The Significance Beyond Rate Cuts

As Wall Street speculates on the impending rate cut, the debate between 25 and 50 basis points rages on. However, Eric Fry’s lead analyst, Thomas Yeung, urges us to look beyond these numbers. He emphasizes that the essence of today’s economy transcends the rate cut itself. Rather, it signifies the transition to a mid-stage expansion.

Our experts anticipate numerous rate cuts in the next year, with the Fed possibly reducing the Fed Funds rate by 10 steps. This move is expected to revitalize various sectors and foster economic growth.

Focused Sectors in Preparation

Thomas and Eric have tech and healthcare sectors in their sights, foreseeing them as beneficiaries during mid-stage recoveries. Lower interest rates are poised to support companies within these industries by reducing borrowing costs and driving performance.

On the other hand, Luke is eyeing tech and AI plays post-rate cuts, projecting a strengthened economy and increased earnings. He highlights the burgeoning demand for AI-related technologies as a key investment area.

Diverse Investment Approaches

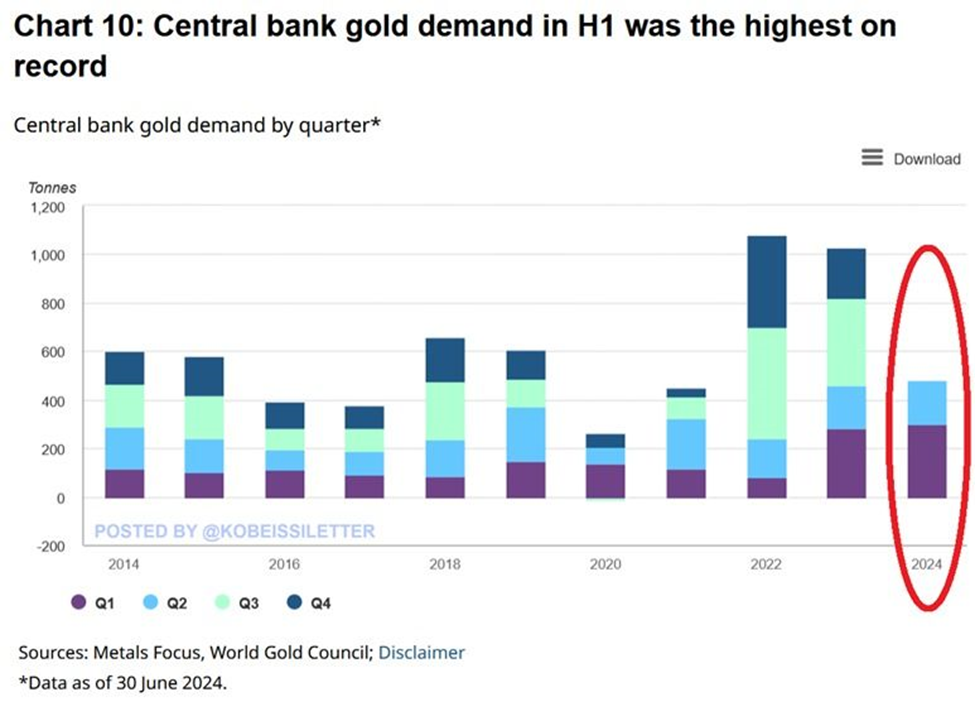

Legendary investor Louis Navellier, known for his data-driven quantitative approach, surprises with a recent endorsement of gold-related investments. Despite gold’s lack of earnings, the surge in gold prices has significantly boosted the earnings of gold mining companies.

Central banks globally have been aggressively purchasing gold, setting records in the process. Louis predicts further price growth in gold due to ongoing global uncertainties and waning confidence in central banks.

Source: Metals Focus, World Gold Council

The current geopolitical environment combined with economic uncertainties further strengthen the case for including gold in investment portfolios moving forward.

Jeff Remsburg signs off, leaving investors contemplating the strategic insights shared by our esteemed experts.