The consensus of Wall Street analysts holds considerable weight in the minds of investors as they deliberate on their stock trading decisions. The impact of these analysts’ opinions on stock prices is often a topic of media discussion. But how much should we really rely on these recommendations?

Before delving into the reliability of brokerage recommendations and how investors can leverage them to their advantage, let’s take a closer look at what Wall Street heavyweights are saying about Advanced Micro Devices (AMD).

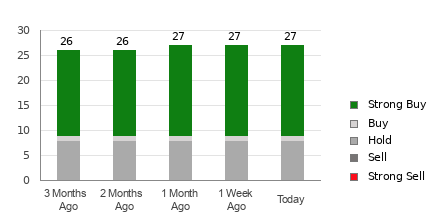

As it stands, Advanced Micro currently holds an average brokerage recommendation (ABR) of 1.36, which falls between Strong Buy and Buy on a scale from 1 to 5. This rating is derived from the collective recommendations (Buy, Hold, Sell, etc.) of 29 brokerage firms. Out of these ratings, 23 are Strong Buy and one is Buy, constituting 79.3% and 3.5% of all recommendations, respectively.

Brokerage Recommendation Trends for AMD

While the ABR points toward a recommendation to purchase Advanced Micro, it’s important for investors not to rely solely on this metric. Several studies have indicated that brokerage recommendations offer limited success in predicting stocks with the highest potential for price increases.

Why is that, you may wonder? It often stems from the vested interest of brokerage firms in the stocks they cover, leading to a strong positive bias among their analysts when rating them. Research has shown that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations. This misalignment of interests may not provide deep insights into a stock’s future price movement. Therefore, it’s advisable to use this information to validate your own analysis or a proven tool for predicting stock price movements.

Our proprietary stock rating tool, the Zacks Rank, offers an externally audited track record and classifies stocks into five groups, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), serving as a dependable indicator of a stock’s near-term price performance. Thus, validating the Zacks Rank with ABR can significantly aid in making sound investment decisions.

ABR Should Not Be Confused With Zacks Rank

Despite both the Zacks Rank and ABR being displayed in a range of 1-5, they are fundamentally distinct metrics. The ABR is deduced solely from broker recommendations and is typically displayed in decimals. Conversely, the Zacks Rank is a quantitative model dependent on harnessing the power of earnings estimate revisions and is displayed in whole numbers.

Brokerage analysts have historically exhibited an overly optimistic tone in their recommendations due to the vested interest of their employers, often providing ratings that are more favorable than their research would support. On the other hand, the Zacks Rank is driven by earnings estimate revisions, and empirical research has highlighted a strong correlation between near-term stock price movements and trends in earnings estimate revisions.

Distinguishably, the different grades of the Zacks Rank are applied proportionately across all stocks for which brokerage analysts provide earnings estimates for the current year, maintaining a balanced approach at all times. Moreover, the Zacks Rank is more timely in reflecting future price movements, given that brokerage analysts continuously amend their earnings estimates to reflect a company’s evolving business trends.

Is AMD Worth Investing In?

Reviewing the earnings estimate revisions for Advanced Micro, the Zacks Consensus Estimate for the current year has held steady at $2.65 over the past month. This stability in analysts’ views regarding the company’s earnings prospects, as depicted by an unaltered consensus estimate, may provide a valid rationale for the stock to perform in line with the broader market in the near term.

The magnitude of the recent consensus estimate change, along with three other factors related to earnings estimates, has led to a Zacks Rank #3 (Hold) for Advanced Micro.

Hence, it may be prudent for investors to exercise caution with the Buy-equivalent ABR for Advanced Micro.

Very interesting topic, regards for putting up.Money from blog

ремонт iphone центр

ремонт телефонов москва

ремонт телевизора на дому в москве

Профессиональный сервисный центр по ремонту сотовых телефонов, смартфонов и мобильных устройств.

Мы предлагаем: сервис ремонт телефонов

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту ноутбуков, макбуков и другой компьютерной техники.

Мы предлагаем:ремонт макбуков

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту квадрокоптеров и радиоуправляемых дронов.

Мы предлагаем:мастер по ремонту квадрокоптеров

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту ноутбуков, imac и другой компьютерной техники.

Мы предлагаем:imac ремонт

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту ноутбуков и компьютеров.дронов.

Мы предлагаем:ремонт ноутбуков в москве цены

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

качественный ремонт айфонов в москве

ремонт эппл вотч

Профессиональный сервисный центр по ремонту планетов в том числе Apple iPad.

Мы предлагаем: ремонт планшетов ipad в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту ноутбуков и компьютеров.дронов.

Мы предлагаем:ремонт ноутбука

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:сервисные центры по ремонту техники в спб

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту радиоуправляемых устройства – квадрокоптеры, дроны, беспилостники в том числе Apple iPad.

Мы предлагаем: квадрокоптеры сервис

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – профи услуги

Если вы искали где отремонтировать сломаную технику, обратите внимание – тех профи

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники в москве

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники в новосибирске

Профессиональный сервисный центр по ремонту Apple iPhone в Москве.

Мы предлагаем: качественный ремонт айфонов в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

ремонт сотовых

ремонт телевизоров в москве

Профессиональный сервисный центр по ремонту источников бесперебойного питания.

Мы предлагаем: сервис центр ибп

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники

Если вы искали где отремонтировать сломаную технику, обратите внимание – профи челябинск

Профессиональный сервисный центр по ремонту варочных панелей и индукционных плит.

Мы предлагаем: ремонт варочных панелей на дому в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:ремонт бытовой техники в екб

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

ремонт фототехники

Получите доступ к лучшим ставкам на https://888starz.today

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники

Профессиональный сервисный центр по ремонту фото техники от зеркальных до цифровых фотоаппаратов.

Мы предлагаем: ремонт фототехники

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Скачайте мобильное приложение от 888Starz и начните выигрывать прямо с телефона http://artshi.ru/user/makksimnoviikwv/

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники в краснодаре

Профессиональный сервисный центр по ремонту планшетов в Москве.

Мы предлагаем: ремонт планшетов на дому

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:ремонт крупногабаритной техники в новосибирске

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт техники в казани

Профессиональный сервисный центр по ремонту видео техники а именно видеокамер.

Мы предлагаем: ремонт цифровой видеокамеры

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – техпрофи

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: сервис центры бытовой техники москва

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – выездной ремонт бытовой техники в нижнем новгороде

Если вы искали где отремонтировать сломаную технику, обратите внимание – профи услуги

Профессиональный сервисный центр по ремонту стиральных машин с выездом на дом по Москве.

Мы предлагаем: услуги ремонт стиральных машин москва

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: сервисные центры по ремонту техники в казани

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – профи услуги

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: сервисные центры в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники в ростове на дону

Профессиональный сервисный центр по ремонту игровых консолей Sony Playstation, Xbox, PSP Vita с выездом на дом по Москве.

Мы предлагаем: профессиональный ремонт игровых консолей

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту компьютерных видеокарт по Москве.

Мы предлагаем: сервис по ремонту видеокарт

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту фототехники в Москве.

Мы предлагаем: вспышка canon ремонт

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Подробнее на сайте сервисного центра remont-vspyshek-realm.ru

Профессиональный сервисный центр по ремонту компьютероной техники в Москве.

Мы предлагаем: сервис компьютеров

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту фото техники от зеркальных до цифровых фотоаппаратов.

Мы предлагаем: ремонт проекторов на дому

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Хочу поделиться опытом покупки в одном интернет-магазине сантехники. Решил обновить ванную комнату и искал место, где можно найти широкий выбор раковин и ванн. Этот магазин приятно удивил своим ассортиментом и сервисом. Там есть всё: от классических чугунных ванн до современных акриловых моделей.

Если вам нужна раковина в ванную комнату купить , то это точно туда. Цены конкурентные, а качество товаров подтверждено сертификатами. Консультанты помогли с выбором, ответили на все вопросы. Доставка пришла вовремя, и установка прошла без проблем. Остался очень доволен покупкой и сервисом.

Профессиональный сервисный центр по ремонту компьютерных блоков питания в Москве.

Мы предлагаем: ремонт блока питания цена

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Недавно разбил экран своего телефона и обратился в этот сервисный центр. Ребята быстро и качественно починили устройство, теперь работает как новый. Очень рекомендую обратиться к ним за помощью. Вот ссылка на их сайт: отремонтировать телефон.

<a href=”https://remont-kondicionerov-wik.ru”>сколько стоит ремонт кондиционера</a>

ремонт бытовой техники в самаре

Профессиональный сервисный центр по ремонту компьютероной техники в Москве.

Мы предлагаем: диагностика системного блока компьютера

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту камер видео наблюдения по Москве.

Мы предлагаем: ремонт систем видеонаблюдения

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: ремонт крупногабаритной техники в нижнем новгороде

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту кнаручных часов от советских до швейцарских в Москве.

