Homebuilder Stocks Rally To New Highs Despite Housing Sales Struggle

Record Surge in Homebuilder Stocks

The surge in homebuilder stocks to record highs on Friday painted a rosy picture, propelled by a promising inflation report signaling imminent interest rate cuts in September.

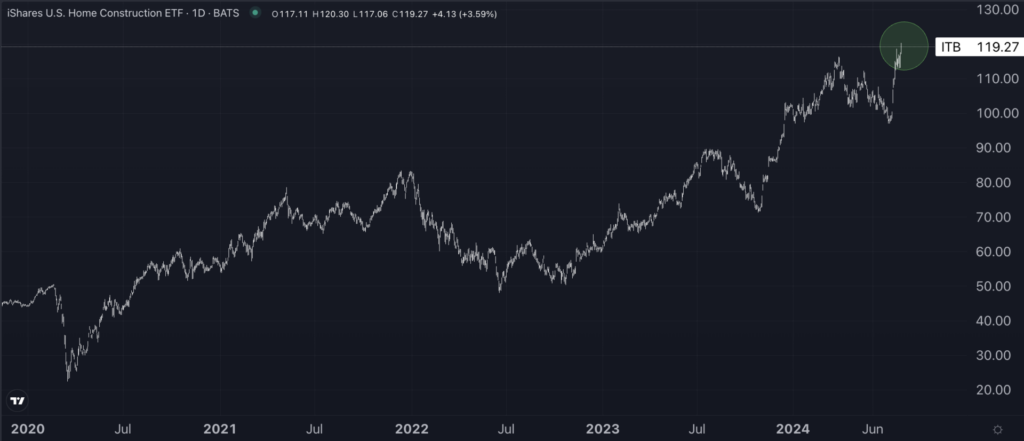

The iShares U.S. Home Construction ETF, a pivotal gauge of U.S. homebuilder equities, leaped 3.8%, securing its third consecutive week of upward mobility.

Over the last three weeks, U.S. homebuilder stocks have soared over 20%, fueled by expectations of lower interest rates boosting sectors like home construction.

Market sentiment has now priced in a Federal Reserve rate cut in September, with speculation rife for even more reductions by December 2024.

Bank of America analyst Rafe Jadrosich noted, “Homebuilders are currently trading at the upper echelon of the historical valuation spectrum, powered by a higher return-on-equity (ROE).” This tendency is forecasted to reach an average ROE of 22%, a distinct uptick from the 2019 level of 20%.

Notably, comparable valuation levels in 2018 and 2021 preceded sharp pullbacks as the Fed hiked rates, as emphasized by Bank of America. Nevertheless, the investment powerhouse is optimistic about the present scenario in 2024’s latter half, foreseeing a probable initiation of rate cuts by the Fed.

On Friday, Bank of America made headlines by double-upgrading Mohawk Industries, Inc. from Underperform to Buy, elevating their price target from $120 to $177 post better-than-anticipated Q2 2024 earnings.

Top-Performing Homebuilder Stocks In July 2024

As of July 26, 2024, the top ten best-performing stocks in the U.S. Home Construction ETF this month are:

| Name | Price Chg. % (MTD) |

| Mohawk Industries, Inc. | 37.16% |

| M/I Homes, Inc. | 35.92% |

| Green Brick Partners, Inc. | 31.50% |

| American Woodmark Corporation | 28.44% |

| Dream Finders Homes, Inc. | 27.42% |

| JELD-WEN Holding, Inc. | 26.80% |

| Installed Building Products, Inc. | 26.65% |

| D.R. Horton, Inc. | 26.29% |

| Tri Pointe Homes, Inc. | 26.26% |

| Century Communities, Inc. | 26.05% |

Latest Mortgage Rates, Housing Market Data

The Mortgage Bankers Association disclosed that the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances of $766,550 or less decreased by 5 basis points to 6.62% for the week ending July 19, 2024.

Despite the reduction in borrowing costs, several housing market indicators paint a gloomy picture.

Homebuilder confidence sagged to 42 in July, its lowest reading this year, according to Bank of America.

Jeffrey Roach, chief economist for LPL Financial, expressed concerns, mentioning, “The low housing supply and soaring interest rates have plunged affordability to recent lows.”

The National Association of Realtors reported a considerable 5.4% slump in existing home sales for June, marking the most substantial monthly decline since 2022.

Furthermore, the U.S. Census Bureau released data revealing that new single-family home sales slid 0.6% month-on-month to a seasonally adjusted annual rate of 617,000 in June 2024, hitting a seven-month low and falling short of the projected 640,000, as elevated prices continued to restrain affordability.

The median sales price of existing homes surged 4.1% year-over-year, setting a new record high.

Now Read: