When pondering over the decision to invest in a stock, the nods and winks from Wall Street analysts often come into play. These analysts, holed up in brokerage firms, throw their two cents in on a stock through their ratings, giving birth to media reports that can sway stock prices. But is the gospel truth hidden in these tidbits?

Before we delve into the trustworthiness of these brokerage endorsements and how you can spin them to your advantage, let’s snoop around to see what the bigwigs on Wall Street think about the fate of Broadwind Energy, Inc. (BWEN).

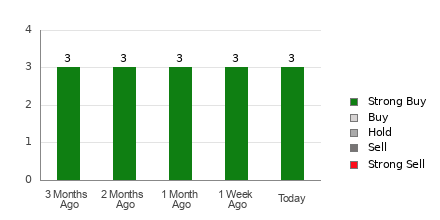

Draped in an average brokerage recommendation (ABR) of 1.00 – on a spectrum ranging from 1 to 5, strutted by Strong Buy to Strong Sell – Broadwind Energy is basking in the glow of approval shimmered upon it by three brokerage firms. In the realms of ABR, a score of 1.00 hints at a sanctuary of Strong Buy.

Of these tried and tested three buddies of brokerage bag of tricks, a unanimous trio chants the mantra of Strong Buy, harmoniously echoing across the hills, representing the full 100% of recommendations.

Brokerage Backtracks for BWEN

The ABR whispers sweet nothings about Broadwind Energy, but hitching your wagon solely to this star might not be the silver bullet you seek. Reams of studies suggest that relying on brokerage recommendations is akin to scrying in the dark, leading many an investor astray.

Ever wondered why? The analysts, snug in their brokerage cocoons, tend to spin a yarn of positivity around the stocks they cover, filling the air with lullabies of Strong Buy. These studies twirl the tale of five “Strong Buys” for every “Strong Sell,” laying bare the skewed interests of these firms against the retail investors, leaving them bereft of foresight into a stock’s future dance.

Thus, it’s wise to use this information as a side dish to your own recipe of analysis or garnish it atop a tried-and-true tool adept at prising open the Pandora’s box of stock movements.

Zacks Rank, our exclusive tool decked with external audits, sorts stocks into five corners of a ring, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), showcasing itself as a crystal ball for a stock’s near-future performance. So, validating the ABR through the Zacks Rank might just be your golden ticket to investment opulence.

ABR vs. Zacks Rank: A Tale of Two Cities

In a world where ABR and Zacks Rank parade on a scale from 1 to 5, they twirl in vastly different dance styles.

While brokerage whispers fuel the ABR engine, spitting out its verdict in decimals, the Zacks Rank waltzes to the tune of earnings estimate revisions, spinning in whole numbers from 1 to 5.

Burrowed into the brokerage beds, analysts continue their soliloquies of hope with ratings shinier than their research supports, leading the investors down the garden path far more frequently than lighting the way.

On the flip side, the Zacks Rank nests in the bosom of earnings estimate revisions. Studies unveil a waltz of earnings estimate trends paralleling short-term stock price capers.

Moreover, the Zacks Rank tailor-fits its grades for all stocks featuring in the brokerage analysts’ current-year earnings vision board. This tool keeps the seesaw balanced among its five kingdom ranks.

And another feather in the cap of Zacks Rank lies in its timeliness, always ready with fresh tidings. While the ABR snoozes on outdated laurels, the Zacks Rank sprints alongside the earnings estimate revisions, quick to herald a stock’s future voyage.

Is BWEN a Hidden Gem?

Tuning into the earnings forecast for Broadwind Energy, the Zacks Consensus Estimate has taken a pleasant 154.5% leap over the last moon cycle, landing softly at $0.09.

The symphony of analysts’ glee over the company’s earnings horizon, as testified by a flock of them flapping their wings in unison to raise EPS estimates, could well be the rocket fuel propelling the stock to the stars in the near run.

The thunderous boom in the consensus estimate magnitude, coupled with other three elements sprinkled on the earnings estimate salad, has crowned Broadwind Energy with the Zacks Rank #1 (Strong Buy). If you crave for more, you can savor the full list of Zacks Rank #1 (Strong Buy) maestros here >>>>

Thus, the drumbeat of the Buy-equivalent ABR may well light your path through the labyrinth of investments.

Free Report – The Bitcoin Profit Phenomenon

Zacks Investment Research unveils a Special Report to guide you on a treasure hunt for whopping gains from the world’s premier decentralized currency.

No crystal balls for tomorrow, but during the last rounds of three presidential masquerades, Bitcoin chippered up as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%.

Zacks prophesizes another whirlwind. Jump on board for a read on Bitcoin: A Tumultuous Yet Resilient History.

Download Now – It’s FREE Today >>

Broadwind Energy, Inc. (BWEN) : Free Stock Analysis Report