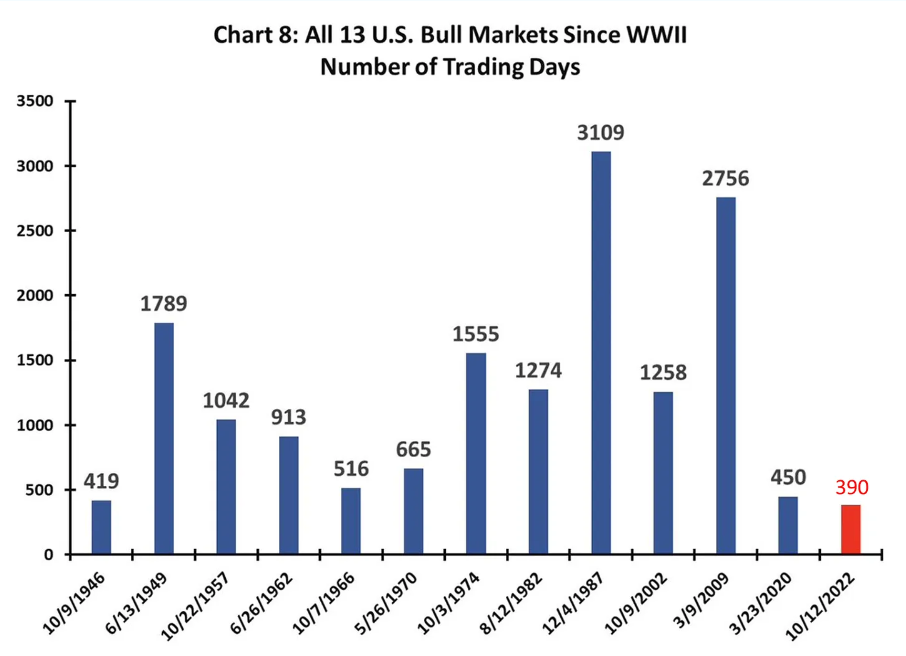

The short-term ups and downs tend to obscure our vision of long-term bullish markets, often leading us to misinterpret the broader perspective.

If the current bullish market were to close today, it would rank as the fourth shortest since the postwar era, standing at the fourth position out of the thirteen previous bull markets in terms of total return since its inception (40.7%).

Looking back, the 2020 post-pandemic market claimed the title for the strongest gains (+94.5%), while the 1946 bull market lagged behind with the weakest performance, though still positive at +11%.

Comparing the trajectory of the current bull market against those that began in December 2022 vividly illustrates a contrasting market environment compared to a year ago.

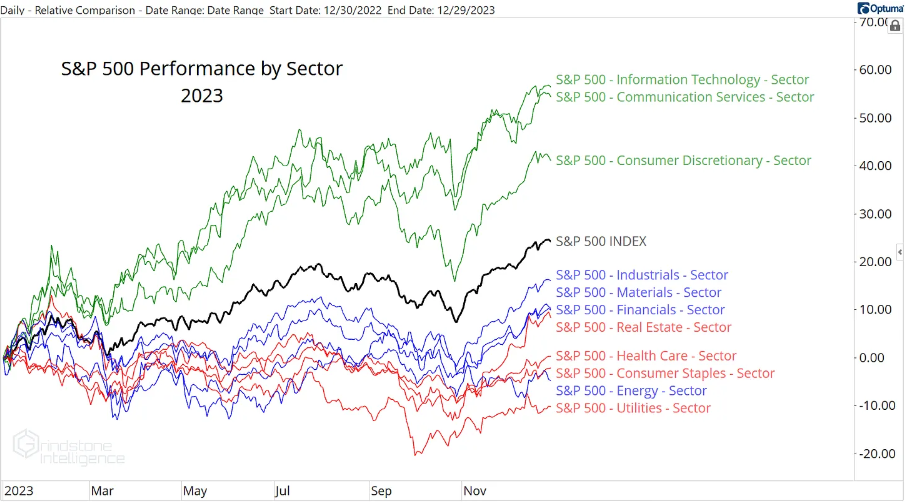

Transition in Sector Dominance

In 2023, mega-cap growth stocks held sway in the bull market, propelled by the upward trend that surpassed the market’s average performance.

Notably, growth-oriented sectors displayed a robust bullish trend, contrasting with the subdued performance of value sectors and risk-off sectors.

This year, communication services have surged, cementing their status as a top performer. However, real estate continues to struggle while a clear leader among the middle sectors remains elusive.

The debate within the market hints at uncertainty about the sector that will ultimately reign supreme.

Robust Market Breadth Signals Confidence

The growth vs. value ratio has been steadily climbing since September 2020, attempting to breach the previous highs in 2021 and 2023.

Recently, a breakout occurred, followed by consolidation above a critical support level in 2024. Such consolidations typically indicate a continuation of the bullish long-term trend.

While growth stocks are poised to maintain their outperformance, a brief downturn might hint at a potential shift favoring value stocks.

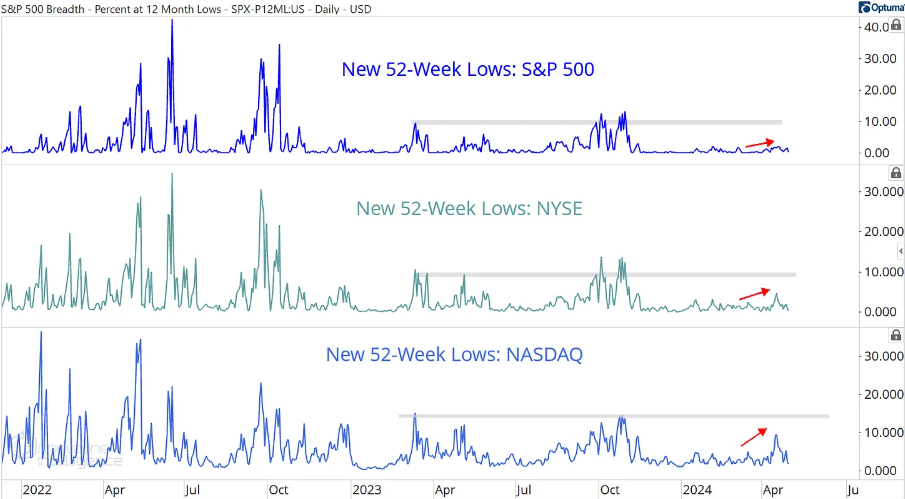

Before definitively declaring a bearish turn, a weakening in market breadth is necessary. This would be apparent through a general market reversal, yet presently, 58% of S&P 500 stocks remain above their 200-day moving average.

Furthermore, the number of new lows currently lags behind the levels witnessed in 2023, suggesting we are still some distance away from a solid bear market indication.