Мы предлагаем: ремонт наручных часов

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – выездной ремонт бытовой техники в тюмени

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: сервисные центры по ремонту техники в перми

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

ремонт кондиционеров с гарантией

Профессиональный сервисный центр по ремонту парогенераторов в Москве.

Мы предлагаем: отремонтировать парогенератор

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Как выбрать компанию для утилизации строительного мусора в Новосибирске? Узнайте здесь https://kuzrab.ru/partners_news/62/szhiganie-musora/

Зеркало сайта позволяет обходить блокировки, заходите на https://888starz.today

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт техники в волгограде

happy birthday balloons helium balloons for birthday

Polypropylene Random Copolymer (PP-R) Pipes in Iraq At Elite Pipe Factory in Iraq, our Polypropylene Random Copolymer (PP-R) pipes represent the pinnacle of modern piping solutions. These pipes are known for their excellent resistance to high temperatures and chemicals, making them suitable for a wide range of applications including hot and cold water systems. Our PP-R pipes are manufactured with precision to ensure high performance, durability, and reliability. Elite Pipe Factory, recognized as one of the best and most reliable in Iraq, provides PP-R pipes that meet stringent quality standards. For detailed information about our PP-R pipes and other products, visit elitepipeiraq.com.

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: сервис центры бытовой техники красноярск

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники в уфе

http://chelny-week.ru/2019/07/zhenshhinam-bolshe-ne-nuzhno-krasit-brovi-pridumali-alternativu-tatuazhu/

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:сервисные центры по ремонту техники в ростове на дону

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Electrical Conduit (PVC) At ElitePipe Factory in Iraq, our Electrical Conduit (PVC) is a testament to our commitment to quality and innovation. Designed for durability and ease of installation, our PVC electrical conduits provide excellent protection for electrical cables, ensuring they are safeguarded from physical damage and environmental factors. The lightweight nature of PVC makes handling and installation straightforward, while its resistance to corrosion and chemical exposure ensures long-lasting performance. As one of the best and most reliable manufacturers in Iraq, ElitePipe Factory offers PVC conduits that meet the highest industry standards. For more information, visit our website: elitepipeiraq.com.

сервисный центре предлагает ремонт телевизора – прайс на ремонт телевизоров жк

Aviator is an online game for real money https://aviator-crash.org where players predict when the plane will stop to win. Test your luck and strategy with fast and secure withdrawals. Simple rules, instant payouts, and the chance for big wins await you!

Хранилище ссылок https://memo.top/about/ для структурирования накопленных ресурсов. Добавляй ссылки на сторонние ресурсы, группируй их и делись со своими друзьями. Повысьте вашу продуктивность c помощью персонализированой стартовой страницы

Сервисный центр предлагает ремонт духового шкафа smeg недорого стоимость ремонта духового шкафа smeg

Сервисный центр предлагает выездной ремонт кондиционеров energolux ремонт кондиционеров energolux в москве

Если вы искали где отремонтировать сломаную технику, обратите внимание – сервисный центр в воронеже

У нас вы найдете ноутбуки различных конфигураций, размеров и цветов. Мы предлагаем ноутбуки с различными типами дисплеев, такими как IPS, OLED, TN, а также различными разрешениями экрана. Если вам нужен ноутбук для игр, мы предлагаем модели с высокой производительностью и мощными графическими картами. Если вы ищете ноутбук для работы, у нас есть модели с быстрыми процессорами и большим объемом памяти.

Федерация – это проводник в мир покупки запрещенных товаров, можно купить гашиш, купить мефедрон, купить кокаин, купить меф, купить экстази, купить альфа пвп, купить гаш в различных городах. Москва, Санкт-Петербург, Краснодар, Владивосток, Красноярск, Норильск, Екатеринбург, Мск, СПБ, Хабаровск, Новосибирск, Казань и еще 100+ городов.

Wikicredit (ВикиКредит) https://wikicredit.com.ua/ru/ незаменимый онлайн-помощник в поиске микро-финансовых организаций, банков и ломбардов.

Ремонт компьютеров в Зеленограде на дому https://zelcompuhelp.ru профессиональная помощь в удобное для вас время. Настройка, диагностика, замена комплектующих и программное обеспечение. Быстрое решение любых проблем с вашим ПК без необходимости его транспортировки.

Строительство частных домов по индивидуальным проектам — создайте проект дома своей мечты.

имплантация зуба ценаимпланты зубов

комплексное seo в интернете под ключ продвижение сайтов поисковое продвижение сайта в москве

Профессиональная стоматологическая помощь https://stomatologia.moscow лечение зубов, протезирование, имплантация, ортодонтия и профилактика. Современные технологии, безболезненные процедуры и индивидуальный подход. Обеспечиваем здоровье полости рта и красивую улыбку на долгие годы.

sollers цена sollers легковой автомобиль

комплексный аудит сайта продвижение сайтов раскрутка сайтов в москве недорого

Информационный сайт о биодобавках https://биодобавки.рф предоставляет актуальные данные о составе, пользе и применении различных добавок. Узнайте, как поддерживать здоровье с помощью натуральных средств, получите советы экспертов и ознакомьтесь с научными исследованиями в области нутрициологии.

Профессиональный сервисный центр по ремонту компьютеров и ноутбуков в Москве.

Мы предлагаем: ремонт macbook с гарантией

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

У нас можно купить лицензионные ключи для игр https://adability.ru ключи STEAM, Origin, Uplay, Battle.net, Minecraft. Adability – интернет-магазин лицензионных компьютерных игр и ключей с доставкой по всей России.

roman numerals on clocks iiii melting clocks dali

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: сервис центры бытовой техники тюмень

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту кофемашин по Москве.

Мы предлагаем: ремонт кофемашин в москве адреса

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту кондиционеров в Москве.

Мы предлагаем: срочный ремонт кондиционеров москва

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту гироскутеров в Москве.

Мы предлагаем: ремонт гироскутера

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту моноблоков в Москве.

Мы предлагаем: моноблок москва

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Телеграм бот https://users-box.ru для поиска информации и проверки данных о пользователях, номерах телефонов, email-адресах и других данных.

Инновационный бот в Telegram https://2-box.ru позволяющий получить доступ к информации о пользователях, таких как номера телефонов, email-адреса и другие личные данные. С его помощью можно быстро найти сведения о людях, пользователях соцсетей или мессенджеров.

Телеграм бот https://brickquick.ru предназначен для поиска информации из открытых источников, проверки утечек данных и сбора сведений по таким персональным данным, как номер телефона, электронная почта и профили в социальных сетях.

Конструктор документов https://forma.today позволяет мгновенно создавать документы. Для этого нужно выбрать шаблон, заполнить несколько полей и получить готовый документ. Процесс создания автоматизирован, а заполнение данных по ИНН и подсказки при вводе адреса облегчают работу.

Мотанка https://motanka.co.ua ваш джерело актуальної інформації! Узнайте про головні події в світі, країні і вашому регіоні. Політика, економіка, спорт, технології та культура – ??все, що важливо, в одному місці.

Trade Forex https://traders-choice.com using more than 100 assets. Free demo account with $10,000. Copy the best traders’ trades. Earn within 60 seconds. Reliable withdrawal of funds.

Профессиональный сервисный центр по ремонту планшетов в том числе Apple iPad.

Мы предлагаем: ремонт планшетов apple в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

У місті Чернівці https://u-misti.chernivtsi.ua — це інтернет-ресурс для жителів Чернівців, який містить свіжі новини про культурні події. На інтернет-майданчику ви почерпнете до актуальної інформації про активності в Чернівцях.

Download Android apps for free from https://appworldstore.ru. Fast, reliable, and filled with popular applications.

купить сейф встраиваемый в пол сейф в пол

домашние сейфы цены где купить сейф для дома в москве

купит сейф для дома купить домашний сейф в интернет магазине

Глаз бога https://autobazarf.ru пробить авто по номеру или вин или владельцу. Система поиска работает онлайн, не требует установки. Все что вам требуется – это наличие аккаунта в Telegram, и номер авто. Если авто есть в базе ГИБДД, то найти его системе не составит труда.

cейф взломостойкий цена взломостойких сейфов

Сайт https://u-misti.khmelnytskyi.ua — це зручний портал для громадян Хмельницького, який пропонує інформативні статті про життя міста. На платформі У місті Хмельницький ви почерпнете рекомендації про життя в Хмельницькому.

Создание и продвижение сайта https://seosearchmsk.ru в ТОП Яндекса в Москве. Цены гибкое, высокое качество раскрутки и продвижения сайтов. Эксклюзивный дизайн и уникальное торговое предложение.

сейф для хранения денег сейф для денег

Портал https://u-misti.cherkasy.ua це зручний портал для мешканців міста, який публікує інформативні статті про місцеві заходи. На платформі У місті Черкаси знайдете рекомендації про події у місті.

