Key Takeaways

- Major indexes hit all-time highs after Trump’s election victory, spurred by hopes of additional rate cuts.

- Consumer discretionary stocks stand to gain as investor confidence increases during this stock rally.

- Dolby Laboratories, Carnival, Netfill and American Outdoor Brands stocks appear ready to benefit.

Wall Street resumed its rally earlier this week as Donald Trump began his new term as President of the United States. Investors have been hopeful that the Trump administration will implement a spate of economic policy changes, which saw major indexes hit all-time highs after his election victory in November.

On Thursday, Trump’s dovish comments on rate cuts and oil prices gave a boost to investors’ confidence, sending stocks on a rally, with the S&P 500 hitting an all-time closing high. Given the positive sentiment and hopes of more rate cuts in the near term, discretionary stocks like Dolby Laboratories, Inc. DLB, Carnival Corporation & plc CCL, Netflix, Inc. NFLX and American Outdoor Brands, Inc. AOUT appear to be a lucrative buy.

Each of the stocks has a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Trump Calls for More Rare Cuts, Lower Oil Prices

On Monday, Trump called for more rate cuts during a virtual address to the World Economic Forum. The President said he would “demand that interest rates drop immediately.” He also said that he would request Saudi Arabia to lower oil prices, which have skyrocketed over the past several months.

Investors cheered Trump’s dovish comments. This sent stocks on a rally, with the S&P 500 closing at 6,118.71 points, surpassing its earlier all-time high of 6,090.27, registered in December. The Dow and Nasdaq also finished 0.9% and 0.2% higher.

Lower Interest Rate to Further Boost Stocks

The Federal Reserve has cut interest rates by 100 basis points in three installments since September, bringing its benchmark policy rate to 4.25-4.5% after hiking them by 525 basis points in its bid to curb 40-year-high inflation.

The massive rate cut in the final quarter of 2024 came as a major boost to markets and the overall economy as several sectors started showing signs of a rebound. Lower borrowing costs and easing price pressures revived demand for goods and services.

However, the optimism somewhat faded in the final weeks of December as investors feared that the Federal Reserve could slow its pace of rate cuts after inflation showed signs of rising. The bearish sentiment continued into this year as the Fed said that it sees two rate cuts at the most this year.

Trump’s comments have raised hopes of more rate cuts this year. Markets are pricing in a 99.5% chance of no rate cut in January, according to the CME FedWatch tool. However, the chances of no rate cut in March have declined to 69.6% after Trump’s comments from 77.9% last week.

Given the bullish sentiment, investing in discretionary stocks appears to be a prudent choice. The Consumer Discretionary Select Sector SPDR (XLY) has gained 33.2% in the past year and 22.4% in the last six months compared to the S&P 500 index’s gain of 25.8% and 10.1%, respectively.

4 Discretionary Stocks With Upside

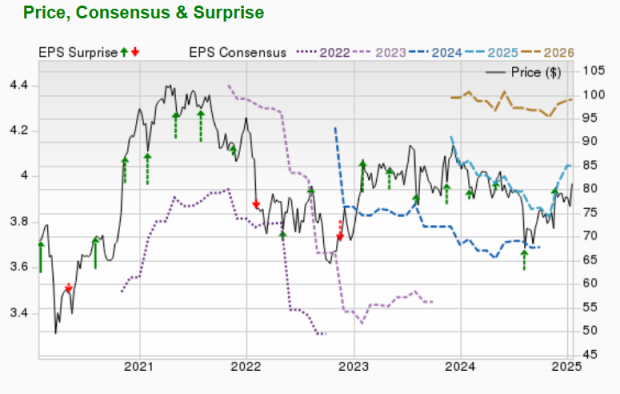

Dolby Laboratories, Inc.

Dolby Laboratories, Inc. develops audio and imaging technologies that revolutionize entertainment for user-generated content, TV shows, films, music and gaming. A majority of DLB’s revenues are derived from the licensing of audio technologies. Dolby Laboratories operates on various licensing models including a two-tier model, an integrated licensing model, a patent licensing model, recoveries and collaboration arrangements.

