In the realm of Wall Street, Lululemon’s (LULU) stock has long been the apple of investors’ eyes, praised for its stellar growth as a premier athletic apparel retailer with a devoted following.

Nonetheless, the tides have turned, with LULU witnessing a steep -46% drop year to date, ignited by a conservative fiscal 2024 guidance. While the expected net revenue growth of 10%-11% is commendable, it failed to meet the soaring expectations of many analysts.

As the anticipation builds for Lululemon’s Q1 earnings, set to be unveiled after-market on Wednesday, June 5, the burning question lingers – is it time to hold onto LULU or strike a deal as per the approaching quarterly results?

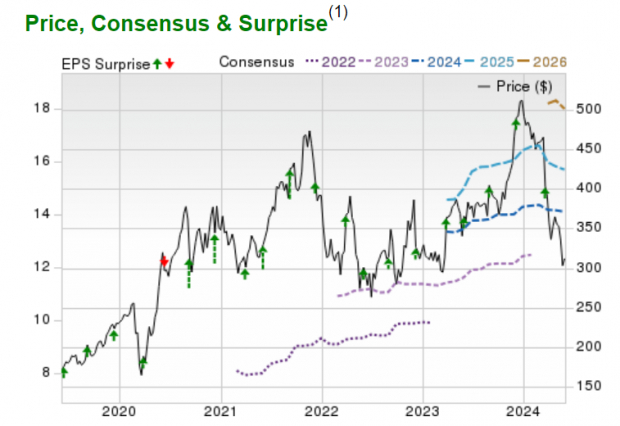

Image Source: Zacks Investment Research

Anticipation for Q1 Performance

Reflecting on the Price, Consensus & Surprise chart above, Lululemon has consistently outperformed earnings projections for 15 consecutive quarters. However, a lackluster outlook post its recent Q4 report sent shockwaves, causing LULU’s stock to nosedive.

Despite concerns over subdued consumer expenditure, the estimates suggest that Lululemon’s Q1 sales could touch $2.2B, marking a 10% jump from last year’s $2B. Additionally, Q1 earnings are anticipated to spike by 4% to $2.38 per share.

Reflection on Historical Performance & Valuation

While Lululemon strides forward with steady growth amidst heightened expectations, a flashback to its historical performance alongside a close scrutiny of its valuation stands paramount for potential investors at this juncture.

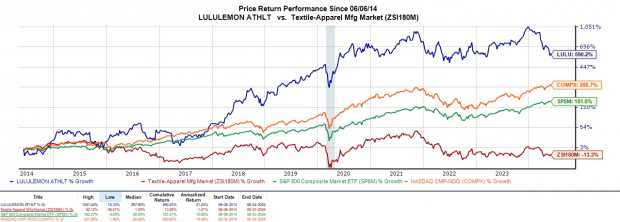

Looking back five years, LULU boasts a remarkable +75% rise, showcasing immense gains nearly touching +600% over the past decade. These figures outshine the Zacks Textile-Apparel Market’s -13%, surpass the S&P 500’s +181%, and even outpace the Nasdaq’s +289%.

Image Source: Zacks Investment Research

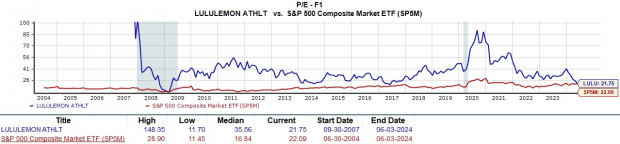

Of intrigue is the fact that Lululemon is currently trading at its lowest forward earnings multiple since its IPO in 2007 at 21.7X. This figure undeniably falls beneath its historical P/E zenith of 148.3X and embodies a 38% discount compared to the long-standing median of 35.5X.

Image Source: Zacks Investment Research

Key Takeaway

While the allure to invest in Lululemon at its current levels is enticing, with the apparel giant projecting a modest double-digit percentage growth on both revenue and earnings in FY24, caution is urged. LULU carries a Zacks Rank #4 (Sell), with EPS estimates for FY24 witnessing a gradual descent over the past quarter alongside a recent minor dip.

Today, See These 5 Potential Home Runs >>

lululemon athletica inc. (LULU) : Free Stock Analysis Report