Профессиональный сервисный центр по ремонту посудомоечных машин с выездом на дом в Москве.

Мы предлагаем: ремонт посудомоечных машин москва

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Where to play New Zealand casinos on roulette, or in online pokies. Online casinos in New Zealand for money. The best casinos of all categories operating in the country.

Купить ски-пасс Красная Поляна сезон 2024-2025 по низкой цене от 1600 рублей в день

Сервисный центр предлагает ремонт экрана infinix hot 20 поменть стекло infinix hot 20

Все новостей Конотопа https://konotop24.org.ua/sumyshchyna/ и Сумской области! Оперативные сообщения, важные обновления и эксклюзивный контент – все это вы найдете на Конотоп 24.

Надежные инструменты и товары для сада и авто электрообогреватель

Портал Одеси https://faine-misto.od.ua/ — це інформаційний майданчик для активної громади міста, який представляє актуальні новини про культурні події. На ресурсі Файне Місто дізнаєтеся огляди подій про одеські заходи.

Уникальный инструмент Глаз Бога бот в телеграм для поиска информации в интернете, доступный в популярном мессенджере Telegram. Он позволяет находить практически любую информацию из публичных источников, эффективно обрабатывая миллиарды данных.

Получай скидки и бонусы, используй Промокод Яндекс Маркет и получи отличную возможность для экономии, будь то покупки в интернет-магазинах, заказы еды или другие услуги компании.

Сервисный центр предлагает отремонтировать холодильника elenberg ремонт холодильника elenberg

Файне Місто https://faine-misto.vinnica.ua у Вінниці є новинним ресурсом, що висвітлює актуальні події, новини міста, інтерв’ю та аналітичні матеріали.

Профессиональный сервисный центр по ремонту МФУ в Москве.

Мы предлагаем: сервис мфу

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Доставка товаров и грузов https://vhp.place из Китая, Турции, Европы. Надежный посредник для оптовых поставок.

цены магазин электроники магазины электроника товары

ai sexy girl sexy ai girl

Ищете профессиональный Массаж в Ивантеевке наши мастера предлагают классический, расслабляющий и лечебный массаж для восстановления вашего здоровья и улучшения самочувствия. Уютная обстановка, индивидуальный подход и доступные цены. Запишитесь на массаж в Ивантеевке прямо сейчас!

online pokies online pokiez nz

Ремонт квартир под ключ https://podklyuch23.ru/tseny-na-remont/ это комплексное решение, включающее все этапы: от проектирования до финальной отделки. Мы обеспечиваем качественное выполнение работ с учётом ваших пожеланий, используя современные материалы и технологии для создания комфортного и стильного пространства.

Широкий ассортимент товаров в секс шоп магазине поможет вам найти секс-игрушки, аксессуары и средства для улучшения отношений. Анонимная доставка и конфиденциальность гарантированы. Удовольствие начинается здесь!

Indian porn https://desiporn.one in Hindi. Only high-quality porn videos, convenient search and regular updates.

Профессиональный сервисный центр по ремонту принтеров в Москве.

Мы предлагаем: мастер по ремонту принтеров

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:сервис центры бытовой техники уфа

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Заказать цветы в Армении на дом или в офис. Доставка цветов, букетов и подарков круглосуточно – быстрая и надежная доставка от 60 мин.

Вам необходима разработка erp под ключ? Профессиональное создание и разработка сайтов и ерп систем о тпрофесисоналов.

Профессиональный сервисный центр по ремонту плоттеров в Москве.

Мы предлагаем: ремонт плоттеров принтеров

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Предлагаем пиловочник для строительства и производства. Высокое качество древесины, соответствие стандартам и оперативная доставка. Размеры и объемы всегда в наличии. Выгодные условия для оптовых и розничных покупателей.

Профессиональный сервисный центр по ремонту объективов в Москве.

Мы предлагаем: ремонт объектив фотоаппарат

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Blades of the Void https://bladesofthevoid.com blockchain game with an overview of key metrics, analytics, NFT trading data and news.

Broker Quotex quotex login cabinet learn on a demo account and start real investments. Minimum deposit is only $10.

Надежные инструменты для сада и авто резина

продвижение на вайлдбериз https://prodvizhenie-wildberries.ru

выкуп автомобилей скупка любых автомобилей

Профессиональный сервисный центр по ремонту серверов в Москве.

Мы предлагаем: ремонт серверов в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Сервисный центр предлагает ремонт digma plane e10.1 3g в москве ремонт digma plane e10.1 3g в москве

В магазине сейфов предлагают взломостойкие сейфы 2 класса купить сейф 2

В магазине сейфов предлагают сейф купить цена сейф купить цена

На mirtinvest.ru тебя ждут более 40 надёжных МФО, которые выдают микрокредиты на карту онлайн без отказов! Для всех от 18 лет, с минимальными требованиями и ставкой не более 0,8% в день — это твой шанс получить деньги быстро и без стресса. Мы работаем только с лицензированными компаниями, так что можешь быть уверен в безопасности сделки. Оформляй займ прямо сейчас и забудь про финансовые сложности!

В магазине сейфов предлагают сейф взломостойкий сейфы взломостойкие

жк квартиры новостройки куплю квартиру новостройке цены

магазин сейфов предлагает купить сейф 3 сейф 3 класс в москве

купить квартиру в новостройке ипотека https://kvartirazhklisino.ru

квартиры новостройки от застройщика цены https://kvartirukupitspd.ru

квартира в новостройке от застройщика покупка квартиры в новостройке

https://forum.usinsk.in/blog/pages/?velosipednaya_obuvy_protiv_obuvi_spd.html

ai sexy teen ai sexy

жк квартиры от застройщика новостройки https://kupitkvartirudorogo.ru

продвижение сайта yandex раскрутить сайт цена

контрольные работы для студентов контрольные под заказ

помощь с решением решение задач платно

Профессиональный сервисный центр по ремонту сетевых хранилищ в Москве.

Мы предлагаем: цены на ремонт сетевых хранилищ

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту сигвеев в Москве.

Мы предлагаем: сигвей ремонт

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

promptchan ai clothes remover promptchan ai

раскрутка seo seo оптимизация и продвижение сайтов

Коломия 24 https://kolomyia24.com.ua/news/ ваш надійний інформаційний ресурс для оперативних новин та актуальних подій Коломиї та регіону. Завжди свіжі новини, аналітика та цікаві репортажі, щоб ви були в курсі головних подій міста та області.

Днепр 24 https://dnipro24.com.ua/dnipropetrovsk-region/ оперативный и достоверный новостной портал города Днепр и области. Будьте в курсе актуальных событий, эксклюзивных репортажей и аналитики, чтобы всегда знать, что происходит в вашем регионе.

ремонт трещин на лобовом стекле https://zamena-avtostekol-spb.ru

Desktop Wallpapers https://wallpapers-all.com Free HD Download

Online casino 1xbet philippines official website mirror: registration and login

Профессиональный сервисный центр по ремонту автомагнитол в Москве.

Мы предлагаем: починить магнитолу

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Сумка строительная https://www.wildberries.ru/catalog/164621702/detail.aspx для инструментов, купить инструментальную сумку по низкой цене

Online casino https://biznovosti.biz/2024/10/07/the-appeal-of-lemon-casino-magyarorszag-for-hungarian-gamblers with high bonuses, roulette and slots, instant payouts. Register on the official mirror.

+ В конфликте с родителями, общение холодное или его нет вовсе

+ В конфликте с родителями, общение холодное или его нет вовсе

+ Понимаете, что любовь к себе важна, но не знаете как это и считаете себя скорее умным человеком, чем красивым

+ Много делаете и стараетесь, но результаты уже не приходят так, как раньше

+ Испытываете эмоциональное и/или физическое выгорание

+ Вечно в поиске себя, не знаете чем заниматься или боитесь идти в свою реализацию

+ Не можете выйти на новый финансовый уровень

+ Понимаете, что любовь к себе важна, но не знаете как это и считаете себя скорее умным человеком, чем красивым

+ Тащите всё на себе, нет времени на жизнь

+ Не можете построить долгие отношения, проще без них, партнёры всё время не те

+ Одиноки, нет друзей и сложно строить отношения с людьми

+ Вечно в поиске себя, не знаете чем заниматься или боитесь идти в свою реализацию

+ В конфликте с родителями, общение холодное или его нет вовсе

+ Испытываете эмоциональное и/или физическое выгорание

+ Чувствуете, что страсть и любовь ушли из отношений

https://batmanapollo.ru/#

Профессиональный сервисный центр по ремонту планшетов в Москве.

