Deere & Company’s stock took a nosedive of -5% in Thursday’s trading session following its fiscal second-quarter earnings report that surpassed both top and bottom-line expectations. The agricultural equipment pioneer revised its fiscal 2024 net income guidance downwards, sending shockwaves through the market.

Despite this setback, the agriculture giant remains a frontrunner in the manufactured agricultural equipment landscape, prompting investors to ponder whether to seize the opportunity and buy the dip in Deere’s stock considering its robust historical performance.

Exploring Q2 Financial Performance

Deere’s Q2 net income of $2.37 billion or $8.53 per share surpassed the Zacks Consensus figure of $7.86 a share by a noteworthy 8%. On the revenue front, Q2 sales amounted to $13.61 billion, exceeding estimates of $13.25 billion by 2%.

Comparatively, Q2 earnings dropped -11% year-over-year to $9.65 a share due to escalated operating costs, whereas sales plummeted by -15% owing to decreased volumes. Nevertheless, Deere has outperformed earnings projections for seven consecutive quarters and revenue estimates for eight ongoing quarters.

Image Source: Zacks Investment Research

Guidance & Future Outlook

Despite its impressive track record, Deere revised its fiscal 2024 net income outlook to $7 billion, down from the initial forecast of $7.5-$7.75 billion issued in February.

The downward adjustment is primarily attributed to an anticipated 15% decline in the large agriculture segment in the U.S. and Canada, with a projected 20% downturn in the small agriculture market and turf sales.

Zacks forecasts Deere’s FY24 EPS to witness a -21% decline to $27.39 compared to $34.63 per share the previous year, with overall sales expected to dip by -15% to $47.19 billion.

Comparing Deere’s Historic Performance & Stock Valuation

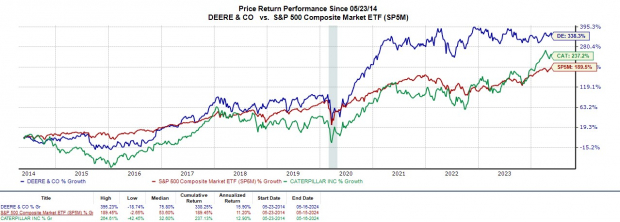

Year to date, Deere’s stock has receded by -1%, yet it exhibits a year-over-year growth of +7%, albeit trailing behind the S&P 500’s +28% surge and significantly lagging Caterpillar’s CAT +65% jump. Notably, over the past five years, Deere’s impressive +192% gain has marginally outpaced Caterpillar’s +186% uptick and substantially outperformed the S&P 500’s +89% hike.

Moreover, in the last decade, Deere’s stock skyrocketed by +338%, surpassing Caterpillar’s +237% growth and towering over the benchmark index’s +189% climb.

Image Source: Zacks Investment Research

Currently priced at $394, Deere’s stock trades at 15.1X forward earnings, slightly below its five-year median of 16.1X and significantly off its peak of 33.1X. This valuation is also notably under the S&P 500’s 22.2X, aligning more closely with Caterpillar’s 16.5X.

Image Source: Zacks Investment Research

In Conclusion

Deere’s stock currently holds a Zacks Rank #3 (Hold). While the current slowdown in agricultural activities may present challenges, the company’s reasonable valuation and stellar historical performance indicate potential long-term rewards for patient investors.