The world of retail is akin to a turbulent sea; one moment, calm waters prevail, and the next, a storm hits. This week, the landscape was abuzz with activity, shedding light on the current state of the American consumer.

The July U.S. Retail Sales Report

As the dust settled on the latest earnings reports, eyes turned to the July U.S. retail sales report, a crucial barometer of consumer spending habits. In a refreshing turn of events, retail sales in July experienced a hearty 1% increase, trumping economists’ expectations of a mere 0.3% rise. Delving deeper, categories like spending at bars and restaurants, clothing and accessories, as well as electronics and appliances all witnessed significant upticks, signifying a resilient consumer base.

Interestingly, despite the prevailing headwinds, a notable 11 out of 14 segments surveyed reported a rise in sales, hinting at a shift towards prudent spending habits and value-conscious choices among consumers.

Breaking Down Walmart’s Earnings

Stepping into the limelight, Walmart showcased its second-quarter earnings, painting a picture of strength and stability in uncertain times. The retail behemoth outperformed expectations, with earnings per share at $0.67, surpassing estimates by 3.1%. Revenues of $169.3 billion marked a solid 4.8% year-over-year increase, outshining projections of $168.53 billion.

Moreover, Walmart’s robust e-commerce sales growth in both the U.S. and internationally, as well as a flourishing global advertising business, underscored its adaptability and agility in a changing retail landscape.

“Each part of our business is growing – store and club sales are up, eCommerce is compounding as we layer on pickup and even faster growth in delivery as our speed improves. Our new businesses like marketplace, advertising, and membership, are also contributing, diversifying our profits and reinforcing the resilience of our business model.”

Notably, President and CEO Doug McMillon’s assertion that the average consumer remains steadfast contradicts the prevailing narrative of economic turmoil, providing a glimmer of hope in uncertain times.

Is Walmart a Smart Buy?

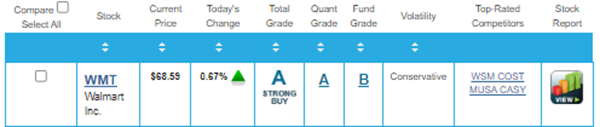

Following the resounding success of Walmart’s earnings report, the burning question on investors’ minds is whether to ride the wave of optimism and invest in the company. The answer, according to Portfolio Grader, is a resounding yes.

Boasting an A-rating, Walmart shines as a “Strong Buy”, supported by stellar Quantitative and Fundamental Grades. The stock stands as a testament to institutional confidence and robust underlying performance, making it an enticing prospect for savvy investors.

Unveiling the Resilience of Walmart Amid Economic Uncertainty

Walmart’s Steadfast Performance in Turbulent Times

As the American consumer grapples with mounting financial stress, Walmart stands as a beacon of stability. Renowned for its ability to weather economic storms, the retail giant’s sales and revenues exhibit a remarkable resistance to the fluctuations that often unsettle markets.

The Power of Diversification in Investment Strategies

The notion of a diversified portfolio is a timeless principle in the world of investments. Just as different dances complement each other on a ballroom floor, stocks within a portfolio can play contrasting roles – some advancing while others retreat. The “Growth Investor” recommendations epitomize this strategy, offering a balanced mix of stocks that can thrive in various economic climates.

Confidence in the Face of Economic Ambiguity

While the economic horizon remains clouded with uncertainty, the “Growth Investor” stocks underpin a sense of assurance. Like a sturdy vessel navigating rough seas, these investments are poised to navigate the choppy waters of the market and emerge stronger, irrespective of external economic shifts.