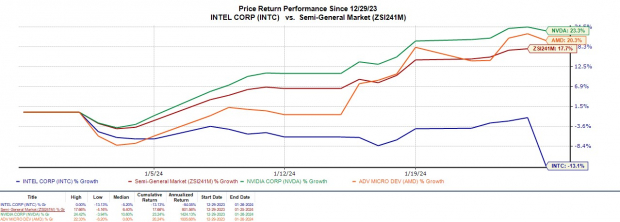

Intel’s (INTC) stock plummeted 12% in today’s trading session after the chip giant posted favorable Q4 results after market hours on Thursday but provided underwhelming guidance for the first quarter. This abrupt decline comes in the midst of a vibrant chip sector, with the Zacks Semiconductor-General Industry already up 18% year to date and 121% over the last year, led by strong performances from Nvidia (NVDA) and AMD (AMD).

Despite Intel’s stock being down 13% YTD, it had climbed 55% in the last year. The recent dip could potentially pose a buying opportunity for investors.

Image Source: Zacks Investment Research

Q4 Review

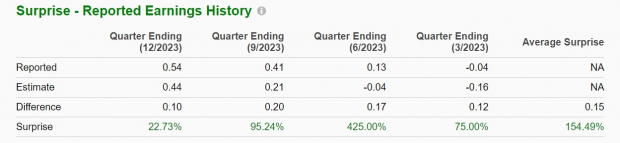

CEO Pat Gelsinger stated the fourth quarter capped off a year of tremendous progress on Intel’s transformation with Q4 EPS of $0.54 a share topping the Zacks Consensus of $0.44 a share by 23%. More impressively, Q4 earnings soared 440% from $0.10 a share in the prior year quarter. This also marked Intel’s fourth straight quarter of topping earnings estimates.

On the top line, Q4 sales of $15.4 billion came in 2% better than expected and rose 10% year over year. Intel attributed the exhilarating results to consistent execution and accelerated innovation which resulted in strong customer momentum for the company’s products.

Image Source: Zacks Investment Research

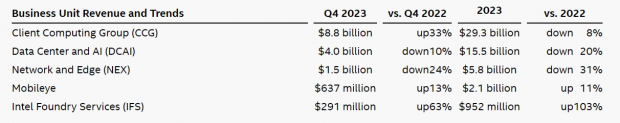

Following a very sharp recovery in 2022, Intel’s full-year fiscal 2023 revenue of $54.2 billion dipped 14% year over year with annual earnings of $1.05 per share falling 43% from $1.84 a share.

In a bid to compete against the likes of Nvidia and AMD regarding AI-powered chips, Intel is continuing to build its external foundry business and at-scale global manufacturing by executing its mission to bring AI everywhere. Intel expects this to drive long-term value to shareholders.

Intel expects this to drive long-term value to shareholders with the company previously announcing the organizational change to integrate its Accelerated Computing Systems and Graphics Group into its Client Computing Group and Data Center and AI Group. Notably, Data Center and AI revenue did dip 10% during Q4 to $4 billion but Client Computing revenue jumped 33% to $8.8 billion.

Image Source: Intel Press Release

Mobileye Headwinds & Weaker Outlook

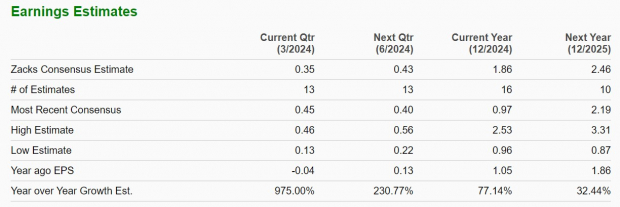

Discrete headwinds in Intel’s Mobileye segment which is the company’s autonomous driving technologies unit along with business exits among others are impacting overall revenue for the first quarter. This led to Intel offering first quarter revenue guidance of $12.2 billion-$13.2 billion which was below most analysts’ expectations and the current Zacks Consensus of $14.3 billion.

Intel expects Q1 earnings to be at $0.13 a share which was well below the current Zacks Consensus of $0.35 a share (current quarter below) and fueled today’s selloff.

Image Source: Zacks Investment Research

Bottom Line

It may be too soon to buy the dip in Intel’s stock as earnings estimates are likely to decline given the company’s weaker-than-expected guidance. For now, Intel’s stock lands a Zacks Rank #3 (Hold) and may continue to reward longer-term investors but the company’s transformation and outlook should still be closely monitored going forward.