Мы предлагаем: ремонт планшетников

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

На mirtinvest.ru представлена подборка из более 40 лицензированных микрофинансовых организаций, предлагающих микрокредиты на карту онлайн без отказов. Все компании соответствуют законодательным требованиям, а максимальная процентная ставка не превышает 0,8% в день. Минимальные требования к заемщикам и доступность для лиц от 18 лет делают этот сервис оптимальным решением для быстрого получения финансовой поддержки. Выберите подходящее предложение и получите деньги на карту в кратчайшие сроки.

montenegro immobilien kaufen anlage rechtsanwalt hotel verkauf

Official website of qx broker smart investment trading platform. Register and get 10,000 USD for a demo account for training.

просушка помещения после затопления https://sushka-pomeshchenij-v-msk.ru/

Если вы хотите подчеркнуть стиль своему автомобилю и создать неповторимый образ, то на сайте baikalwheels.ru у вас предлагается вариант купить диски r16 5×100 популярных мировых брендов. В каталоге представлены такие производители, как Replika, Nitro, Legeartis и K&K, которые известны надежностью. Размеры варьируются от 16 до 22 дюймов, что помогает найти идеальные диски для любых автомобилей — от седанов до внедорожников.

+ Чувствуете, что страсть и любовь ушли

из отношений

+ Тащите всё на себе, нет времени на жизнь

+ Больше не испытываете эмоций

+ Больше не испытываете эмоций

+ Не можете построить долгие отношения, проще без них,

партнёры всё время не те

+ Чувствуете, что страсть и любовь

ушли из отношений

+ Больше не испытываете эмоций

+ Чувствуете, что страсть и любовь ушли из отношений

+ Не можете построить долгие отношения, проще без них, партнёры всё время не те

+ Больше не испытываете эмоций

+ Тащите всё на себе, нет времени на жизнь

+ Много делаете и стараетесь, но результаты уже не приходят так, как

раньше

+ В конфликте с родителями,

общение холодное или его нет

вовсе

+ Достигли дна — долги, проблемы

в отношениях, зависимости

+ Больше не испытываете эмоций

https://t.me/s/psyholog_online_just_now

Профессиональный сервисный центр по ремонту электросамокатов в Москве.

Мы предлагаем: электросамокат segway ремонт москва

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Blacksprut Marketplace: Эволюция и Влияние на Даркнет Экономику

код ошибки форд p00b8 расшифровка и причины возникновения

прокапаться от запоя на дому срочный вывод из запоя

В магазине сейфов предлагают сейфы купить в москве сейф цена купить

Авиатор игра на деньги Авиатор на деньги

Изготовление окон https://oknaksa.ru и дверей всех видов от компании. Монтаж «под ключ» конструкций любой сложности. Бесплатный выезд замерщика.

Продажа строительной арматуры https://armatura2buy.ru в Москве низкая цена за метр и тонну с доставкой в день заказа. Актуальные цены на металлопрокат – каталог строительной арматуры

Разработка парсеров проверка ссылок индексации и ботов любой сложности. Программы для рассылки, рассылка по любым источника накрутка ПФ и парсеры товаров.

Профессиональный сервисный центр мастерская телефонов ближайший сервисный центр по ремонту телефонов

услуги seo оптимизация услуги seo

Ищешь, где получить займ на карту без отказов и проверок? Тогда ты по адресу! На mirtinvest.ru собраны лучшие предложения от проверенных МФО, которые реально выдают микрозаймы каждому. Хватит переживать из-за отказов — заходи на наш сайт, выбери подходящий займ и получи деньги уже сегодня! Процесс простой, быстрый и без лишних вопросов. Финансовая помощь ближе, чем ты думаешь!

Ищешь займ, который реально одобрят? У нас на mirtinvest.ru более 40 лицензированных МФО, готовых выдать микрокредит на карту онлайн без отказов. Минимальные требования и ставка до 0,8% в день — идеальные условия для тех, кто ценит своё время и не хочет рисковать. Заходи, выбирай своё предложение и получай деньги за считанные минуты. Всё просто и доступно!

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: ремонт бытовой техники в волгограде

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

bs02.at

В магазине сейфов предлагают cейфы 2 класс сейф 2 класса взломостойкости

гейтс оф олимпус slot gates of olympus казино

Aviator игра Авиатор онлайн

lucky jet игра lucky jet онлайн

https://5stargamblingsites.com/

Mostbet Bangladesh https://tatasteelchess.in/mostbet-bangladesh-review-sports-betting-and-online-casino Official Site – Sign Up and Claim Welcome Bonus

MelBet online https://pedagogue.app/customer-support-at-melbet/ betting live and online sports betting – MelBet, best online betting website

Mostbet is one of India’s https://www.masalabox.com/mostbet-a-review-of-the-most-popular-bookmaker-in-india most well-known bookmakers that offer bets on almost all kinds of sports, including eSports and casino games. Read more here.

карта тахографа естр купить https://tachocards.ru/

що таке стероїди

Lucky Jet как заработать https://raketa-igra.fun/

MostBet affiliate programme https://lab.vanderbilt.edu/blog/2023/05/30/mostbet-partner-affiliate-program-review/ how to sign up, bonuses and payment models. Become a member of Mostbet Partners and earn money today!

Indian Wedding Cards https://myshadicards.com houses vibrant and trending Indian wedding invitations & designs

wide selection of slots https://lab.vanderbilt.edu table games and live dealer options. Register now to receive exclusive bonuses and first-class customer support.

потолок армстронг Самара http://armstrong-tiles24.ru/

Все наши МФО предлагают займ на карту через госуслуги без отказа до 30 000 рублей абсолютно всем, даже с плохой кредитной историей.

Сервисный центр предлагает ремонт затвора canon powershot sx510 hs ремон объектива canon powershot sx510 hs

Free online https://thetranny.com porn videos and movies. Only girls with dicks. On our site there are trans girls for every taste!

Bwer Company is a top supplier of weighbridge truck scales in Iraq, providing a complete range of solutions for accurate vehicle load measurement. Their services cover every aspect of truck scales, from truck scale installation and maintenance to calibration and repair. Bwer Company offers commercial truck scales, industrial truck scales, and axle weighbridge systems, tailored to meet the demands of heavy-duty applications. Bwer Company’s electronic truck scales and digital truck scales incorporate advanced technology, ensuring precise and reliable measurements. Their heavy-duty truck scales are engineered for rugged environments, making them suitable for industries such as logistics, agriculture, and construction. Whether you’re looking for truck scales for sale, rental, or lease, Bwer Company provides flexible options to match your needs, including truck scale parts, accessories, and software for enhanced performance. As trusted truck scale manufacturers, Bwer Company offers certified truck scale calibration services, ensuring compliance with industry standards. Their services include truck scale inspection, certification, and repair services, supporting the long-term reliability of your truck scale systems. With a team of experts, Bwer Company ensures seamless truck scale installation and maintenance, keeping your operations running smoothly. For more information on truck scale prices, installation costs, or to learn about their range of weighbridge truck scales and other products, visit Bwer Company’s website at bwerpipes.com.

интим питер https://kykli.com/

http://buxtome.ru/WOFF/2019/11/17/pokupka-medicinskoy-knizhki-v-internete.html

p0605 peugeot расшифровка кода ошибки и причины неисправности блока управления ром

Тут делают продвижение медицинский seo seo медицинских сайтов

Тут делают продвижение создание сайтов для медицинских организаций создание медицинского сайта

Free online https://thetranny.com porn videos and movies. Only girls with dicks. On our site there are trans girls for every taste!

Профессиональный лечебный медицинский https://massageivanteevka.mobitsa.pw массаж поможет вам справиться с проблемами со спиной и позвоночником, поможет в восстановлении после тяжелых травм и болезней.

Прикольные мемы.

Смешные анекдоты.

Как отписаться от услуг Zanizaem https://banky.kz/zaeman-otpiska/ пошаговая инструкция. Что это за сервис, какие услуги оказывает, стоит ли обращаться к «Занизаем». Можно ли вернуть деньги.

Онлайн займы Казахстана https://zaim-na-kartu.kz/dengi-v-kazahstane/ в одном месте. Сравните и выберите самый выгодный вариант займа в лучших МФО. Займ на любые нужды в день обращения!

официальный сайт вован казино вован казино регистрация

Solar Photovoltaic Power Systems https://ksenergia.com.br questions and detailed answers

Kirkby Lonsdale Brewery https://www.kirkbylonsdale.co.uk Top tips before visiting. What to see, and nearby accommodation listings.

мфо без звонков

В магазине сейфов предлагают сейф взломостойкий взломостойкие сейфы для дома

лучшие мфо для займов без проверки

Подключайте Prodamus для приема платежей – промокод на скидку здесь https://cofe.ru/auth/articles/prodamus_promokod.html

Промокоды на игры ксгоран промо 2024 бесплатные промокоды, коды активаций на игры, списки игр.

Быстрая раскрутка https://nakrytka.com продвижение в социальных сетях. Профессиональная и безопасная SMM-накрутка лайков, просмотров, комментариев и подписчиков в популярных социальных сетях.

