U.S. auto giant General Motors GM just gave investors a reason to cheer, announcing a 25% dividend hike and a $6 billion share buyback program. The stock rose 3.75% yesterday on the news as the automaker reinforced its commitment to shareholder returns.

While the payout boost is exciting, should you buy General Motors stock now? Tariff risks loom large. U.S. President Trump is set to impose a 25% tariff on imports from Mexico and Canada. And GM — which has the highest exposure to Mexico among U.S. automakers — could face higher costs, which might eventually translate to elevated vehicle prices and declining demand. Is GM prepared for this potential headwind? And more importantly, is this the right time to buy, or should investors stay on the sidelines? Let’s dive in.

General Motors’ Dividend and Buyback Boost

The new dividend of 15 cents per share (up from the current 12/cents a share) will take effect with GM’s next planned payout to be announced in April 2025, bringing it in line with its closest rival, Ford F. Meanwhile, under the $6 billion repurchase plan, GM will execute a $2 billion accelerated share repurchase (ASR), expected to be wrapped up by the second quarter of 2025, leaving $4.3 billion for future buybacks.

GM’s strong financials support these investor-friendly moves. The company generated $14 billion in adjusted auto free cash flow last year and returned nearly $7.6 billion to shareholders via dividends and buybacks. It also met its goal of reducing outstanding shares below 1 billion, closing 2024 at 995 million shares. With $35.5 billion in total automotive liquidity, including $21.7 billion in cash, GM’s balance sheet remains robust.

GM Better Prepared for Tariff Troubles

General Motors is the largest U.S. automaker importing cars from Mexico, with around 750,000 vehicles shipped from Mexico and Canada to the United States in 2024. Many of GM’s most popular models, like the Chevy Silverado, GMC Sierra and mid-sized SUVs, are built in Mexico. With Trump’s 25% tariff on Mexican and Canadian imports set to take effect on April 2 (pushed back from the original March 4 deadline), the big question is—is GM prepared?

According to GM’s CFO, Paul Jacobson, the company has been bracing for this scenario since November and has a game plan in place. One major step GM has taken is cutting its international inventory by over 30%, reducing the risk of sitting on vehicles that could suddenly become much more expensive. Quoting Jacob, “The last thing you want is a bunch of finished inventory that just suddenly became 25% more expensive.” The company is also working with logistics partners to keep supply chains as efficient as possible.

While Ford CEO Jim Farley warned that tariffs would bring “a lot of cost and a lot of chaos” to the U.S. auto industry, GM seems to be taking a more proactive approach. Jacobson noted that GM has other cost-effective strategies to adjust to the changing trade environment.

With the extra time before the tariffs kick in, GM has even more room to refine its approach. While no solution will come free, GM still appears to be in a better position than its rivals to navigate the tariff woes. Although the company may face some issues in the near term because of the policy change, its long-term prospects remain solid.

What Else is Working in GM’s Favor?

GM held onto its crown as the top-selling automaker in the United States in 2024, with market share rising 30 basis points to 16.5%. The company also hit its $2 billion net-fixed cost-reduction goal, boosting profitability. Thanks to strong demand and disciplined cost management, GM raised its 2025 earnings outlook to $11-$12 per share, up from $10.60 in 2024.

General Motors Company Price, Consensus and EPS Surprise

General Motors Company price-consensus-eps-surprise-chart | General Motors Company Quote

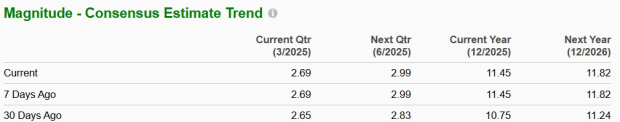

Amid stellar 2024 results and upbeat EPS view for 2025, analysts have upwardly revised their earnings estimates over the past 30 days.

Image Source: Zacks Investment Research

GM’s U.S. EV sales are also gaining momentum, with 114,000 units sold in 2024, a 50% jump from 2023. In the final quarter of 2024, GM’s EV portfolio became profitable at the variable level, helped by scaling production, lower material costs, and new models like the Escalade IQ and Sierra EV. EV losses are expected to shrink by $2 billion this year.

Further, GM’s China restructuring is paying off. Excluding a $5 billion restructuring charge, the company posted positive equity income in the fourth quarter of 2024. Deliveries surged 40% sequentially, the biggest jump since mid-2022. The company aims to return its China business to profitability this year.

GM is Undervalued

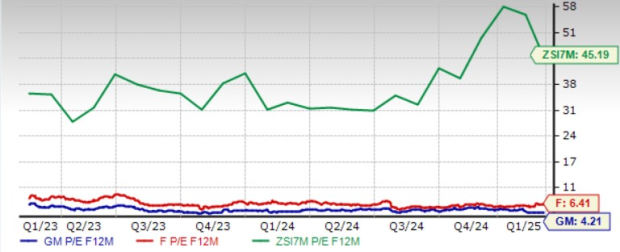

At its current levels, GM stock looks highly attractive from a valuation standpoint. With a forward price-to-earnings ratio of 4.21, GM trades at a significant discount to industry levels as Ford.

GM P/E Appealing

Image Source: Zacks Investment Research

GM Remains a Solid Pick

Despite tariff worries, GM seems better prepared to handle the challenges. It has a strong U.S. presence, is focused on cost-cutting, and is making investor-friendly moves. Its EV business is growing, and the stock still looks cheap compared to its potential. Analysts are also bullish, with an average price target of $58.09, suggesting about 20% upside from here.

The stock carries a Zacks Rank #2 (Buy) and a VGM Score of A. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).