Understanding Brokerage Recommendations

When it comes to investing in the stock market, the guidance often sought after is that of the esteemed Wall Street analysts. These financial savants hold the power to influence stock prices through their endorsements of Buy, Sell, or Hold decisions. But just how reliable are these recommendations? Let’s delve into the latest insight provided by Wall Street analysts regarding Builders FirstSource (BLDR) and the likelihood of turning that information into a sound investment strategy!

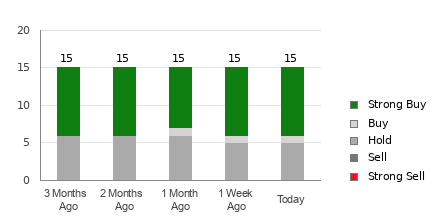

Builders FirstSource’s Brokerage Recommendations

According to the composite rating derived from the analysis of 17 brokerage recommendations, Builders FirstSource (BLDR) currently holds an average brokerage recommendation (ABR) of 1.53. Ratings range from 1 to 5, with 1 being a Strong Buy and 5 representing a Strong Sell. The current ABR leans towards a Strong Buy, indicating a favorable sentiment from the majority of analysts.

Challenge the Status Quo

However, making a decision based solely on brokerage recommendations may not be as straightforward as it seems. Research indicates that these recommendations may not always provide the most reliable insights to navigate the complex realm of the stock market.

Why is this so? Well, it appears that the analysts at brokerage firms are often swayed by their own affiliations, leading to an inherent positive bias in their ratings. Studies have shown that for every “Sell” recommendation, there are an overwhelming five “Strong Buy” endorsements. This misalignment of interests underscores the need for diligent scrutiny before relying solely on these recommendations.

The Power of Zacks Rank

Not all hope is lost, though. Enter the Zacks Rank, a renowned stock rating tool with a proven track record. Unlike the ABR, which hinges solely on brokerage recommendations, the Zacks Rank draws its strength from the analysis of earnings estimate revisions. This crucial difference sets it apart from the potentially skewed nature of brokerage recommendations.

The correlation between earnings estimate revisions and stock price movements has been well-documented, giving the Zacks Rank an edge in gauging a stock’s potential for growth.

Comparing ABR and Zacks Rank

It’s essential to recognize that while both the ABR and Zacks Rank share a scale from 1 to 5, they are fundamentally distinct in their methodologies. The ABR reflects brokerage recommendations and often carries decimal values, while the Zacks Rank is based on quantifiable earnings estimate revisions and is displayed in whole numbers, from 1 to 5.

Embracing Objectivity

Despite the allure of brokerage recommendations, the wisdom lies in complementing this insight with a careful evaluation of the Zacks Rank. This multifaceted approach can serve as a reliable compass in the tumultuous waters of stock investment, allowing investors to form a more well-rounded and independent perspective.

Conclusion: The Path Ahead for BLDR

So, what’s the bottom line for potential investors eyeing Builders FirstSource (BLDR)? Analyzing the recent boost in earnings estimate for the company, which has consequently clinched a Zacks Rank #2 (Buy) status, offers a compelling reason to consider its potential as an investment opportunity. The affirmation of analysts through their consensus estimate revisions underscores the promise that BLDR holds for prospective growth.

Embracing a comprehensive approach that amalgamates ABR insights with the discerning lens of Zacks Rank could pave the way for a well-informed investment strategy in the dynamic world of stocks.

Explore the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here

As investors navigate the realm of brokerage insights and internalize the potency of tools such as the Zacks Rank, the potential for informed decision-making becomes an increasingly attainable reality.