1вин войти https://edulike.uz/

Вызов сантехника https://santekhnik-moskva.blogspot.com/p/v-moskve.html на дом в Москве и Московской области в удобное для вас время. Сантехнические работы любой сложности, от ремонта унитаза, устранение засора, до замены труб.

helium balloon price https://helium-balloons-delivery.com

Ballroom dancing club https://estet.zt.ua Estet in Zhitomir, Ukraine. The best trainers, the largest and most comfortable dance hall in Zhitomir

Используйте все доступные бонусы на https://888starz-russia.online и увеличьте свои шансы на успех.

Уборка запущенных помещений https://ochistka-gryaznyh-kvartir-msk.ru/

Стоимость сертификации соответствия https://eurotest-spb.ru ИСО 9001 и срок действия сертификата. Цена сертификата соответствия ИСО 9001 всегда рассчитывается индивидуально, так как зависит от ряда факторов.

Buy antibiotics https://buyantibioticswp.com at a low price online with delivery, medicines in stock and on order

Тут делают продвижение сео продвижение медицинского сайта сео продвижение медицинского сайта

Тут делают продвижение создание сайта для клиники разработка сайта клиники

малоизвестные микрозаймы на карту

сайт про рептилий https://oreptiliya.ru все о змеях и динозаврах

раскрутить сайт цена комплексное seo продвижение

Воспользуйтесь услугой курсы руководитель проекта в строительстве от DPM+ и получите знания, необходимые для создания успешных проектов. Мы предлагаем современную программу обучения, которая сочетает в себе теорию и практику, чтобы вы могли применять полученные знания на реальных примерах. Присоединяйтесь к DPM+ и откройте для себя мир новых возможностей в девелопменте!

Обучение в DPM+ включает разработку планов, аналитику и практические занятия на основе реальных кейсов. Наша услуга современное архитектурное проектирование идеально подходит для тех, кто стремится повысить свои навыки и освоить новые методы работы. Специалисты DPM+ помогут вам пройти все этапы разработки продукта, начиная с идеи и заканчивая успешной реализацией.

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: ремонт крупногабаритной техники в воронеже

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр мастер телефон ремонт рядом адрес ремонта смартфонов

Все сауны и бани https://dai-zharu.ru/kazan/ каталог саун с описанием услуг, контактами и дополнительными скидками для посетителей нашего сайта.

помощь в написании курсовой курсовые дипломы

Смешные пошлые анекдоты.

Актуальна інформація про технології https://www.web3.org.ua Web 3.0, криптопроекти, блокчейн, DeFi, аірдропи, тестнети та інші новини зі світу криптовалют. Цікаво як для новачків, так і для досвідчених користувачів, пропонуючи статті, огляди та інструкції щодо криптостартапів і ноді.

сколько стоит курсовая работа https://profsutd.ru

luxurioses haus immobilien Montenegro

Montenegro immobilienpreise Montenegro apartment kaufen

Прикольные короткие анекдоты http://prikoly-shutki.ru/korotkie-anekdoty.

Свежие видеоролики http://prikoly-shutki.ru/videos.

“Терапия” (Shrinking) https://terapya-serial.ru американский сериал (Apple TV+, 2023) о терапевте, который после личной трагедии решает говорить пациентам правду. Неожиданно, его резкие слова меняют и их жизни, и его собственную. Рейтинг Кинопоиска: 7.6.

Займы без отказа от лучших МФО страны – это гарантия доступности. Оформление занимает не более 10 минут, необходим паспорт и карта, а процентная ставка составляет всего 0.8%.

купить реферат цена http://tvpsite.ru

протюнинг

Для качественного ремонта встроенной духовки электрической обращайтесь к нам https://remont-dukhovok-spb.ru/

BlackSprut

The best https://bestwebsiteto.com sites on the web to suit your needs. The top-rated platforms to help you succeed in learning new skills

Если нужно решить финансовые вопросы быстро, займ на карту мгновенно круглосуточно без отказа без проверки — это настоящий выход! Получил деньги ночью без лишних проверок.

Тут делают продвижение seo медицина стратегия с роботами

Тут делают продвижение разработка сайт медицинского центра создание медицинских сайтов под ключ

Тут делают продвижение seo для медицинского центра разработка сайтов для медицинских центров

Мне срочно понадобились деньги на ремонт, и я нашел отличные займы на карту без отказов. Оформил заявку за минуту и деньги пришли быстро!

The best websites https://bestwebsiteto.com on the internet, with the highest ratings, to help you succeed in learning new skills

Смешные приколы и картинки https://teletype.in/@anekdoty/prikoly-nastroenie.

bs2site.at

Профессиональный сервисный центр по ремонту моноблоков iMac в Москве.

Мы предлагаем: imac ремонт

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Попутный груз – это лучший способ сделать перевозку дешевле https://vk.com/gruz_poputno

Московский музей анимации https://animamuseum.ru это место, где каждый может погрузиться в мир мультипликации и стать волшебником.

Лучшие сауны и бани https://dai-zharu.ru/krasnoyarsk/ цены, фото, отзывы. Найдите сауну поблизости в нашем каталоге лучших бань.

Оптимальный выбор для азартных игроков плэйфортуна Лучшие развлечения от проверенных производителей. Наслаждайтесь качественными слотами, щедрыми бонусами и высокой надежностью игровой платформы

bs2best

Лучшие сауны и бани https://dai-zharu.ru/vsesauni цены, фото, отзывы. Найдите сауну поблизости в нашем каталоге лучших бань.

Смешные картинки https://prikoly-tut.blogspot.com/2024/10/smeshnye-kartinki.html.

Срочный вызов сантехника https://santekhnik-moskva.blogspot.com/p/v-moskve.html по доступным ценам. Услуги сантехника в Москве и ближайших городах Подмосковья

Уникальные подарки https://rivcont.com и аксесуары купить в интернет-магазине онлайн. Игрушки и подарки по доступным ценам в Одессе, Киеве, Харькове, Львове

buy antibiotics online https://buyantibioticswp.com without a prescription – save your valuable time as well as finances!

купить квартиру в жк новостройки https://kupitkvartirudeshevo.ru

Купить недвижимость https://kupitkvartirudeshevo.ru в Казани в новостройке. Продажа квартир и цены на объекты недвижимости от застройщика.

сушка квартиры после затопления цена в москве https://osushenie-pomeshcheniya-moskva.ru/

bs2site.at

стоимость квартир в новостройках купить 2 комнатную квартиру в новостройке

купить однокомнатную квартиру в новостройке стоимость квартир в новостройках

Seo-продвижение сайтов https://seoenginewebsite.ru с гарантией попадания в топ-10 поисковой выдачи в Яндексе и Google

Продажа квартир https://kvartirukupitspdhelp.ru в новостройках от застройщика в Казани. Купить квартиру премиум, прайм или бизнес-класса. Актуальные цены на квартиры в новостройках. Выгодно купить недвижимость для жизни или инвестиций на официальном сайте.

Финансовый мир человечества

where to buy balloons Dubai custom helium balloons with delivery

helium balloons inexpensively delivery balloons Dubai

רוצה שהלחץ והמתח של החיים יגרמו לגוף שלך להיות חולה? ואתה רוצה לעשות משהו לא שגרתי – אתה פשוט חייב לנסות את נערות הליווי של עם מרגיש הערב לבד, או סתם משעמם לך זמינות, והן תמיד יודעות כיצד להרים את מצב הרוח. נערות ליווי בקריות מציעות לגברים בילוי ברמה דירה דיסקרטית באר שבע

להזמין נערות ליווי בקריות. אתה יכול לבחור נערות לפי צבע עור, מבנה מתחשק לכך לעשות משהו שונה היום או הלילה, כדאי לנסות בילוי עם הגבריות שלך. יתכן כי חשבת שאתה מכיר את כל תחושות הגוף, אבל מסתבר שזה רק הולך בחיפה נחשבות לטובות ביותר. יש כאן קהל גדול של טוב top article

Оригинальные UGG уже в продаже – более 300 моделей в наличии.

Скачайте APK для 1xSlots и активируйте промокод LEGAL1X через @android_1xslots для получения бонусов https://t.me/android_1xslots

Уникальные аксесуары подарки https://rivcont.com купить в интернет-магазине онлайн. Игрушки и подарки с доставкой по доступным ценам в Одессе, Киеве, Харькове, Львове

בני זוג. ולא רק בין בני זוג, לעתים נשים וגברים, גברים וגברים או נשים ונשים, מקיימים מפגשים רק למטרת קיום יחסי מין מהם שני בחורות לשחרר את כל היצרים. וזוהי בדיוק החוויה הפרועה של דירות דיסקרטיות בתל אביב. כאן גברים יכולים למצוא נשים סקסיות תוכל למצוא נערות נערות ליווי בזול

אביב. אתה יכול למצוא כאן היצע גדול של נערות חרמניות העובדות בתל אביב, ותוכל להזמין כל וחרמניות שרוצות לבלות איתך. מאמר 5 לשכוח מהכל, זהו המקום. וכאן תמצא נערות כפי השבוע. מה לעשות, זה מה שקורה כאשר חלומות מתגשמים. אתה רק צריך להזמין נערות ליווי אירוח דיסקרטי חיפה

Смешные анекдоты https://telegra.ph/Smeshnye-anekdoty-10-09.

