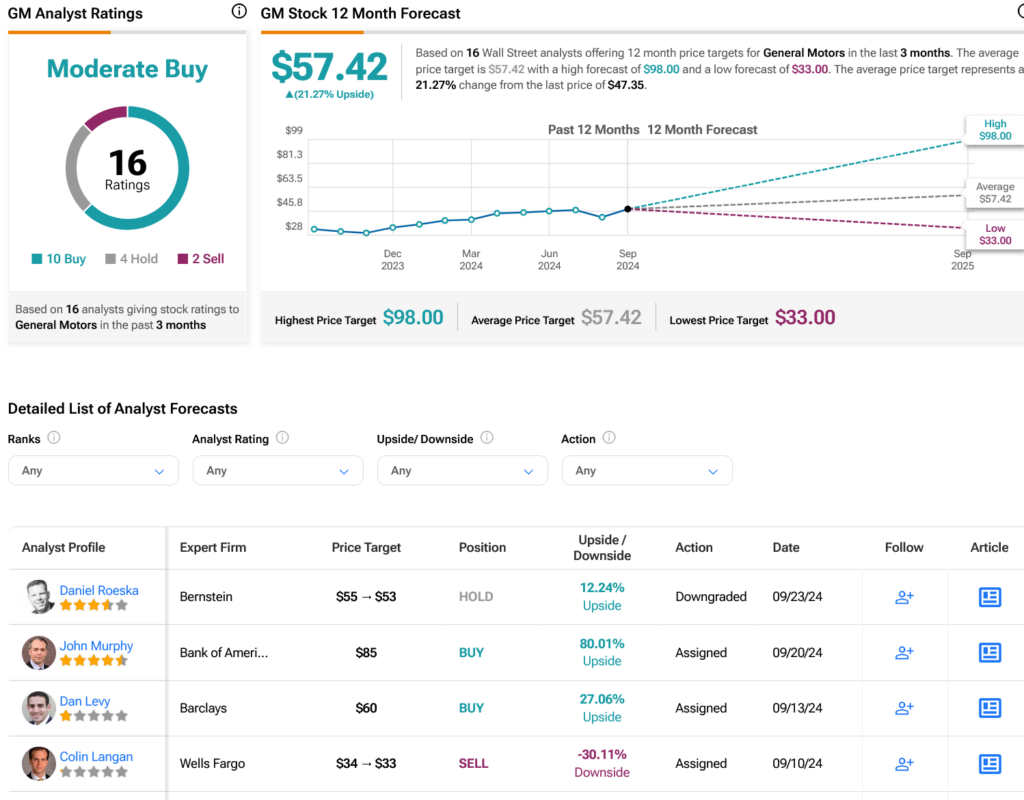

Peering into the crystal ball of Wall Street predictions, analysts have pegged GM’s stock with a Moderate Buy consensus. This rating stems from ten Buy recommendations, four Hold ratings, and two Sells tabulated over the past quarter. Despite a robust 44.4% surge in share price over the past year, the average price target for GM rests at $57.42 per share. This forecast plots a promising 21.27% upside potential for investors seeking a greener shade of profit.

Explore more GM analyst ratings here