Despite the fact that some economists suggest that macro factors can explain a significant portion of relative portfolio performance, many investors still struggle to use these factors when making tactical allocation decisions over a 6‑ to 18‑month horizon.

The sheer amount of macro data may make it difficult to anticipate which variables will drive returns. Another challenge is that the influence of macro factors on asset class returns may differ depending on initial conditions. A rise in unemployment, for example, may have a different effect on equity returns if it occurs during an expansion or a recession.

The same could be said of any macro factor: depending on the prevailing regime, the potential impact on asset returns will differ. Yet, for the most part, previous research does not account for this relationship. To map macro factors to expected asset returns, I propose the use of dashboards that can be dynamically updated to inform investment decisions on an ongoing basis.

The proposed process focuses on relative returns between pairs of asset classes. I highlighted which factors may have a significant impact on trades between these pairs under various scenarios, taking into account current conditions as reflected in the macro factors’ current percentile levels.

Historically, stable or improving macro conditions have typically correlated with strong returns for “risk on” trades, such as long large‑cap and small‑cap stocks, high-yield bonds, and emerging markets debt. Regarding style rotation, growth stocks typically have longer duration than value stocks.

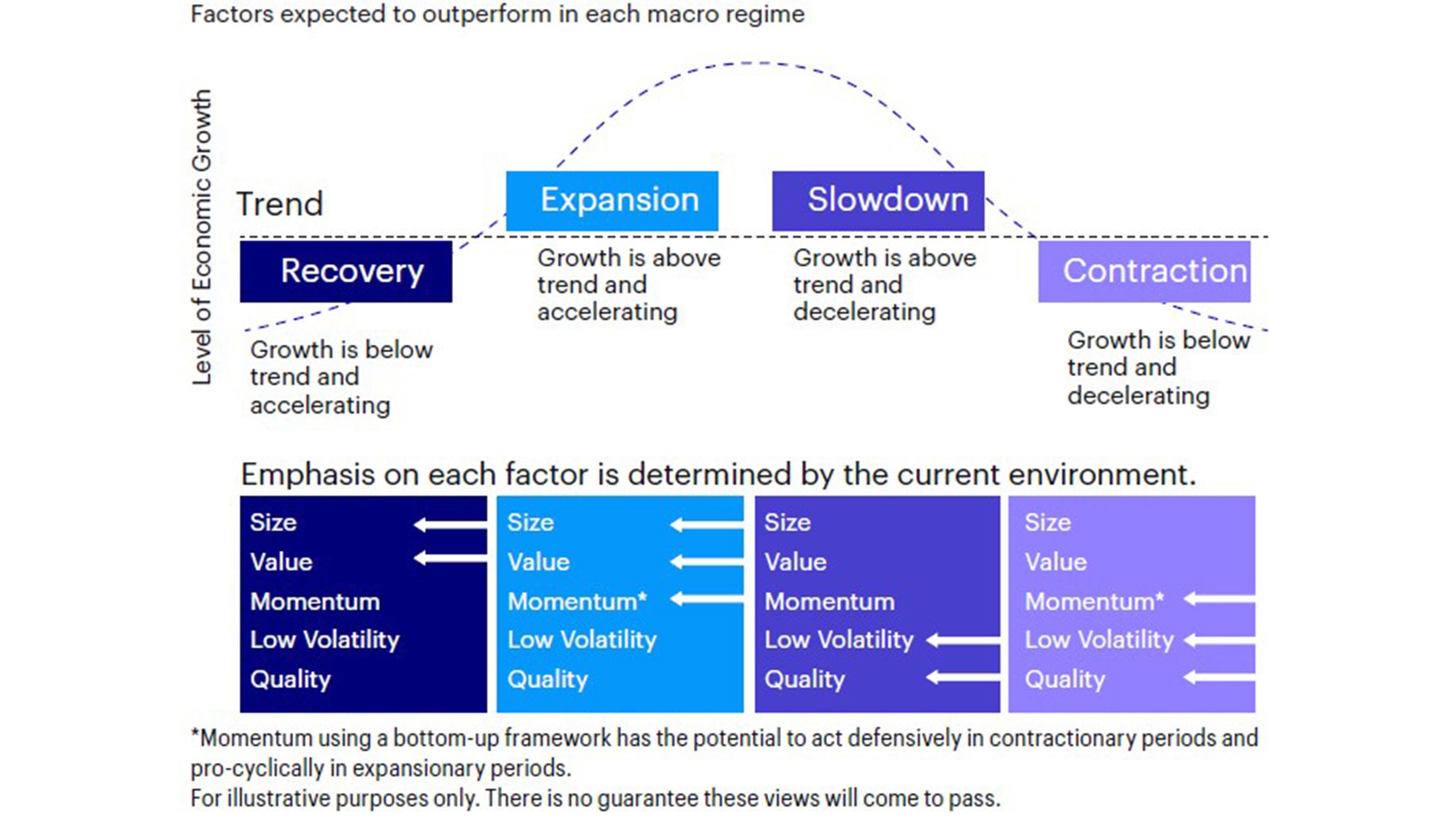

Therefore, even though the dividend yield on value stocks historically has been higher than on growth stocks, growth typically has outperformed value when interest rates decline, while value has tended to outperform when rates rise. Factor cyclicality can be understood in the context of factor fundamentals and their sensitivity to macroeconomic risks.

While size and value tend to be pro-cyclical factors, low volatility and quality tend to be defensive factors. Momentum, a more transient factor, tends to outperform during late cyclical stages. My dashboard can help practitioners filter the historical data to try to predict the impact of macro factors on asset returns, using a framework that incorporates current conditions and that investors can easily replicate.