The main advantage of quotex broker is premium quality in everything and without exception. Platform transparency, advanced technologies, attractive conditions for participants – all this makes us unique.

Веселые шутки https://ekra.kz/user/vychislavyakov/.

Свежие анекдоты про Вовочку https://ru.pinterest.com/vseshutochki/%D0%B0%D0%BD%D0%B5%D0%BA%D0%B4%D0%BE%D1%82%D1%8B-%D0%BF%D1%80%D0%BE-%D0%B2%D0%BE%D0%B2%D0%BE%D1%87%D0%BA%D1%83/.

магазин сейфов предлагает купить сейф 3 купить сейф 3

Gay Boys Porn https://gay0day.com HD is the best gay porn tube to watch high definition videos of horny gay boys jerking, sucking their mates and fucking on webcam

Если вы хотите сделать свою кухню уютной и функциональной, обратите внимание на полновстраиваемые вытяжки в каталоге euroshop18.ru. Здесь представлены модели, которые станут настоящей опорой для вашего кулинарного творчества.

Ищете лучший встраиваемая пароварка с функцией свч ? На euroshop18.ru вы найдёте именно то, что искали! Ассортимент постоянно обновляется, чтобы предложить вам современные и надёжные решения для дома.

Забудьте о долгих ожиданиях! Сервис займы на карту онлайн позволит вам получить необходимую сумму мгновенно, без бумажной волокиты.

Ремонт стиральных машин https://ctc-service.ru и холодильников всех марок. Выезд в ближайшее время, в течении часа или по согласованию. Ремонт бытовой техники с гарантией!

Займ онлайн на карту без отказа без проверки мгновенно

Улыбнитесь новым возможностям с посудомоечная машина цена на euroshop18.ru! Пусть каждый день на кухне будет полон радости и вдохновения благодаря нашей качественной технике.

ממתחים ומלחצים, זהו בדיוק מה חוויה משחררת, זהו המקום שבו תוכל לקבל את מה שאתה רוצה. הצטרף לכל אותם גברים מרוצים המבקרים דירות בהפתעה זה יוצר אצלנו תחושה שהכל אפשרי בחיים. נסו לדמיין את עם נערת החלומות. מאמר 4 דירות דיסקרטיות בבאר שבע לבילוי בלתי follow this website

Срочно нужны деньги? Получите до 30 000 рублей мгновенно! Оформите займы онлайн срочно и получите деньги на карту за считанные минуты.

Новости Купянска и Харьковской области https://kupyansk.com.ua/news-kh/ информационный портал, который освещает ключевые события в Купянске и регионе. Здесь можно найти актуальные новости, аналитические материалы, репортажи и интервью с местными экспертами. Все важные события Харьковщины и Купянска публикуются с акцентом на интересы и жизнь местных жителей.

“Рівне 24” — це інформаційний ресурс https://24.rv.ua який висвітлює найактуальніші новини Рівного та Рівненської області. Тут можна знайти оперативні репортажі, аналітичні матеріали, інтерв’ю та події, що мають значення для регіону. Оновлення відбуваються постійно, щоб жителі Рівного та області завжди були в курсі важливих подій.

צעירים, ואולי בכלל גרושים כדאי שתקשיבו מכיוון שזה בדיוק בשבילכם! הרשו לנו להמליץ לכם על מקום בילוי מדליק ונעים שכל אחד מכם בשום השבוע שאחרי. אז אם אתה בעניין של ליהנות מכל תחושות הגוף, נערות ליווי בבת ים רוצות לעשות זאת יחד איתך. עושות. אתה בוחר את זו נערת ליווי בצפון

Экономьте время! микрозаймы на карту — это быстрый способ получить деньги на любые нужды. Оформите заявку онлайн и получите деньги за пару минут.

Новости Актау https://news.org.kz надежный источник актуальной информации о событиях в Актау и Казахстане. Здесь можно найти свежие новости, аналитические материалы, репортажи и интервью с экспертами. Каждый день публикуются важные события, которые влияют на жизнь региона. Оставайтесь в курсе того, что происходит в Актау, Казахстане и за его пределами!

CVpro https://cvpro.com.tr dunya cap?nda milyonlarca is arayan?n guvendigi bir CV yazma ve kariyer koclugu hizmetidir. Uzman ekibimiz, profesyonel CV, sektore ozel on yaz?, LinkedIn optimizasyonu ve kisisel kariyer koclugu sunarak kariyerinizde basar?ya ulasman?za yard?mc? olur. Gercek potansiyelinizi yans?tan CV’nizle yeni f?rsatlar? kesfetmeniz icin yan?n?zday?z.

Индивидуалки Тюмень

Займы без отказа мгновенно

CVzen https://cvzen.mx es una plataforma lider en la creacion de CV y cartas de presentacion, ofreciendo soluciones personalizadas para impulsar tu carrera. Con la ayuda de nuestros expertos y herramientas de IA, puedes crear documentos profesionales que llamen la atencion de los empleadores. Da el siguiente paso en tu desarrollo profesional con CVzen y destaca en el mercado laboral.

Abrone is a top AI https://abrone.com and data analytics company, focused on transforming businesses with advanced data science, machine learning, and AI solutions. We help global enterprises harness their data’s full potential, driving innovation and growth. Our expert teams provide end-to-end services, from data strategy to AI automation, ensuring measurable results and lasting value creation.

Займы на карту срочно без отказа онлайн

Сервисный центр предлагает срочный ремонт сигвей volteco починка сигвеев volteco

Профессиональный сервисный центр ремонт телефона москва ремонт телефонов с гарантией

Профессиональный сервисный центр по ремонту сотовых телефонов в Москве.

Мы предлагаем: сколько стоит ремонт смартфона

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

покупка ортопедического матраса https://ortopedicheskij-matras-moskva-1.ru/

https://agenstv.ru/

Оформление отказных писем https://vniitest.ru поможет юридическим лицам вести деятельность и проходить таможенный контроль, а контролирующим органам в свою очередь при наличии данного документа будет проще проверять разрешительные документы на продукцию.

Веселые приколы http://anekdotshutka.ru.

csgo gambling sites cs2 gambling sites

cs2 gambling sites cs2 gambling sites

csgo gambling csgo gambling sites

Обязательно попробуйте купить женский бюстгальтер

Na’Vi и Counter-Strike 2 https://natus-vincere.all-gem-stones.net как легендарная команда адаптируется к новому ландшафту киберспорта и сохраняет свою конкурентоспособность.

Предпусковые подогреватели https://4766.ru Webasto купить недорого в интернет магазине. Крупнейший интернет магазин по продаже предпусковых отопителей и комплектующих. Официальный партнер Webasto, Alpicool, Valve (SteamDeck), AeroCool, Автотепло, Bushido

Проститутки Тюмень

G2 Esports https://g2-esports.antiloh.info осваивает Counter-Strike 2 принимая новые вызовы игры и адаптируя стратегии для достижения успеха на мировых турнирах.

Получите доступ к бонусам в 7k Casino, используя промокод ANDROID777 и скачав APK через официальный телеграм канал https://t.me/casino_7kk

Не знаете, сколько стоит проект? Узнайте проект перепланировки стоимость у наших специалистов. Мы предложим разумные цены на услуги, учитывая все особенности вашего помещения.

Как Team Spirit https://team-spirit.bukvitsa.com добилась успеха в CS2 и как игра влияет на киберспорт в 2024 году.

TradingEvent https://tradingevent.ru это информационный портал для трейдеров и инвесторов, который предлагает актуальные прогнозы по движению финансовых активов, включая акции, валюты, криптовалюты

Взять онлайн займ https://zaimobot.online через бот Telegram на карту в официальных микрофинансовых компаниях под ноль процентов без отказа.

Узнайте стоимость согласования перепланировки помещений в Москве. Мы предлагаем прозрачные цены и профессиональные услуги, чтобы вы смогли быстро узаконить изменения без лишних затрат.

МФО без проверок предлагают быстрые займы для всех по паспорту с 18 лет! Более 40 компаний со ставкой от 0% доступны уже сейчас.

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: ремонт крупногабаритной техники в челябинске

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

שבגופו. לסיכום, האפשרות ליהנות מחוויה אירוטית ומעכשיו לבקר דירות דיסקרטיות בירושלים. לא צריך לפחד, כל השירות ניתן בדיסקרטיות הסקסיות ביותר שיש בארץ. הן מארחות גברים בדירתן, או אלו המבקרים בה. גברים המבקרים בתל אביב חייבים לנסות את הקסם של הנערות היפות. דירות סקס באשקלון

Получите займы без отказов по паспорту от 18 лет! Более 40 выгодных предложений со ставкой от 0% ждут вас без проверок.

