The 2024 Q2 earnings season is slowly coming to a close, with numerous companies showcasing higher profitability through margin expansion. Among them are Deckers Outdoor (DECK), Kimberly Clark (KMB), and Walmart (WMT). Let’s delve into the details of each company’s latest quarterly releases.

Deckers Outdoor: Brand Momentum Propels Growth

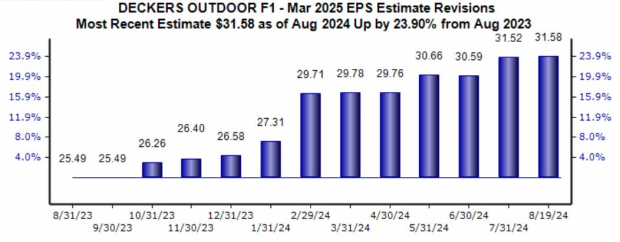

Deckers Outdoor has once again impressed investors by surpassing earnings and revenue expectations significantly. With EPS surging 90% year-over-year and sales escalating by 22%, the company’s continued brand momentum, particularly in UGG and Hoka shoes, has been a key driver of its success. The company raised its fiscal year outlook, reflecting a positive trajectory ahead.

The company’s consistent margin expansion, notably demonstrated by a gross margin increase to 56.9% from 51.3% in the previous year, has further enhanced its profitability outlook.

Image Source: Zacks Investment Research

Kimberly-Clark: Resilience in the Consumer Staples Sector

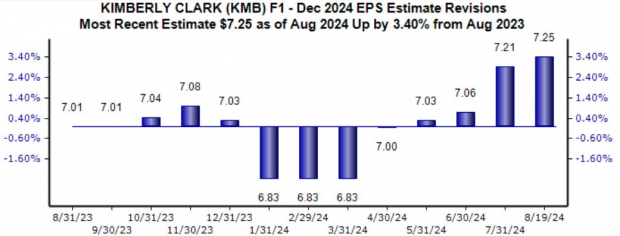

Kimberly-Clark (KMB) has showcased its defensive nature within the consumer staples sector, with its shares gaining over 15% year-to-date. Positioned to generate consistent demand regardless of economic conditions, the company’s strategic cost management practices have significantly boosted its profitability. Its adjusted EPS rose by 20% year-over-year in the latest quarter.

Margin expansion has been a key factor contributing to the company’s success, as reflected in the chart below.

Image Source: Zacks Investment Research

Walmart: Harnessing Higher Profits and Digital Growth

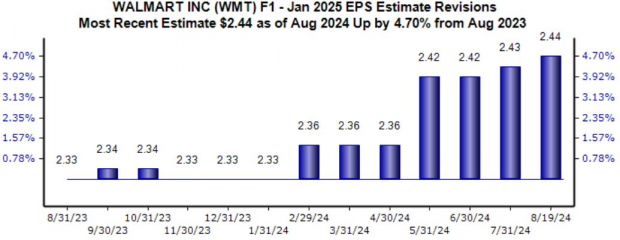

Walmart (WMT) reported a 22% increase in EPS and nearly 5% revenue growth, surpassing market expectations. The retail giant’s improved gross margin and operating income underscore its strong performance. Its digital efforts, with a notable 21% surge in global eCommerce sales, have been pivotal in driving growth across all segments.

Following the positive earnings report, Walmart raised its FY25 net sales and adjusted operating income guidance, signaling optimism. Analysts have adjusted their earnings outlook accordingly, projecting a 10% increase year-over-year.

Image Source: Zacks Investment Research

Conclusion

All three companies, Deckers Outdoor (DECK), Kimberly Clark (KMB), and Walmart (WMT), have demonstrated strong performance in their recent quarterly releases. The common thread of margin expansion has significantly contributed to their enhanced profitability, setting a positive tone for their future outlook.