IonQ, Inc. IONQ offers valuable contributions in the field of quantum computing. However, semiconductor behemoth NVIDIA Corporation NVDA is also investing in this rapidly evolving technology and developing advanced quantum computing systems. Let us thus look at which of these two companies has greater potential for growth in the quantum computing sector.

IonQ’s Aspirations in the Field of Quantum Technology

Quantum computers leverage quantum mechanics to perform complex calculations more efficiently than traditional supercomputers. According to McKinsey, the market for advanced quantum computers is expected to grow to $100 billion by 2035. IonQ is taking advantage of this trend by developing quantum computers that use trapped linear chain ions, reaching over 100 qubits with fewer errors than other quantum systems.

IonQ has also been actively acquiring companies to tap into this emerging technology. Recently, it acquired Lightsynq Technologies, known for its universal optical quantum interconnects, and ID Quantique, a leader in quantum cybersecurity. Earlier this year, IonQ also purchased Qubitekk, a notable player in quantum networking.

Meanwhile, IonQ reported a net operating loss of $75.7 million in the first quarter, up from $52.9 million in the same period last year. Despite these losses, IonQ held $588.3 million in cash at the end of the quarter, which can be used for further research in quantum computing. Additionally, IonQ plans to raise capital through a $1 billion equity offering to support its growth in the quantum computing field.

NVIDIA Looks Toward a Future With Quantum Computers

NVIDIA announced a record $130.5 billion in revenues for the 2025 fiscal year, marking a 114% increase year over year. The company also had an exceptional first quarter, with revenues reaching $44.1 billion, a 69% rise from the same period last year. NVIDIA’s business has remained profitable, with an operating income of $21.6 billion in the first quarter, up 28% year over year.

The unprecedented demand for NVIDIA’s innovative Blackwell chips and CUDA software has given the company a strong advantage in the artificial intelligence (AI) industry, driving its revenues and profits. Now, like AI, NVIDIA aims to lead in the quantum computing space. Nvidia plans to integrate its graphics processing units (GPUs) and quantum processing units (QPUs) into a hybrid quantum system that can correct calculation errors in real time. Utilizing its GPU framework serves as a strategic shift from traditional classical computers to quantum technology.

NVIDIA is establishing research centers to support the development of quantum computing. According to CEO Jensen Huang, these centers will develop large-scale, practical and accelerated quantum supercomputers.

Which Stock, IonQ or NVIDIA, Offers Greater Growth Potential?

IonQ has ambitious plans to expand in the quantum computing industry, as shown by its series of acquisitions. It offers its quantum systems to customers through Alphabet Inc.’s GOOGL Google Cloud, Amazon.com, Inc.’s AMZN Amazon Web Services, and Microsoft Corporation’s MSFT Azure. However, IonQ’s revenue growth in the most recent quarter remained flat, and it was unprofitable, raising doubts about whether it can achieve its high ambitions.

Quantum computing is still in the early stages, and IonQ, being a relatively untested company, risks significant setbacks if it doesn’t meet its goals. NVIDIA, however, is the world’s most valuable company with a proven track record of success. It consistently generates income and has substantial cash to tackle current challenges in quantum computing. NVIDIA reported $53.7 billion in cash in the fiscal first quarter.

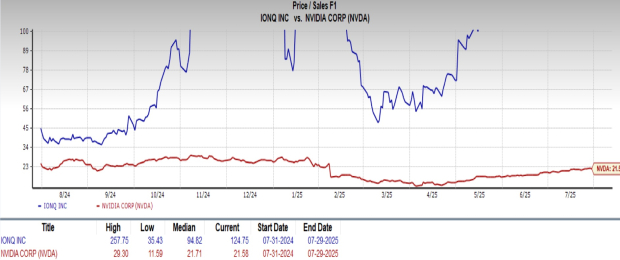

Valuation is another concern for IonQ. The pure-play quantum stock has a forward price-to-sales (P/S) ratio of 124.75, while NVIDIA’s is 21.58. This suggests that IonQ is overvalued, and its share prices might decrease as the market corrects itself. Therefore, it’s clear that although both companies are making progress in the quantum industry, NVIDIA currently presents better growth prospects and is a safer investment (read more: Is SMCI Stock the Next NVIDIA, and Is It Worth Buying?).

Image Source: Zacks Investment Research

Both NVIDIA and IonQ possess a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market’s next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don’t build. It’s just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

IonQ, Inc. (IONQ) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).