SpaceX, the hottest and most highly valued private company, has seen extraordinary investor interest lately. Like many other high-profile startups, it has chosen to remain private as institutional investors continue to pour money into the firm.

Since SpaceX shares don’t trade on a stock exchange, investing is not easy if you’re not a big private equity investor, a venture capitalist, or an employee. Since retail investors can’t purchase its shares directly, they are exploring other options.

A small, relatively unknown ETF has seen its assets more than double since it added SpaceX to its holdings, and a closed-end fund has been on a wild ride, trading at an insane premium to the value of its underlying assets. We explore the fund options available to retail investors.

Why Everyone Wants a Slice of SpaceX

Elon Musk founded SpaceX in May 2002, before he became involved with Tesla. The company now has a de facto monopoly on rocket launches, according to The Wall Street Journal, offering a launch frequency and cost efficiency that competitors are unable to match.

After the awe-inspiring engineering feat of catching a heavy booster rocket with chopstick-like mechanical arms, its valuation surged to about $350 billion, up from approximately $210 billion in June 2024.

Its satellite-internet division, Starlink, is reported to be a cash cow. While not much is known about its finances, traders are betting that the company could secure more government contracts due to Musk’s proximity to President Trump.

In his inaugural address, Trump promised to send astronauts to Mars. Musk previously predicted that Starship, the world’s most powerful rocket, could reach the planet within two years. The administration could play a key role in helping SpaceX achieve its Mars ambitions.

Baron Mutual Funds

Billionaire investor Ron Baron has been a strong supporter of Elon Musk for a long time. Ron has consistently purchased SpaceX shares annually since 2017 on behalf of his mutual funds and other accounts, according to his letter dated July 16, 2024.

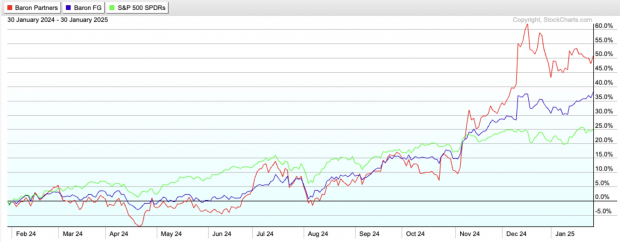

Baron Partners Fund BPTRX currently has 15% of its total assets in SpaceX, while Baron Focused Growth Fund BFGFX holds 11% of its net assets in SpaceX as of 12/31/24. The funds have returned 51% and 38%, respectively, over the past year, compared to the S&P 500’s gain of 25%.

Tesla TSLA is the top holding in both funds, which have significantly outperformed their respective benchmarks since inception.

Image Source: Stockcharts

The Destiny Tech 100 (DXYZ)

The Destiny Tech 100 is a closed-end fund that intends to invest in a portfolio of the top 100 venture-backed private technology companies. It currently holds 22 companies, with SpaceX making up 37% of the portfolio.

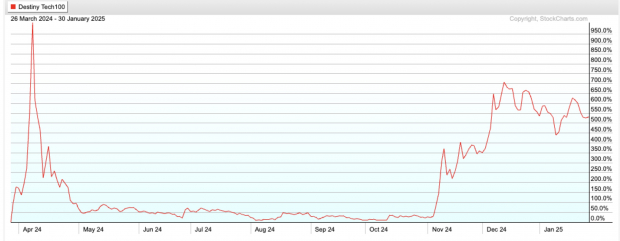

The fund has surged more than 500% since its inception in March last year, but its performance has been extremely volatile. More importantly, it often trades at a massive premium to its net asset value (NAV).

After a euphoric surge of over 1,000% right after its debut—driven by speculators piling in to gain exposure to the hottest unicorns—it plunged, giving up most of its gains. Despite a recent jump, it is still trading significantly below its all-time high.

As of September 30, 2024, DXYZ reported an NAV of $5.32 per share, yet it is currently trading at over $55 per share. The fund updates the fair value of its holdings on a quarterly basis, so while the latest NAV is unknown, the premium could still be close to 1,000%.

Investors should remember that a closed-end fund’s market price can deviate significantly from its NAV based on supply and demand, unlike ETFs and mutual funds.

Image Source: Stockcharts.com

ARK Venture Fund

Launched in September 2022, Cathie Wood’s Ark Venture Fund (ARKVX) is a closed-end interval fund that invests in both public and private firms. SpaceX is its largest holding, making up about 16% of the portfolio as of 12/31/24.

Other well-known startups, including Epic Games and OpenAI, are also among its top holdings. Private companies make up approximately 83% of its total portfolio.

The fund is up about 11% over the past year. Since its inception through December 31, 2024, it has returned about 19%, underperforming the S&P 500’s 26% return over the same period.

Like other closed-end interval funds, ARKVX allows investors to redeem only a limited amount per quarter during specific time frames.

The Entrepreneur Private-Public Crossover ETF (XOVR)

XOVR is the first ETF to hold a private company. The fund changed its ticker and strategy in August but remains focused on entrepreneurial companies.

The fund recently added SpaceX through a special-purpose vehicle (SPV). As The Wall Street Journal pointed out, such SPVs may charge fees as high as 25% of any gains, and it is unclear how these fees will impact the value of its SpaceX position.

The fund’s SpaceX position has declined slightly from 12.3% as of December 12, due to inflows. Essentially, if the fund gathers more assets, it will need to acquire more SpaceX shares to avoid dilution.

Additionally, there is little clarity on how the ETF will determine a “fair value” for its SpaceX position as required by the SEC.

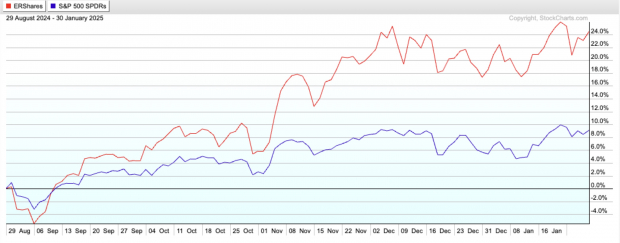

The fund currently has about $300 million in assets and charges an expense ratio of 0.75%. Since changing its strategy in August, the ETF has returned about 24%, compared to the S&P 500’s 9% gain.

Image Source: stockcharts

Other top holdings include NVIDIA (NVDA), Alphabet GOOGL, and Meta Platforms META. (Read:

Will We See More Private Asset ETFs in 2025?

As the market for private assets continues to expand, some of the biggest asset managers are racing to bring them to retail investors. However, the inherent illiquidity and valuation challenges of private assets make it difficult to package them into an ETF that offers intraday liquidity and pricing.

The SEC places a 15% limit on open-ended funds holding illiquid investments. It defines an investment as illiquid if it cannot be sold within seven days without significantly impacting its market value.

BlackRock, the world’s largest asset manager, is making a significant push into private markets, investing nearly $28 billion to acquire private-equity firm Global Infrastructure Partners, private-assets data provider Preqin, and private credit manager HPS Investment Partners.

Meanwhile, State Street has partnered with Apollo Global to file for a novel public and private credit ETF, where Apollo would serve as a liquidity and pricing provider for the fund. This fund will provide insight into the challenges of packaging private assets into ETFs.

ETFs have helped facilitate access to previously inaccessible market areas. The industry is known for its innovation, and investors love the ETF structure. ETFs have often acted as tools for price discovery during periods of market disruption.

I believe the industry will find ways to fairly value illiquid assets on a regular basis, and we will see more private asset ETFs in 2025.

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Get Your Free (BPTRX): Fund Analysis Report

Get Your Free (BFGFX): Fund Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report