The transportation sector recently endured a tremor due to the disappointing performance of United Parcel Service (UPS) on July 23. This unexpected turn of events cast a shadow over investor sentiments, leading to a cautious approach towards both the company’s stock and the broader sector.

UPS Reports Soft Q2 Earnings

Despite witnessing volume growth in the United States for the first time in nine quarters, UPS failed to implement an effective cost-cutting strategy to boost volumes during the second quarter. The company reported an earnings per share of $1.79, falling short of the Zacks Consensus Estimate of $1.98 and marking a 29.5% decline from the previous year. Revenues also dropped by 1% year-over-year to $21.8 billion, missing the Zacks Consensus Estimate of $22.31 billion. Such results signify a setback for UPS, as it grapples with escalating labor costs amid a tepid demand environment post a surge in e-commerce deliveries due to the pandemic.

United Parcel Service revised down its revenue guidance to $93 billion from a previous range of $92-$94.5 billion for the year. The Zacks Consensus Estimate stands at $93.01 billion. Furthermore, the company reduced its operating margin forecast to 9.4% from the earlier range of 10-10.6%.

Market Reaction

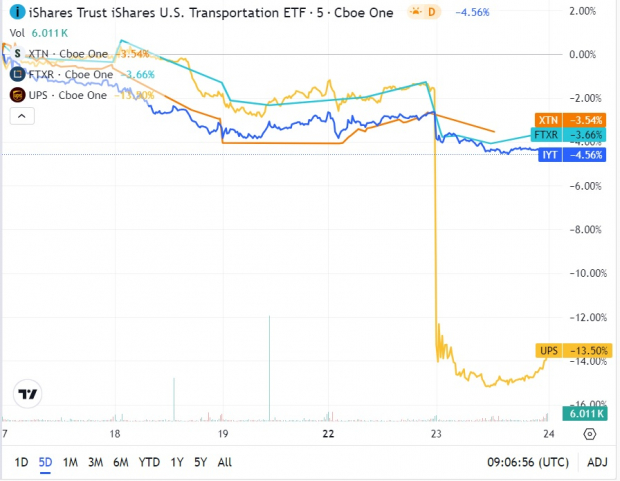

UPS witnessed its biggest decline in 25 years, with a staggering 12% drop following the second-quarter results and a lackluster outlook. This downturn also reverberated in the ETF market, causing the iShares U.S. Transportation ETF (IYT), First Trust Nasdaq Transportation ETF (FTXR), and SPDR S&P Transportation ETF (XTN) to decline by 1.9%, 2.6%, and 0.9%, respectively, on that day.

Image Source: Zacks Investment Research

Facing the Future

Despite the recent setbacks faced by UPS and the anticipate difficulties, investors should not overlook transportation ETFs in their portfolios. These funds provide diversification by encompassing various industries such as railroads, airlines, and low-cost trucking, which can help buffer against shocks from major industry players.

IYT has significant exposure to railroads, making up around 27.2% of its portfolio, while airfreight & logistics accounts for nearly 21.5%. FTXR, on the other hand, allocates the majority of its assets to automobiles (26.9%) and delivery services (16%). XTN has a substantial focus on cargo ground transportation (31.4%) and passenger airlines (24.6%).

When it comes to individual holdings, UPS comprises 9.3% of the IYT portfolio and 6.7% of the FTXR portfolio. Conversely, XTN follows an equal-weight methodology. Despite IYT being more popular and liquid, XTN offers cost-effectiveness with an annual fee of 35 bps. These ETFs hold a Zacks ETF Rank #2 (Buy), indicating potential outperformance against the broader market in the foreseeable future. Nevertheless, the transport sector is projected to witness a 12.6% decline in earnings, as per the Zacks Earnings Trend report, which might further weigh on ETFs.