Intuit Inc. INTU stock has tripled the Zacks Tech sector over the last 20 years and doubled Tech during the past decade. Despite its outperformance, INTU is down -3% in the last three years while TECH has surged.

Intuit dropped recently after it failed to break out to new all-time highs, including a big slip early this week sparked by reports that Elon Musk is looking into a free IRS mobile app.

See the Zacks Earnings Calendar to stay ahead of market-making news.

Intuit, the tech giant behind TurboTax, Credit Karma, QuickBooks, and Mailchimp, reports its Q1 FY25 results after the closing bell on Thursday, November 21. Investors might want to consider buying Intuit for both near-term and long-term upside.

Why Intuit Stock Has Lagged Tech the Last Several Years

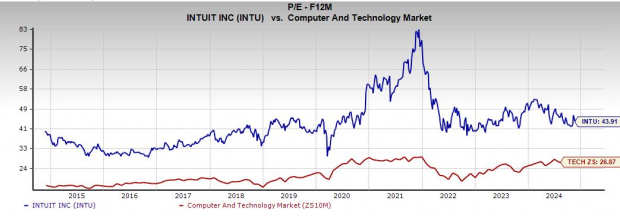

Intuit stock has fallen out of favor over the last several years largely due to its valuation as interest rates climbed. INTU trades at 43.9X forward 12-month earnings compared to the Tech sector’s 26.8X.

Wall Street had been willing to pay a premium for Intuit stock for the last decade because of its impressive top and bottom-line growth in a stable industry that is never going out of style. But higher rates, alongside fears surrounding artificial intelligence’s (AI) potential role in tax prep and filing have investors worried.

Image Source: Zacks Investment Research

More recently, investors are nervous about the rollout of the IRS’ new free online tax prep system and brand-new reports that Elon Musk is looking into a free IRS mobile app. It is highly unlikely that the U.S. government is able to do a better job than Intuit’s offerings and it has diversified its business.

On top of that, Intuit is trading at a 45% discount to its 10-year highs in terms of forward earnings even though it trades just 9% below its all-time highs in terms of price.

The Bull Case for Intuit Stock

Intuit’s TurboTax software transformed INTU into a technology powerhouse with a $181 billion market cap that posts consistent double-digit sales and earnings growth. Taxes will be with mankind forever and a government-backed tax prep offering from the IRS hardly seems like a viable long-term Intuit competitor.

Intuit utilized the Covid boom to expand its software portfolio into other areas of consumer finance, email marketing, digital-ad services, and more. Intuit boasts roughly 100 million customers across TurboTax, QuickBooks, Credit Karma, and Mailchimp.

TurboTax is the most recognizable and consumer-facing part of its business. But Intuit’s wider consumer unit includes Credit Karma’s personal finance services such as credit cards, personal loans, home and auto loans, and insurance.

Intuit’s offerings such as QuickBooks serve small businesses and self-employed people around the world via financial and business-management services, payroll solutions, merchant payment-processing solutions, and financing for small businesses, and more.

Image Source: Zacks Investment Research

INTU boosted its Small Business and Self-Employed Group sales by 19% in fiscal 2024, with Online Ecosystem revenue 20% higher. Intuit grew its total revenue by 13% in FY24 (ended July 31) as part of 16% average sales growth during the past nine years.

Intuit is projected to grow its revenue by 12% in FY25 and FY26 to climb from $16.29 billion in FY24 to $20.46 billion. Intuit’s consistent top-line expansion is up there with the likes of Microsoft MSFT and others.

Intuit is projected to boost its EPS by 14% in FY25 and FY26, following its 18% earnings growth last year. INTU’s earnings revisions have stagnated recently to help it earn a Zacks Rank #3 (Hold).

Intuit this summer showcased its AI investments that should eventually help it expand and hopefully improve earnings as well. INTU said it would cut 1,800 jobs (10% of its workforce) and hire roughly 1,800 new people “primarily in engineering, product, and customer-facing roles” to pursue AI-driven expansion.

Intuit expects its increased AI investments will make it more attractive to mid-market customers and boost its international reach, among other efforts.

Time to Buy INTU Stock on the Dip Before Its Breakout?

Intuit stock has climbed 3,000% in the past 20 years to more than triple Tech’s 725% and double Microsoft’s 1,444%. INTU is up 600% in the last 10 years to roughly double Tech even though it has dipped 3% in the past three years while Tech jumped 25%.

Image Source: Zacks Investment Research

Intuit briefly broke out above its 2021 peaks earlier this month after getting rejected several times in 2024. The stock has dropped 10% since November 13 after it hit new highs and reached its most overbought RSI levels of the past year.

INTU is trading 13% below its average Zacks price target and trying to find support at its 21-day moving average.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report