The impending Q3 earnings season is on the horizon, with financial giants poised to disclose results shortly. However, before diving into the lofty world of banking data, the spotlight first falls on PepsiCo (PEP), a stalwart in the realm of consumer staples, slated to release its earnings next week on Tuesday, October 8th, just before the market commences trading.

Peering into PepsiCo’s Prospects

As we assess the trajectory of PEP shares, a modest 1.2% increase in 2024 appears lackluster amid a market environment that urges caution in Consumer Staples stocks due to the magnetic draw of the surging Technology sector. The juxtaposition of these sectors reflects a compelling narrative of change within the investment landscape.

An intriguing illustration showcasing the year-to-date movement of PEP shares compared to the Zacks Consumer Staples sector and the S&P 500 offers a visual representation of the stock’s performance trends.

Image Source: Zacks Investment Research

Over recent months, analysts have tempered their expectations for PepsiCo’s upcoming quarter. The Zacks Consensus EPS estimate of $2.30 has dwindled by 2% since mid-July, signifying a 2.2% upswing from the corresponding period last year.

Image Source: Zacks Investment Research

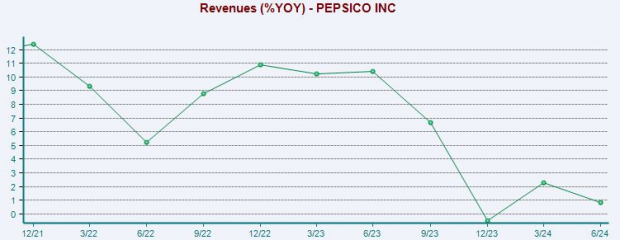

Revenue projections echo a similar narrative, with expectations of $23.9 billion reflecting a mild 1% decline over the same period yet heralding a 1.9% augmentation from the year-prior. A marked deceleration in revenue growth becomes apparent when examining the evolving pace over recent periods.

An important precision to note is that the ensuing chart delineates the year-over-year percentage change and not the explicit sales figures.

Image Source: Zacks Investment Research

Compared against historical benchmarks, the current forward 12-month earnings multiple of 19.6X remains notably lower than the five-year median of 23.6X and the zenith of 27.8X. This valuation signifies moderating growth expectations by investors, as indicated earlier.

Contemplating the Buy Decision

As anticipation mounts for PepsiCo’s impending quarterly reveal, prevailing sentiments, tinged with a hint of skepticism, see analysts marginally revising their earnings and sales prognostications downward. In the realm of stock performance, 2024 paints a picture of disillusionment; however, a favorable forecast could potentially breathe renewed vitality into PEP shares.

The current scenario indicates a moment for prudence, a ‘wait and see’ approach, especially with the recurrent downward adjustments. Notwithstanding, given its defensive nature, PEP shares are unlikely to suffer a drastic nosedive should the results fall shy of expectations.

This environment evokes a discerning mindset, a tempered optimism in the face of evolving market dynamics that underpin the fundamental decisions shaping investment strategies.