Before investors make decisions about buying, selling, or holding a stock, they often look to Wall Street analysts for guidance. These analysts, employed by brokerage firms, provide ratings and recommendations which can influence a stock’s price. But how reliable are these recommendations? Let’s delve into the analysis of PulteGroup (PHM) by Wall Street analysts and examine the efficacy of brokerage recommendations.

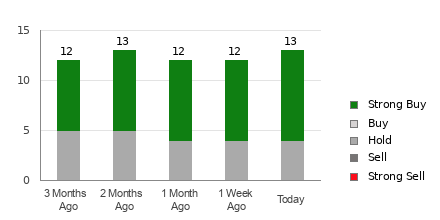

PulteGroup currently holds an average brokerage recommendation (ABR) of 1.44, indicating a favorable outlook. This rating, derived from recommendations of 16 brokerage firms, falls between Strong Buy and Buy on a scale ranging from 1 to 5. Among the 16 recommendations, 12 are Strong Buy and one is Buy, collectively making up 81.3% of all recommendations.

Understanding Brokerage Recommendation Trends

While the ABR suggests a positive sentiment towards PulteGroup, it’s important for investors to exercise caution when relying solely on this information. Multiple studies have revealed the limitations of brokerage recommendations in predicting stock price movements accurately. These limitations stem from the inherent bias of analysts towards the stocks they cover, often resulting in an overly positive rating bias.

Comparing ABR and Zacks Rank

It’s crucial to distinguish between the ABR and the Zacks Rank, despite both being rated on a 1 to 5 scale. While the ABR is based solely on brokerage recommendations, the Zacks Rank utilizes a quantitative model that incorporates earnings estimate revisions to evaluate stocks. Research has consistently demonstrated a strong correlation between earnings estimate trends and short-term stock price movements.

The freshness of the data is also a differentiating factor between ABR and Zacks Rank. While the ABR may lack timeliness, the Zacks Rank promptly reflects analysts’ earnings estimate revisions, making it a more current indicator of future price movements.

Is PulteGroup a Sound Investment?

Examining the earnings estimate revisions for PulteGroup, the Zacks Consensus Estimate for the current year has witnessed a positive increase, indicating growing optimism among analysts regarding the company’s earnings potential. These factors have culminated in a Zacks Rank #2 (Buy) for PulteGroup, further reinforcing the positive outlook for the stock.

Therefore, while the ABR suggests a buying opportunity for PulteGroup, investors should weigh this information against other fundamental analysis tools and market research.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

PulteGroup, Inc. (PHM) : Free Stock Analysis Report