Wall Street analysts’ endorsements often sway investor decisions, setting the tone for buy, sell, or hold actions on stocks. But how reliable are these recommendations, especially when it comes to TJX?

Before delving into the nitty-gritty of brokerage guidance reliability, it’s essential to gauge Wall Street’s sentiment on TJX.

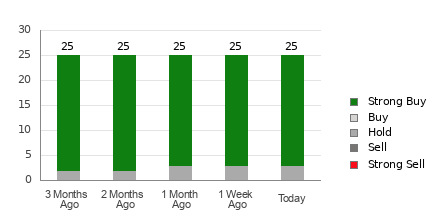

Current data reveals a brokerage average recommendation (ABR) of 1.24 for TJX, indicating a consensus leaning towards the bullish side. This numerical verdict amalgamates ratings from 25 brokerage firms, out of which an overwhelming 88% are championing a Strong Buy stance on TJX.

Unearthing Trends in Brokerage Recommendations for TJX

The ABR rating may paint a rosy picture for TJX, but relying solely on this data for investment decisions could be akin to waiting for a ship to dock on a breezeless day. Studies suggest brokerage recommendations have a spotty track record when it comes to selecting stocks poised for substantial price appreciation.

The underlying reason? Analysts in the brokerage realm often exhibit a strong bias towards stocks they cover, with positivity dominating their ratings. For every “Strong Sell” mandate, there are typically five “Strong Buy” endorsements, showcasing a skewed outlook more aligned with the interests of their employers than those of everyday investors.

Therefore, the prudent approach would be to integrate this information with other validated tools like the Zacks Rank, a battle-tested stock rating mechanism that segments stocks into five ranks, from Strong Buy to Strong Sell, based on historical performance.

ABR vs. Zacks Rank: Diverging Paths

While the ABR and Zacks Rank may seemingly share a scale from 1 to 5, they are fundamentally different metrics.

The ABR hinges solely on brokerage recommendations, often embellished with decimals, while the Zacks Rank operates via a quantitative model that leverages earnings estimate revisions, displayed in whole numbers from 1 to 5.

Brokerage analysts’ predisposition towards optimism in recommendations doesn’t go unnoticed, making them less reliable for investors seeking unclouded advice. In stark contrast, the Zacks Rank relies on factual earnings estimate revisions, a cornerstone for projecting short-term stock movements.

Moreover, the Zacks Rank maintains balance across all stocks covered by analysts, ensuring no favoritism, and reacts swiftly to earnings estimate alterations, providing timely insight into future price movements.

Deciphering the TJX Conundrum

An examination of TJX’s earnings estimate revisions reveals a stagnant Zacks Consensus Estimate of $4.15 for the current year over the past month.

Stability in analysts’ outlook implies TJX’s stock may tread water in the near future vis-a-vis the broader market, resulting in a Zacks Rank #3 (Hold) classification for the company.

With this in mind, exercising a modicum of caution with TJX’s ABR leaning towards Buy may be sage advice for the discerning investor.

© 2024 Benzinga.com. Benzinga refrains from offering investment counsel. All rights reserved.