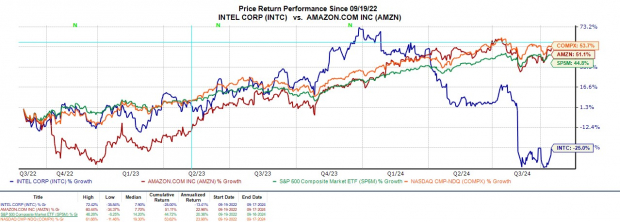

In the realm of tech stocks, where volatility is often the name of the game, the recent partnership expansion between Intel and Amazon has sent a wave of optimism through investors. As markets brim with anticipation of the Fed’s rate-cut announcement, Intel (INTC) and Amazon (AMZN) have emerged as key players, driving the broader tech stock rally with their collaborative plans unveiled on Monday.

Intel’s stock, which had plummeted to a 10-year low of $18 a share in August, saw a remarkable 8% surge in today’s trading session. Meanwhile, Amazon shares also made significant gains, rising by as much as 2% in early morning trading and marking a year-to-date increase of over 20%, with AMZN approaching the $200 mark.

Image Source: Zacks Investment Research

Enhancing AWS Cloud Services

The collaboration between Intel and Amazon, longstanding partners in supporting Amazon Web Services (AWS), takes a new turn with a fresh agreement to develop custom AI chips. These chips, crafted using Intel’s high-performance 18A process, aim to elevate the efficiency and capabilities of AWS’ AI-as-a-service (AIaaS) offerings.

A Boost for Intel’s Fortunes

Amidst fierce competition within the semiconductor industry, Intel’s pact to supply AI-powered chips to Amazon stands out as a multiyear, multibillion-dollar deal. This move arrives at an opportune moment for Intel to reclaim its stature as a major chip manufacturer, having ceded substantial market share to rivals like Nvidia (NVDA) and AMD (AMD).

Image Source: Zacks Investment Research

Amazon’s Growth Trajectory & Financial Stability

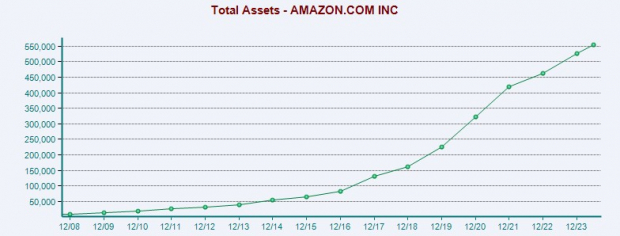

Notably, Amazon’s healthy financial standing, with over $89 billion in cash reserves and a robust balance sheet boasting $554.18 billion in total assets compared to $318.37 billion in total liabilities, bodes well for its continued collaboration with Intel.

Image Source: Zacks Investment Research

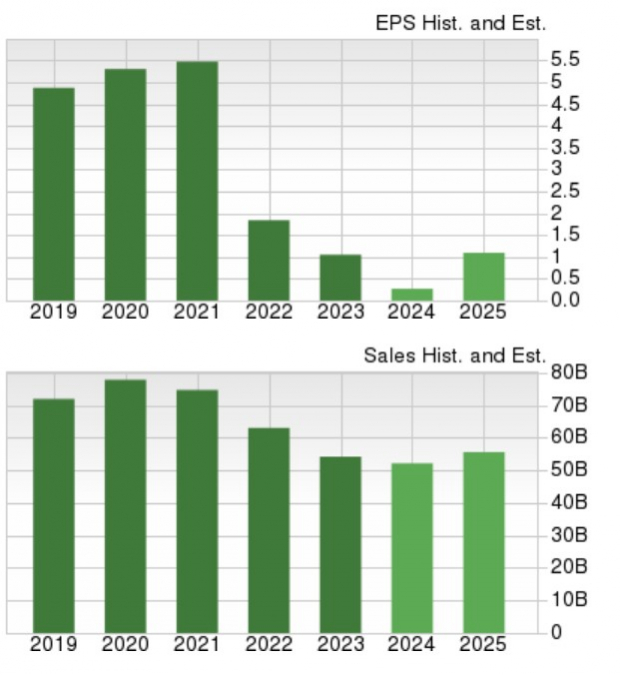

The tech behemoth, akin to a character from the Magnificent Seven, is anticipated to witness robust double-digit EPS growth in the upcoming fiscal years, with total sales poised to climb by over 10% annually. Amazon’s revenue trajectory is veering towards an impressive $700 billion figure.

Image Source: Zacks Investment Research

Parting Thoughts

Both Amazon and Intel shares currently hold a Zacks Rank #3 (Hold), indicative of the mixed outlook for these tech giants. While the extended collaboration promises mutual benefits and long-term value, investors might want to exercise caution, especially with Amazon’s stock having surged significantly this year and Intel’s rebound potential still being gauged.

For astute investors seeking to navigate the technology landscape, the partnership between Intel and Amazon beckons as a compelling narrative of collaboration and growth, amidst the ever-evolving tech industry terrain.