Dolby Laboratories’expected earnings growth rate for the current year is 6.9%. The Zacks Consensus Estimate for current-year earnings has improved 2% over the past 60 days. DLB currently carries a Zacks Rank #2.

Image Source: Zacks Investment Research

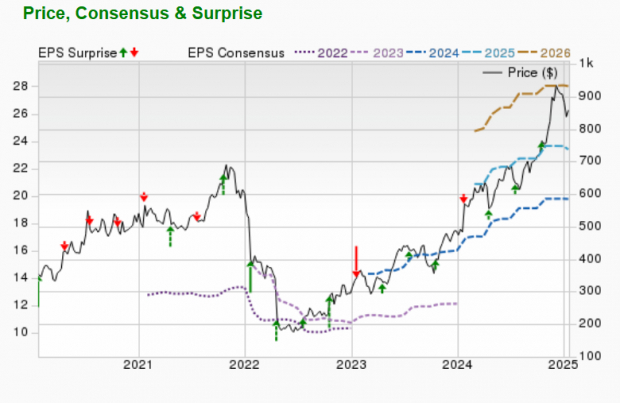

Carnival Corporation & plc

Carnival Corporation & plc operates as a cruise and vacation company. As a single economic entity, CCL forms the largest cruise operator in the world. Carnival Corporation & plcis the world’s leading leisure travel firm and carries nearly half of the global cruise guests.

Carnival Corporation’s expected earnings growth rate for the current year is 24.7%. The Zacks Consensus Estimate for current-year earnings improved 6.6% over the last 60 days. CCL currently carries a Zacks Rank #2.

Image Source: Zacks Investment Research

Netflix, Inc.

Netflix, Inc. is considered a pioneer in the streaming space. NFLX has been spending aggressively on building its portfolio of original shows. This is helping Netflix sustain its leading position despite the launch of new services like Disney+ and Apple TV+, as well as existing services like Amazon Prime Video.

Netflix’s expected earnings growth rate for the current year is 19.6%. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the past 60 days. NFLX currently carries a Zacks Rank #2.

Image Source: Zacks Investment Research

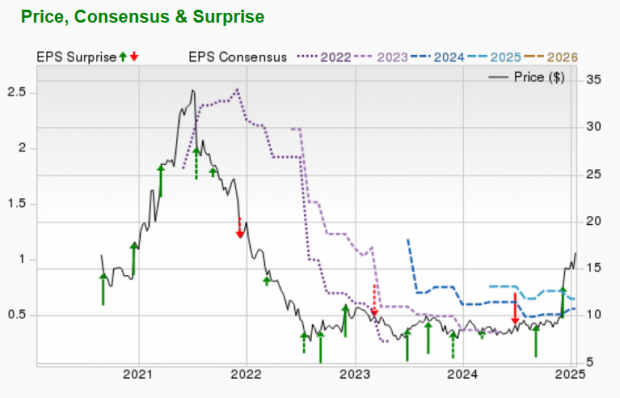

American Outdoor Brands

American Outdoor Brands, Inc. is a provider of outdoor products and accessories, including hunting, fishing, camping, shooting and personal security and defense products, for rugged outdoor enthusiasts. AOUT produces products under the brands Caldwell, Crimson Trace, Wheeler, Tipton, Frankford Arsenal, Lockdown, BOG, Hooyman, Smith & Wesson Accessories, M&P Accessories, Thompson/Center Arms Accessories, Performance Center Accessories, Schrade, Old Timer, Uncle Henry, Imperial, BUBBA, UST, LaserLyte and MEAT!.

American Outdoor Brands’ expected earnings growth rate for the current year is 75%. The Zacks Consensus Estimate for current-year earnings has improved 9.8% over the past 60 days. AOUT currently has a Zacks Rank #2.

Image Source: Zacks Investment Research

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Dolby Laboratories (DLB) : Free Stock Analysis Report

Carnival Corporation (CCL) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

American Outdoor Brands, Inc. (AOUT) : Free Stock Analysis Report