Investors often keep a watchful eye on insider trading activities as they can offer a peek into a company’s future trajectory. Who exactly are these ‘insiders’? They are officers, directors, significant stockholders, or individuals privy to internal information due to their affiliations with the company, subject to strict regulations concerning trading.

Recently, notable insider activities have occurred in companies like Intel INTC, Yum China YUM, and Energy Transfer ET, where the CEOs of these firms have embarked on acquiring shares. Let’s delve into these transactions for those keen on shadowing the insiders’ moves.

Intel: A Rocky Road

Intel shares witnessed a tumultuous journey in 2024, failing to capitalize on the semiconductor hype and plummeting nearly 60%. With a Zacks Rank #4 (Sell) tag, earnings outlook for the stock turned bearish post its latest quarterly results.

Image Source: Zacks Investment Research

Despite the gloomy numbers, CEO Pat Gelsinger surged ahead by purchasing 12.5k shares post the disappointing results, totaling around $250k. Gelsinger expressed optimism, highlighting key technological milestones and strategic actions to enhance market position and drive profitability.

Yum China: Riding High

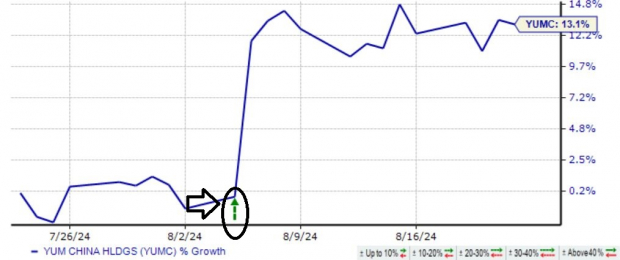

Yum China, birthed post its spin-off from Yum! Brands in late 2016, soared with CEO Joey Wat snagging 3.8k shares worth $130k, boosting her total holdings to 270k shares. The stock witnessed a robust 13% uptick following the latest quarterly report, with adjusted EPS climbing 18% and sales nudging up 1%.

Image Source: Zacks Investment Research

The positive quarterly release showcased record-breaking Q2 sales, operating profit, and EPS. Despite holding a Zacks Rank #3 (Hold), the stock exuded promise.

Energy Transfer: CEO’s Leap

Energy Transfer, a stalwart in U.S. energy assets, saw Co-CEO Thomas Long bolstering confidence with a purchase of 20k shares worth $313k. The stock surged 23% in 2024, primarily backed by upbeat post-earnings sentiments.

Image Source: Zacks Investment Research

While currently labeled as a Zacks Rank #3 (Hold), caution is advised due to downward earnings revisions. A positive tweak in estimates could spell a brighter future for the stock.

Wrapping Up

Monitoring insider trades can offer valuable insights for investors eyeing a longer-term horizon. After all, why would insiders invest if they lacked faith in the company’s trajectory? With CEO buy-ins evident in Intel, Yum China, and Energy Transfer, astute investors might want to take a cue from the insiders.