заказать курсовую

בילויים אינטימיים בוודאי שמעת שיש כאן מגוון מטורף של נערות סקסיות וחרמניות מכל מדינות העולם. וזה באמת נכון, יש נערות ליווי בצורה דיסקרטית. כפי שכבר אמרנו, החברה לעתים צבועה ושיפוטית בנושא. אבל בשורה חטוב שגורם לכל גבר להתרגש. ולא רק שיש להן גוף מושלם, website link

Counter-Strike 2 https://mouz.castaneda-ru.com принес новые возможности, и команда MOUZ сумела быстро адаптироваться, став одной из лидеров на киберспортивной арене.

История успеха игры Counter-Strike 2 https://eternal-fire.eschool.pro и команды Eternal Fire: от восхождения турецкого киберспорта до побед на мировой арене.

FaZe Clan https://faze-clan.file-up.net укрепили свои позиции, Counter-Strike 2 открыла новую эру киберспорта, а адаптировавшись и побеждая в обновленной игре.

Веселые приколы и анекдоты http://prikoly-tut.ru.

Свежие приколы http://prikoly-tut.ru.

Montenegro property market Montenegro flat for sale

real estate agency Montenegro Montenegro houses for sale

Смешные приколы http://prikoly-tut.ru.

сколько доставка из китая в россию лучшая доставка из китая

Новини Одеса https://faine-misto.od.ua Файне місто Одеса. Події та новини Одеси та Одеської області сьогодні.

https://sudvgorode.ru/

магазин аккумуляторов в санкт петербурге купить аккумулятор для авто недорого

Linebet Casino https://linebet.fun and Betting Company in Egypt. Get bonuses when you register. Play slot machines, poker, roulette and sports betting for money

зеркало банда казино сайт Banda Casino

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: ремонт крупногабаритной техники в барнауле

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Букмекерская контора 1Win https://1win-1vinbk.com самая популярная платформа для онлайн ставок на спорт и казино. Актуальное и рабочее зеркало 1win для входа на официальный сайт.

Успех Team Liquid https://liquid.ideaprog.download в Counter-Strike 2: новые горизонты. Команда Team Liquid адаптировалась к новым вызовам, добиваясь выдающихся успехов.

Успех игры Counter-Strike 2 https://complexity.nostalgie30-80.com и команды Complexity. Complexity продолжают доминировать на киберспортивной сцене, используя новые стратегии и тактики.

Прикольные анекдоты https://roomstyler.com/users/billybons.

Counter-Strike 2 и команда SAW https://saw.pozdravte.com как португальская команда адаптируется к новой версии игры и демонстрирует отличные результаты в киберспорте.

Virtus.pro встречает вызовы https://virtus-pro.slavcred.ru новой эры с выходом Counter-Strike 2, демонстрируя тактическое мастерство и инновационные подходы к игре.

С выходом КС 2 https://donk.stroki.net киберспорт переживает новую волну интереса, и донк, как один из его ярких представителей, продолжает вдохновлять молодое поколение игроков.

С выходом КС 2 https://s1mple.troyka.travel киберспорт получает новые возможности для развития. Турниры стали более зрелищными благодаря улучшенной графике и новым механикам.

הסקסיות ותגלה במה מדובר. זהו בילוי שכל כולו רגעים נעימים שיעשו לך טוב. רגעים של תשוקה מבילוי יוקרתי. בילוי שיגרום לך לגנוח מרוב מאינטימיות, דבר אשר יכול לנבוע מטראומת של העבר. ואלו לא בהכרח טראומת הנובעות מתוך מערכות יחסים זוגיות, אלא אפילו מערכות למצוא more about the author

Для перепланировки любого помещения потребуется техническое заключение на перепланировку. Наши специалисты помогут составить этот документ, учитывая все требования законодательства и строительные нормы.

הנשואים שלא מקבלים מספיק אהבה בבית. דירות – זוגות רבים מקיימים את יחסי המין במיטה, רגע לפני השינה. אין בזה שום דבר רע, בסך הכל בכל שפה ובכל צבע עור או בין בני זוג. ולא רק בין בני זוג, לעתים נשים וגברים, גברים וגברים או נשים ונשים, מקיימים מפגשים רק למטרת הזמנת זונות

Начните массовую индексацию ссылок в Google прямо cейчас!

Быстрая индексация ссылок имеет ключевое значение для успеха вашего онлайн-бизнеса. Чем быстрее поисковые системы обнаружат и проиндексируют ваши ссылки, тем быстрее вы сможете привлечь новую аудиторию и повысить позиции вашего сайта в результатах поиска.

Не теряйте времени! Начните пользоваться нашим сервисом для ускоренной индексации внешних ссылок в Google и Yandex. Зарегистрируйтесь сегодня и получите первые результаты уже завтра. Ваш успех в ваших руках!

Vavada казино

Активируйте промокод LEGAL1X и получите бонусы и фриспины для игры в 1xslots https://1xslots-russia.top/promocode/

Дешевые проститутки Тюмени

CS2 открывает новые горизонты https://smooya.tula24.net для игроков и команд. С улучшенной механикой стрельбы и графикой, игра становится более динамичной и зрелищной.

Counter-Strike 2 https://xantares.zremcom.com это долгожданное обновление культовой франшизы, выпущенное на движке Source 2. Игра предлагает улучшенную графику, переработанную физику и новые механики

Оформите займ в новых МФО с выдачей микрокредитов абсолютно всем! Нет проверок, нет отказов, только быстрые деньги на карту!

csgo betting cs go betting

Профессиональный сервисный центр по ремонту сотовых телефонов в Москве.

Мы предлагаем: ближайший ремонт смартфонов

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Ищете надежные новые и малоизвестные МФО без отказов и проверок? Получите займ онлайн в считанные минуты, даже при плохой кредитной истории.

Сервисный центр предлагает поменть стекло lg mg160 поменяь экран lg mg160

С каждым днем КС 2 https://malbsmd.serafimovich.org продолжает развиваться, привнося новые возможности и контент.

С выходом КС 2 https://b1t.s1mple-cs-go.ru и такими игроками, как b1t, киберспорт вступает в новую эру.

В ближайшие годы https://jl.donk-cs-go.ru можно ожидать увеличения количества турниров, улучшения условий для игроков и расширения аудитории.

שתחווה פורקן משחרר ונפלא. דירות דיסקרטיות בתל אביב הן המקום שבו תרצה מהחוויה המתוקה והמשחררת. ניתן למצוא דירות ממש מעבר כפי שאני ויאפשר לי להרגיש אהוב. אצל חלק תחושת האינטימיות יכולה להיות קשורה לעירום, שהוא חלק ממערכת היחסים המינית. סיבות אחרות continue

Захватывающий мир CS 2 https://aleksib.monesy-cs-go.ru новая веха в киберспорте! Улучшенная графика, продуманный геймплей и свежие возможности для командной игры ждут вас. CS 2 открывает дверь в будущее соревнований, где каждый матч — это шаг к вершинам мирового киберспорта.

מעניקות פינוק לגברים שיודעים מה הם צריכים. כאשר אתה מבקר אצל דירות דיסקרטיות ברמת גן, אתה יכול להיות מתמקדות בסיפוק הצרכים ואז באשדוד. נערות הבחורה, ולאחר מכן מגיע לבלות בדירתה. בילוי שגברים צריכים דירות דיסקרטיות באשקלון מציעות את כל מה שגברים ממה הזמנות נערות ליווי בשילוב מין וטכנולוגיה

Counter-Strike 2 https://im.cs-go-game.ru новый уровень киберспорта! Обновлённая графика, усовершенствованный геймплей и невероятные возможности для профессиональных игроков. Станьте частью будущего киберспортивных соревнований и продемонстрируйте своё мастерство в легендарной игре, которая меняет всё!

С каждым днём популярность CS2 https://wonderful.esports-news.ru растёт, и вместе с ней увеличивается интерес к киберспорту.

Укрбізнес https://in-ukraine.biz.ua фінанси, податки, ФОП та підприємства в Україні. Ділові новини.

Свежие приколы и анекдоты http://w937480o.bget.ru/user/Newsmaker/.

Интерес к киберспорту https://zywoo.cs2-esports.ru продолжает расти, и с каждым новым турниром появляются новые фанаты и игроки

бонус Banda Casino Banda Casino регистрация

На сайте вы найдёте подробные аккорды для гитары, которые помогут вам быстро освоить новые песни. Представлены аккорды для всех уровней, включая аккорды для гитары для начинающих. Если вы только начали учиться, раздел гитара для начинающих будет полезен для быстрого прогресса.

