U.S. stocks ended mixed on Friday, with the scoring its fifth straight record closing high as investors continued to assess when the Federal Reserve might begin cutting interest rates.

For the week, the tech-heavy Nasdaq jumped 3.2%, the benchmark rose 1.6%, while the blue-chip declined 0.5%.

Source: Investing.com

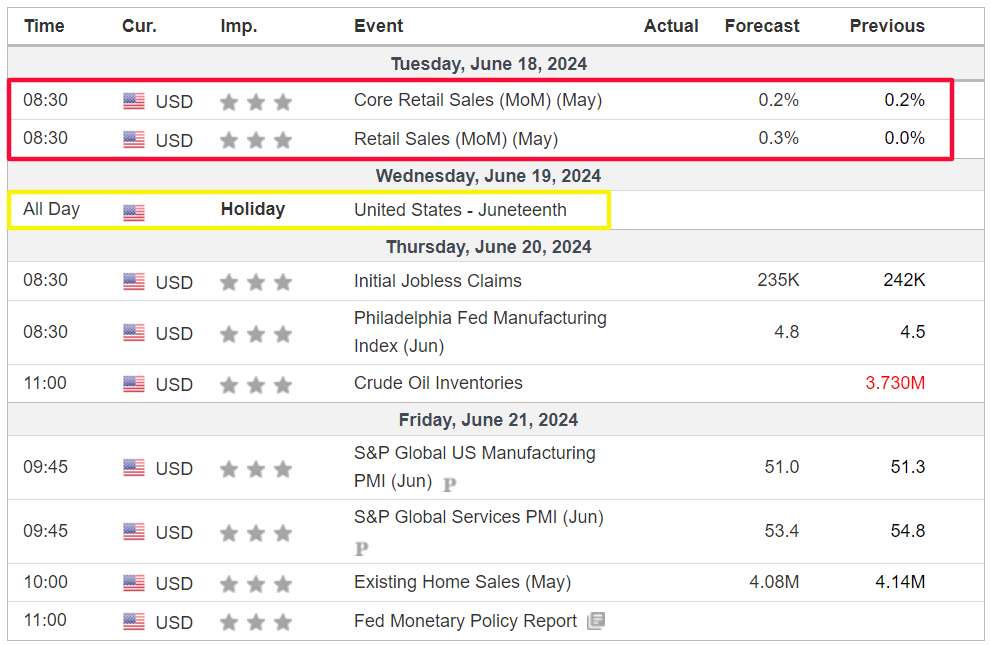

The holiday-shortened week ahead – which will see U.S. stock markets closed on Wednesday in observance of Juneteenth – is expected to be another busy one as investors weigh how much juice is left in the AI-inspired rally on Wall Street and when the Fed may decide to cut rates.

Most important on the economic calendar will be Tuesday’s U.S. retail sales report for May, which is forecast to show a small increase for the month.

Source: Investing.com

That will be accompanied by a heavy slate of Fed speakers, with the likes of district governors Lisa Cook, Thomas Barkin, and Adriana Kugler all set to make public appearances. Traders now see about a 70% chance of the first rate cut hitting in September.

Meanwhile, some of the key earnings reports to watch include updates from Lennar, KB Home, Darden Restaurants, and Kroger.

Stock Analysis: Hewlett Packard Enterprise

I expect Hewlett Packard Enterprise’s stock to outperform this week as the edge-to-cloud company hosts its highly anticipated ‘HPE Discover summit’. The enterprise hardware, software, and consulting company has a history of attracting several analyst upgrades in the wake of its summit presentations.

Shares of Hewlett Packard Enterprise tend to rally during the week of its annual ‘Discover’ event. The Texas-based tech company has a valuation of $28.1 billion and has been on a major uptrend since the start of the year, gaining about 27% so far in 2024

Source: Investing.com

ProTips points out that Hewlett Packard Enterprise boasts an above-average Financial Health Score of 2.9 out of 5.0, supported by its robust profitability outlook and strong sales growth prospects.

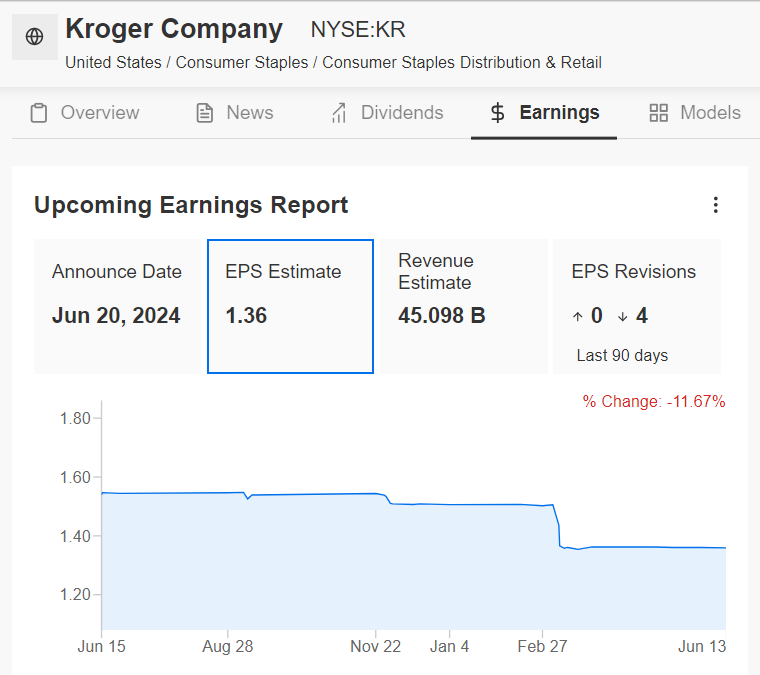

Stock Analysis: Kroger

I believe Kroger will suffer a difficult week ahead as the supermarket giant’s latest earnings will likely reveal a sharp slowdown in both profit and sales growth due to the uncertain macro environment. Market participants expect a sizable swing in KR stock following the update, with a possible implied move of about 6% in either direction, according to the options market.

Kroger – the largest supermarket chain in the country, is expected to deliver Q1 earnings per share of $1.36, falling 9.9% from EPS of $1.51 in the year-ago period, amid higher cost pressures and decreasing operating margins. Shares have lagged the year-to-date performance of the broader market in 2024, rising 10.2%

Source: InvestingPro