Preview: Today, we will unravel the catalysts and strategic moves of the “smart money” investing in MSCI Argentina ETF (ARGT), Russell 2000 Index ETF (IWM), iShares Bitcoin Trust ETF (IBIT), Alibaba (BABA), and JD.com (JD).

Deciphering Smart Money Moves

On Wall Street, amidst the chaos of financial media and individual psychology, crafting a unique investment approach becomes crucial. While noise surrounds us, drawing inspiration from seasoned insiders and successful traders can offer valuable insights. Let’s explore two tactics to track the “smart money.”

1) Monitoring 13F Filings

In the realm of investing, keeping an eye on 13F filings unveils the maneuvers of institutional investors holding over $100 million in AUM. Though timing may not align, understanding the reasoning behind their trades and the significance within their portfolios can provide valuable insights for everyday investors.

2) Insider Buying Patterns

Insights into insider buying tendencies can offer a strategic edge. It’s notable that insider purchases carry more weight than sales as they signify a belief in potential stock appreciation, unlike scheduled selling activities.

Stanley Druckenmiller’s Strategic Moves

Renowned investor Stanley Druckenmiller, lauded for his decades-long success and interdisciplinary expertise, recently made significant bets on Argentina and U.S. small caps.

Argentina Outlook: A New Era of Free Markets

Druckenmiller’s interest in Argentina stemmed from President Javier Milei’s pro-free market stance, illustrating a shift towards free-market policies expected to elevate Argentine stocks.

ARGT ETF: Riding Druckenmiller’s Wave

The ARGT ETF encapsulates a selection of Argentine stocks, reflecting Druckenmiller’s optimistic outlook with a 23% year-to-date surge.

Small Caps: Return to Equilibrium?

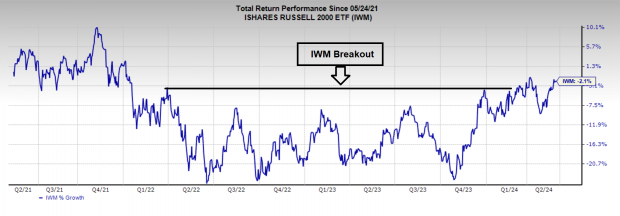

Druckenmiller’s recent venture into call options within the Russell 2000 Index ETF (IWM) hints at a potential shift towards equilibrium for small caps.

Catalyst: Easing Interest Rates

With prospects of lower interest rates on the horizon, small-cap stocks could shed the burden of high rates and start converging towards a standard mean. Technical analysis indicates a promising breakout for IWM, echoing the adage, “The longer the base, the higher in space.”

Image Source: Zacks Investment Research

Bitcoin ETFs Pave the Way for Institutional Participation

The approval of spot Bitcoin ETFs earlier this year set the stage for institutional adoption of the premier cryptocurrency. Recent 13F declarations unveiled over 600 institutions embracing Bitcoin ETFs like IBIT, signaling a significant shift in institutional sentiments towards cryptocurrencies.

Michael Burry & David Tepper: Mavericks of the Market

The market acumen of stalwarts like Michael Burry and David Tepper reflects bold and often accurate calls, reshaping the investment landscape with their unconventional yet successful strategies.

Smart Money Bets: Contrarians Eye China’s Alibaba

David vs Goliath: Burry and Tepper’s Contrarian Vision

Betting against the herd is an art form few master like Michael Burry and David Tepper. Burry’s prescient call during the 2008 Global Financial Crisis earned him notoriety, portrayed by Christian Bale in the film “The Big Short.” On the other hand, Tepper’s massive investments in banks like Bank of America (BAC) paid off handsomely, netting him billions and even the luxury of buying the Carolina Panthers.

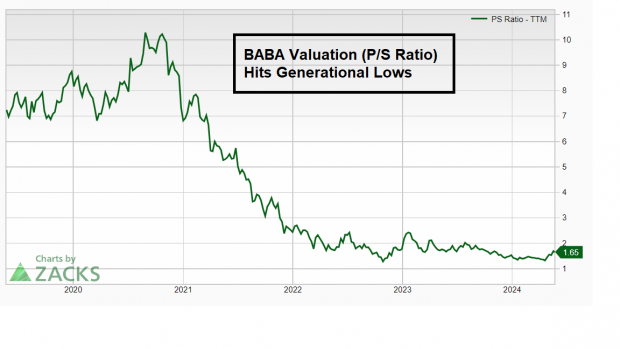

China and Alibaba (BABA): A Contrarian Bet

Turning their gaze towards the e-commerce landscape in China, Burry and Tepper are placing their chips on a potential turnaround. Holding JD.com (JD) as his largest stake, Burry follows up with Alibaba (BABA) as his second-largest position. Tepper, on the other hand, has gone all-in on BABA. Particularly intriguing is the insider activity at Alibaba, with figures like Founder and CEO Jack Ma investing over $100 million in BABA stocks. This move comes at a time when the company boasts a valuation that might be the envy of any bargain shopper.

Image Source: Zacks Investment Research

Deciphering the Clues of Smart Money

This quarter’s 13Fs and insider transactions offer key insights into the trajectories that smart money is charting. From Argentina, small caps, Bitcoin, all the way to the enigmatic rise of China, these market regions are pulsing with potential. By observing the movements and patterns of savvy investors like Burry and Tepper, astute financial minds can glean valuable cues about the shifting winds of the market.