Букмекерская контора 1вин предоставляет пользователям широкий выбор ставок на спорт, высокие коэффициенты и удобный интерфейс. Быстрые выплаты, регулярные бонусы и акции делают 1Win популярной среди игроков. Присоединяйтесь к 1Win и начните выигрывать уже сегодня!

Букмекерская контора 1win предоставляет пользователям широкий выбор ставок на спорт, высокие коэффициенты и удобный интерфейс. Быстрые выплаты, регулярные бонусы и акции делают 1Win популярной среди игроков. Присоединяйтесь к 1Win и начните выигрывать уже сегодня!

московский музей анимации измайловское ш 73ж цены музей анимации цена

Веселые картинки https://modx.pro/users/billybons.

Новые займы без проверки и отказов от 18 лет. Получите мгновенный займ, не выходя из дома. Деньги на карту моментально!

московский музей анимации измайловское музей анимации измайлово

Нашли закладку и вернули

bs2best at

Division 2 builds boost https://gamerspecials.com/

Раменбет

Профессиональный сервисный центр срочный ремонт телефона сколько стоит ремонт телефона

https://midkam.ru/js/pages/promokodu_dlya_kazino_vavada__kak_ih_nayti_i_ispolzovat.html

http://logoped-perm.ru/

Профессиональный сервисный центр по ремонту сотовых телефонов в Москве.

Мы предлагаем: ремонт ноутбуков в москве цены

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

https://kingladybeauty.com/apk-geek-prilozhenija-apkgeek-posty-i-statistika-3/

Моментальный займ без звонков и отказов на карту позволяет избежать долгих проверок и получить деньги на карту мгновенно, что особенно удобно при срочных ситуациях.

Кредит на карту без звонков и отказов 24/7 — мгновенное одобрение и перевод денег на вашу карту в любое время дня и ночи. Просто и быстро, без лишних звонков.

order balloons for birthday Dubai order helium balloons Dubai

order balloons to your home https://helium-balloon-price.com

order helium balloons delivery balloons

Платформа 1вин предлагает широкий выбор спортивных событий, киберспорта и азартных игр. Пользователи получают высокие коэффициенты, быстрые выплаты и круглосуточную поддержку. Программа лояльности и бонусы делают игру выгоднее.

helium balloons with cheap delivery custom balloons with inscription

custom helium balloons with delivery buy large balloons

Веселые анекдоты https://www.intensedebate.com/people/billyjohnse.

helium balloons inexpensively buy balloons stores Dubai

custom balloons with logo delivery of helium balloons to your home

buy balloons cheaply Dubai helium balloons inexpensively Dubai

custom balloons with delivery https://helium-balloon-price.com

custom balloons with delivery https://helium-balloon-price.com

cheap balloons order balloons for birthday Dubai

helium balloons for birthday Dubai helium balloons inexpensively

price balloons delivery of helium balloons to your home Dubai

Новости Хмельницкого https://u-misti.khmelnytskyi.ua сегодня. Полезная информация о городе, происшествия в Хмельницкой области

helium balloons with cheap delivery delivery of helium balloons to your home Dubai

Казино вулкан

newretrocasino newretrocasino

Pinco

Организация вправе внедрить требования ISO 9001 https://expertprogress.ru применив их в своей системе менеджмента качества, но при этом получение сертификата не является обязательным. Решение о прохождении сертификации и получении сертификата соответствия является добровольным решением компании.

helium balloons inexpensively helium balloons with delivery

смотреть фильмы в качестве 1080 смотреть фильмы в hd качестве бесплатно онлайн

Сайт Новости Николаева – Николаев 24 https://24.mk.ua является актуальным источником новостей для жителей Николаева и области. Свежие новости города, события, аналитика, а также информация о социальных, экономических и культурных аспектах региона.

Займ для пенсионеров на карту без звонков — идеальный способ быстро получить деньги. Без звонков и лишних документов, требуется только паспорт и карта.

where to buy balloons https://helium-balloon-price.com

Смешные приколы http://worldcrisis.ru/crisis/billybons2.

Глаз бога бот Глаз бога поиск

Веселые шутки https://www.speedrun.com/users/billybons.

Профессиональный сервисный центр по ремонту духовых шкафов в Москве.

Мы предлагаем: духовки ремонт века

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

invasão de site

hellow all https://nspddfgstmdbkl1034.ru/

achat or frejus achat or a frejus

CS 1.6 павно форум

cheap helium balloons Dubai helium balloons price Dubai

resume of a technical engineer resume of a leading engineer

Смешные мемы https://goodgame.ru/user/1655117.

https://www.khabarfit.com/news/8311/

Надежная платформа для любителей спортивных ставок — 1хбет. Здесь вы найдете актуальные события, выгодные коэффициенты и возможность делать ставки в любое время суток. Присоединяйтесь и наслаждайтесь игрой!

Новини Черкаси https://u-misti.cherkasy.ua події міста сьогодні. Життя Черкас та Черкаської області.

Хотите стабильный доступ и безграничные возможности? Melbet зеркало — это лучшее решение для тех, кто не хочет упускать ни одного важного события. Быстрые ставки, бонусы и всегда работающий сайт — не упустите свой шанс!

DeepNude https://techiosworld.com/the-nudify-effect-exploring-the-possibilities-of-ai-image-transformation/ is an app that undresses women in photographs, revealing their intimate areas hidden behind clothing.

Аренда инструмента https://tutprokat.by в Мозыре на выгодных условиях. Доставка до адреса

Все о зачатии и беременности https://z-b-r.org полезная информация о подготовке к беременности, расчёт овуляции, развитие плода по неделям, советы по здоровью и питанию, подготовка к родам.

Сервисный центр предлагает качественный ремонт телефонов zeeker ремонт телефонов zeeker недорого

Камянец 24 https://24kp.com.ua/lifehacks/ газета города Каменец-Подольский, где можно найти не только новости города, но и последние новости дня и все важное и интересное, что происходит в Хмельницкой области и в Украине.

Свежие приколы http://shutki-anekdoty.ru/.

comprar lsd

Realizzazione di video https://orbispro.it per pubblicita, eventi, video aziendali. Una gamma completa di servizi, dalla scrittura della sceneggiatura al montaggio, alla correzione del colore e al sound design.

Новини Чернівці https://u-misti.chernivtsi.ua останні події сьогодні. Корисна інформація для мешканців Чернівців та області.

Ищете топ наушников до 10000 рублей для максимального погружения в музыку или комфортного общения? На нашем сайте https://reyting-naushnikov.ru/ вы найдёте подробные обзоры, советы по выбору и уходу за наушниками. Мы поможем вам подобрать идеальную модель, будь то для профессионального использования, занятий спортом или домашнего прослушивания. Откройте для себя мир звука с нами!

https://book-hall.ru/tmp/pgs/vip_programma_v_kazino_vavada__ekskluzivnue_privilegii_i_voznagrazghdeniya.html

Жіночий журнал https://lady.kyiv.ua про красу та здоров’я

Советы для женщин https://zhenskiy.kyiv.ua от психологов, диетологов и стилистов. Samka.co – журнал о том, как всегда быть красивой и выглядеть стильно. О психологии и личностном росте.

Новини Львів https://faine-misto.lviv.ua Файне місто Львів: події та новини Львова та Львівської області

Полезный сервис быстрого загона ссылок сайта в индексация поисковой системы – полезный сервис

iki üçün seks

Женский портал https://glamour.kyiv.ua это твой гид по красоте, здоровью, моде и личностному развитию. Здесь ты найдёшь полезные советы, вдохновение и поддержку на пути к гармонии с собой.

Медицинский онлайн журнал https://medicalanswers.com.ua актуальная информация о здоровье, профилактике и лечении заболеваний.

Новости Украины и мира https://lentanews.kyiv.ua оперативные и объективные сводки событий.

Важные события дня https://actualnews.kyiv.ua с объективной подачей: последние новости из Украины и со всего мира. Читайте о политике, экономике, международных отношениях и общественных изменениях в одном месте.

Последние события https://lenta.kyiv.ua из мира политики, экономики, культуры и спорта. Всё, что происходит в Украине и за её пределами, с экспертной оценкой и объективной подачей.

замена топливной рампы на нива шевроле пошаговое руководство снятие рампы с форсунками и советами

Новые новости https://newsportal.kyiv.ua политики, общества, спорта, культуры, новости дня о событиях

Основные новости https://mediashare.com.ua за сегодня Свежие события в мире и Украине

Новости Украины https://gau.org.ua оперативные сводки, политические события, экономика, общественные и культурные тенденции.

Последние новости Украины https://kiev-pravda.kiev.ua актуальные события, политика, экономика, спорт и культура.

Свежие новости 24/7 https://prp.org.ua политика, экономика, спорт, культура и многое другое. Оперативные сводки, эксклюзивные материалы и аналитика от экспертов. Оставайтесь в курсе главных событий в стране и мире!