In an unforeseen twist, Chipotle Mexican Grill’s CMG CEO Brian Niccol announced his departure to head Starbucks (SBUX). Investors are now pondering over which of these retail giants presents a more enticing investment opportunity, especially with Niccol set to assume the CEO position at Starbucks in September.

Chipotle’s exceptional performance under Niccol is evident in its stock surge of over 200% in the last five years, dwarfing Starbucks’ meager 2% growth during the same period. However, past successes do not guarantee future triumphs, leaving investors pondering the wiser choice between the two at present.

Image Source: Zacks Investment Research

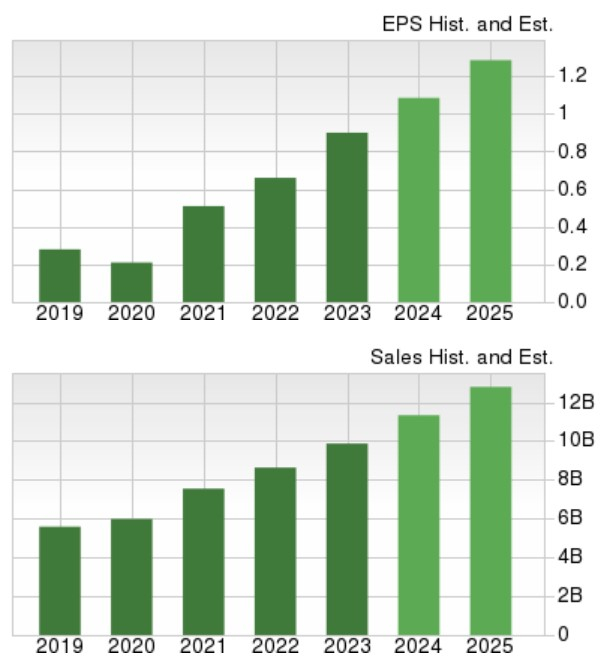

Growth Projections

Following a remarkable 50-1 stock split in June, Chipotle’s yearly earnings are forecasted to rise by 20% in fiscal 2024 to $1.08 per share, a significant leap from last year’s EPS of 0.90 ($45 per share/50). Additionally, an 18% EPS growth is anticipated in fiscal year 2025.

On the revenue front, Chipotle’s total sales are expected to climb by 15% this year and further surge by 13% in fiscal year 2025, reaching $12.79 billion.

Image Source: Zacks Investment Research

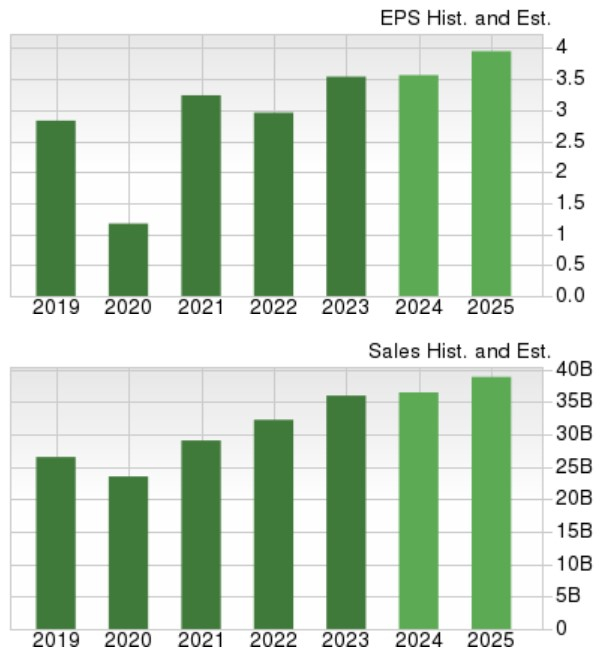

Turning to Starbucks, annual earnings are projected to remain relatively flat in fiscal year 2024 but are expected to increase by 11% in fiscal year 2025, hitting $3.94 per share. Starbucks’ total sales are set to grow by 1% in fiscal year 2024 and are predicted to expand by 6% the following year to $38.84 billion.

Image Source: Zacks Investment Research

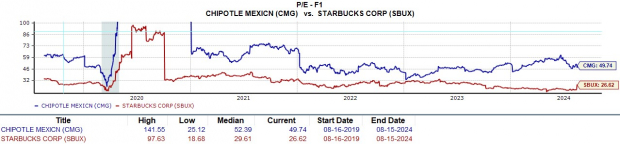

Valuation Analysis

While Chipotle boasts superior growth figures, Starbucks presents a more appealing valuation. SBUX is trading at 26.6X forward earnings, nearly aligning with the S&P 500’s 23.3X. In contrast, CMG is trading at a noticeable premium to the market at 49.7X.

Image Source: Zacks Investment Research

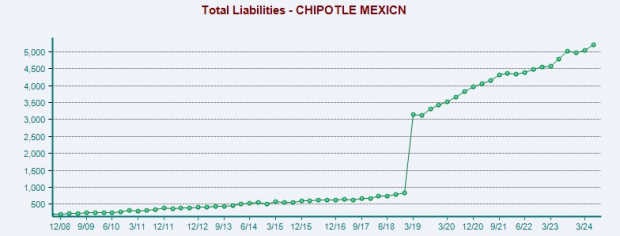

Financial Health Assessment

Financial stability can heavily influence stock selection, and while Starbucks holds more cash reserves, Chipotle boasts a stronger balance sheet. Presently, Chipotle sits on $1.49 billion in cash & equivalents with total assets worth $8.92 billion, offset by total liabilities of $5.2 billion.

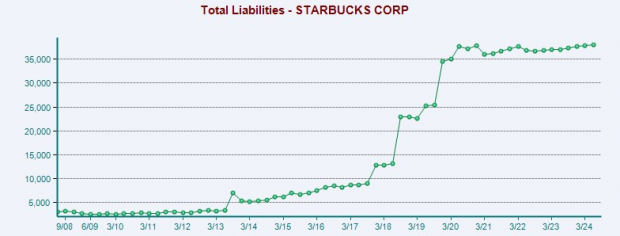

Conversely, Starbucks holds $3.39 billion in cash & equivalents while carrying total liabilities of $38.04 billion against total assets of $30.11 billion.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Final Considerations

Starbucks faces challenges in its operational performance, as evident from concerning signs on its balance sheet. However, the leadership prowess demonstrated by Brian Niccol provides optimism that Starbucks can reach the stellar standards witnessed at Chipotle. Currently, both Starbucks and Chipotle’s stock carry a Zacks Rank #3 (Hold), indicating long-term investment potential, albeit better buying opportunities may arise in the near future.