Even with a modest uptick of +2% in today’s trading session, Target’s (TGT) stock is still grappling with a -7% decline post the disclosure of its mixed Q1 results earlier this week.

Yet, should investors consider this downturn as a promising entry point into the retail giant’s stock for a potential resurgence from its current standing?

Dissecting Q1 Financial Performance

Target’s Q1 EPS of $2.03 fell slightly short of the Zacks Consensus estimate of $2.05 per share by -1%. Even though Q1 sales of $24.53 billion marginally surpassed projections of $24.51 billion, year-over-year earnings were down by -1% and sales by -3% from the corresponding period, attributed to persistent softness in Home and Hardlines categories, among other factors.

Image Source: Zacks Investment Research

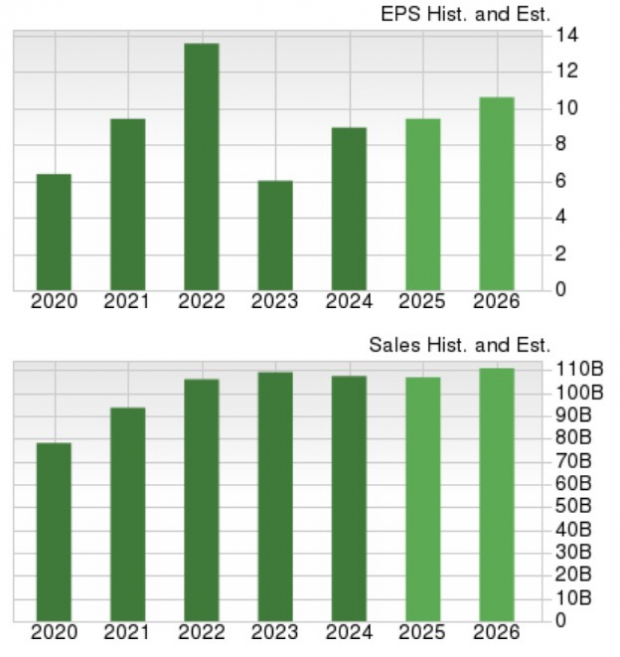

Growth Projections & Market Outlook

Zacks forecasts a 5% uptick in Target’s annual earnings for fiscal 2025, with a projected 13% surge in FY26 to $10.60 per share. While total sales are anticipated to dip to $106.81 billion in FY25 and bounce back by 4% to $110.78 billion in FY26.

Image Source: Zacks Investment Research

Examining Historical Performance & Valuation

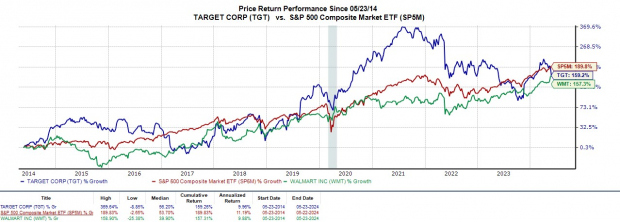

While Target’s YTD stock is trailing behind its retail counterpart Walmart (WMT) by -1%, the long-term trajectory shows a more compelling narrative. Over the past decade, TGT has surged by +159%, albeit slightly behind WMT’s growth of +157%, and the benchmark index which stands at +190%.

Image Source: Zacks Investment Research

Trading at 15.2X forward earnings, Target’s P/E valuation stands intriguingly below Walmart’s 27.2X and the S&P 500’s 22.2X. Furthermore, TGT currently trades well below its historical high of 30.4X and at a slight discount to the median P/E ratio of 16.3X.

Image Source: Zacks Investment Research

The Verdict

With the projected earnings recovery paired with an attractive P/E valuation, the temptation to delve into Target amid its post-earnings dip seems palpable. Yet, for now, Target’s stock remains at a Zacks Rank #3 (Hold).