General Motors Company GM plans to restore North American margins to the 8-10% range, even as the industry navigates shifting economic and regulatory pressures. During its third-quarterearnings call the company reaffirmed that this target is aspirational but achievable with the right strategic adjustments and time to recalibrate operations.

A key area of focus is reducing the net tariff burden. Whether through future trade agreements or through internal cost-management efforts, GM sees meaningful opportunities to offset tariff-related pressures. Another encouraging sign is the stabilization of warranty-related cash outflows. With expenses leveling off, the company expects accruals to catch up over time, eventually creating margin tailwinds as it moves into 2026 and 2027.

General Motors is also taking decisive steps to rightsize its electric vehicle capacity. In the past, production was heavily influenced by a compliance-driven regulatory environment, pushing the company to scale EV operations rapidly. As the market transitions to more natural, demand-driven growth, GM is adjusting its EV footprint to better align with actual consumer interest.

By combining tariff reductions, warranty improvements and a more disciplined EV strategy, GM believes that it can steadily rebuild margins and strengthen its long-term North American profitability. GM carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Margin Performance of GM’s Competitors

Tesla’s TSLA automotive margins inched up from 15% to 15.4% in the third quarter of 2025. Tesla’s margin improvement was driven by lower material costs and stronger fixed-cost absorption as production volumes increased. Tesla’s energy storage division also performed strongly, posting record deployment levels, gross profit and margin gains.

Ford Motor Company F has seen its combined earnings before interest and taxes from software and physical services climb more than 20% over the past three years. Ford’s revenue base has also become more balanced, expanding across different regions, product segments, sales channels and service offerings. In addition, Ford’s industrial operations have consistently delivered cost reductions, providing a solid foundation for sustaining healthy margins.

General Motors’ Price Performance, Valuation and Estimates

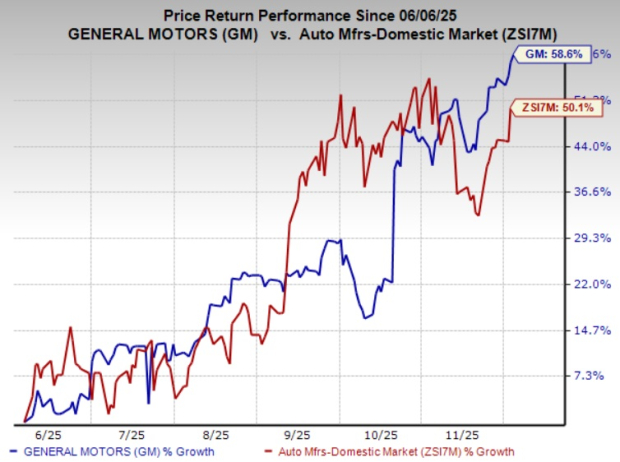

GM has outperformed the Zacks Automotive-Domestic industry year to date. General Motors’ shares have gained 58.6% compared to the industry’s growth of 50.1%.

Image Source: Zacks Investment Research

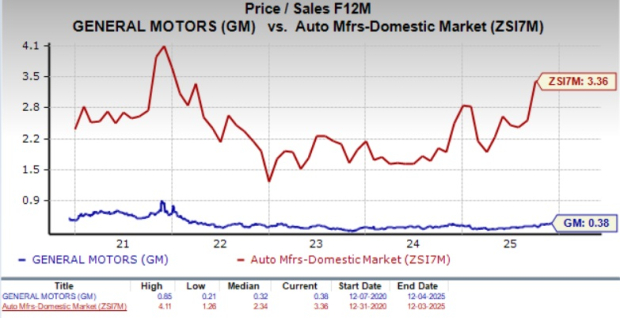

From a valuation perspective, GM appears undervalued. Going by its price/sales ratio, the company is trading at a forward sales multiple of 0.38, down from the industry’s 3.36.

Image Source: Zacks Investment Research

EPS Estimates Revision

The Zacks Consensus Estimate for 2025 and 2026 EPS has narrowed by 21 cents and 38 cents, respectively, in the past 30 days.

Image Source: Zacks Investment Research

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you’ll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).