Key Points

-

Nvidia CEO Jensen Huang predicts annual spending on data center infrastructure and chips will top $1 trillion by 2028.

-

Artificial intelligence (AI) models are becoming more powerful, which means they need more computing capacity to function.

-

The iShares Semiconductor ETF holds many of the top suppliers of AI chips and components, and it’s delivering exceptional returns right now.

- 10 stocks we like better than iShares Trust – iShares Semiconductor ETF ›

Nvidia CEO Jensen Huang predicts annual spending on data center infrastructure and chips will top $1 trillion by 2028.

Artificial intelligence (AI) models are becoming more powerful, which means they need more computing capacity to function.

The iShares Semiconductor ETF holds many of the top suppliers of AI chips and components, and it’s delivering exceptional returns right now.

Developing artificial intelligence (AI) requires substantial computing power, especially as the latest reasoning models spend an increasing amount of time “thinking” to refine their outputs. In fact, Nvidia (NASDAQ: NVDA) CEO Jensen Huang thinks data center operators will spend $1 trillion per year on infrastructure and chips by 2028 to meet demand from those new-age models.

Nvidia is a leading supplier of graphics processing units (GPUs), which are the primary chips used in AI development, so it’s perfectly positioned to benefit from any increase in data center spending. But demand for more computing capacity will also be a tailwind for competitors like Advanced Micro Devices (NASDAQ: AMD) and every company that supplies data center networking equipment and other critical hardware.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

The iShares Semiconductor ETF (NASDAQ: SOXX) is an exchange-traded fund (ETF) that exclusively invests in the suppliers of chips and other computing hardware. Nvidia and AMD are two of the ETF’s largest holdings, and their performance has propelled it to market-crushing returns over the last few years. Here’s how the fund could turn an investment of $500 per month into $1 million over the long term.

Image source: Getty Images.

The ultimate AI hardware ETF

The iShares Semiconductor ETF holds just 30 stocks, so it’s highly concentrated. It specifically focuses on companies that design, manufacture, and distribute semiconductors and components, but especially those with the potential to benefit from powerful themes like AI.

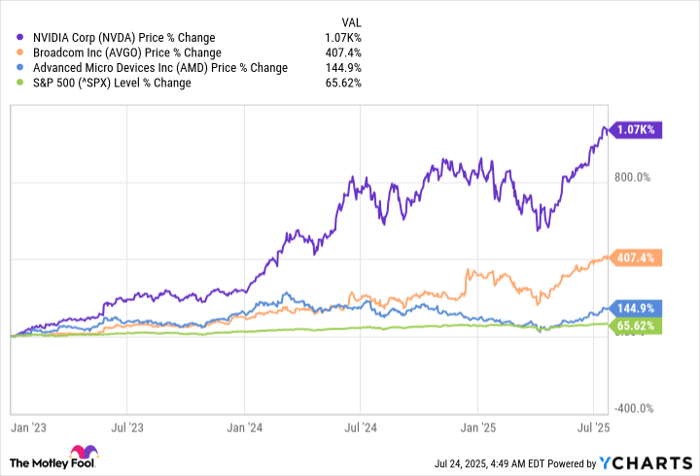

AMD is the largest holding in the ETF with a portfolio weighting of 9.35%, closely followed by Nvidia with a weighting of 8.27%, and Broadcom (NASDAQ: AVGO) at 7.70%. Each of those three stocks has crushed the S&P 500 since the beginning of 2023, which is when the AI boom really started to gather momentum:

Nvidia had a market capitalization of $360 billion on Jan. 1, 2023, but it has since exploded to $4.2 trillion on the back of surging sales of its data center GPUs. Its new Blackwell and Blackwell Ultra chips are designed specifically for AI reasoning models, and demand continues to outstrip supply. But Nvidia is also expanding into other AI segments. Its Drive platform, for instance, is an increasingly popular hardware and software solution for automotive brands that want to install self-driving capabilities into their new vehicles.

AMD is becoming one of Nvidia’s biggest threats in the data center market, having designed its latest CDNA (Compute DNA) 4 GPU architecture to specifically rival the Blackwell architectures. But AMD also supplies some of the industry’s best AI chips for personal computers, which could be a substantial growth driver for the company in the long run.

Broadcom, on the other hand, makes some of the most powerful networking equipment for the data center, which rapidly moves high volumes of data between chips and devices to enable faster processing speeds. Further, Broadcom makes custom AI accelerators on behalf of tech giants like Alphabet, which are becoming a popular alternative to ready-made GPUs in the data center.

Outside of its top three positions, the iShares Semiconductor ETF holds a number of other leading AI hardware stocks, including:

- Micron Technology, which designs some of the industry’s best memory and storage solutions for AI workloads in data centers, computers, and smartphones.

- Taiwan Semiconductor Manufacturing, which is the world’s largest semiconductor fabricator. It manufactures chips on behalf of the industry’s top designers, including Nvidia and AMD.

- Arm Holdings, which designs central processor (CPU) architectures for computer and device manufacturers like Apple.

Turning $500 per month into $1 million

The iShares Semiconductor ETF was established in 2001, so it has helped investors navigate technological revolutions spurred by the internet, the smartphone, the cloud, enterprise software, and now AI. It has delivered a compound annual return of 11.4% since it was established 24 years ago, far outpacing the S&P 500, which has grown by an average of 8.3% per year over the same period.

But over the last 10 years, specifically, the iShares ETF has delivered a compound annual return of 24.1%. The proliferation of data centers and consumer devices triggered a wave of demand for advanced chips over the past decade, which is fueling those returns.

The table below shows the potential gains investors could earn by placing $500 into the iShares ETF every month, based on three different annual returns and three different time frames.

|

Compound Annual Return |

Balance After 10 Years |

Balance After 20 Years |

Balance After 30 Years |

|---|---|---|---|

|

11.4% |

$112,607 |

$461,258 |

$1,545,560 |

|

17.7% (midpoint) |

$165,445 |

$1,121,446 |

$6,661,842 |

|

24.1% |

$251,192 |

$2,976,520 |

$32,604,161 |

Calculations by author.

It’s unlikely this ETF — or any fund — can sustain a 24.1% annual return over the long term. The bigger a company like Nvidia becomes, the harder it gets to find new customers and generate the same rate of growth, which leads to slower returns for investors. However, if Jensen Huang is right and annual data center spending does top $1 trillion by 2028, then the iShares ETF can certainly maintain above-average returns for at least the next few years.

But investors don’t need to earn over 20% per year to turn $500 into $1 million. Even if the ETF reverted to its long-term average return of 11.4% per year, it would still get the job done in under three decades.

However, due to its high concentration, investors shouldn’t put all of their eggs in one basket. They should only buy this ETF as part of a diversified portfolio of other funds or individual stocks, which will help insulate them from substantial losses if the AI boom unexpectedly loses momentum.

Should you invest $1,000 in iShares Trust – iShares Semiconductor ETF right now?

Before you buy stock in iShares Trust – iShares Semiconductor ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Trust – iShares Semiconductor ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $636,774!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,064,942!*

Now, it’s worth noting Stock Advisor’s total average return is 1,040% — a market-crushing outperformance compared to 182% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 21, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Apple, Nvidia, Taiwan Semiconductor Manufacturing, and iShares Trust – iShares Semiconductor ETF. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.