Tesla TSLA shares have been hit mightily amid recent market volatility with the EV giant’s stock down 35% year to date. That said, at $262, TSLA is still sitting on gains of over +40% in the last two years which has roughly matched the S&P 500 but has trailed the Nasdaq’s +57%.

Despite a free fall from highs of almost $500 a share in December, investors have come to find that it is never wise to count Tesla’s stock out for a rebound.

To that point, fears of slower EV growth and price cuts among Tesla’s EV lineup have been dismissed over the last year due to the company’s market dominance. This begs the question of whether it’s time to buy the drop in Tesla’s stock yet, with it noteworthy that TSLA is trading 89% above its 52-week lows of $138 last April.

Image Source: Zacks Investment Research

Tesla & Market Sentiment

Investor sentiment often magnifies Tesla’s appealing growth trajectory and justifies its premium to the broader market in terms of valuation. At the helm of this has been Tesla’s popular but also polarizing CEO, Elon Musk.

Musk’s alignment with President Trump has been under scrutiny of late with Tesla giving up most of its post-election gains in recent weeks. As the co-head of Trump’s Department of Government Efficiency (DOGE), some have come to question if Musk’s political involvement is damaging Tesla’s brand as a conflict of interest.

To that point, TSLA has been hit harder than the other Magnificent-7 themed big tech stocks amid ongoing concerns that Trump’s tariff policies will have an ill effect on the global economy. On the other hand, some investors may see Musk’s position within the DOGE as a way to reduce regulatory tape for Tesla and other EV makers.

Average Broker Recommendations (ABR)

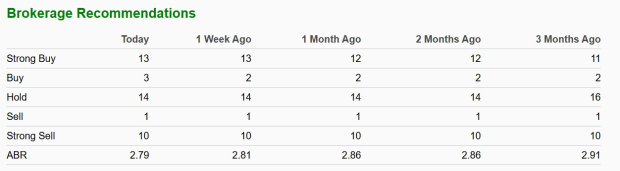

With 41 brokerage firms covering Tesla stock and providing data to Zacks, TSLA currently has an average broker recommendation (ABR) of 2.79 on a scale of 1 to 5 (Strong Buy to Strong Sell). Tesla’s ABR does speak to a polarizing viewpoint for Tesla and Elon Musk at the moment with 13 brokers at a strong buy, 14 at a hold, and 10 at a strong sell.

Image Source: Zacks Investment Research

Tracking Tesla’s P/E Valuation

Given Tesla’s appealing growth trajectory is still intact, investors are certainly eying the recent dip in TSLA for a better buying opportunity. In this regard, TSLA does trade well below its high of 240X forward earnings over the last three years but is slightly above the median of 84.1X during this period.

Image Source: Zacks Investment Research

Bottom Line

It may be too soon to bite at projections of double-digit top and bottom line growth for Tesla in fiscal 2025 and FY26. However, Tesla should remain a viable long-term investment with its stock landing a Zacks Rank #3 (Hold). Furthermore, the Average Zacks Price Target of $348.61 suggests 32% upside for TSLA, although an ascension to this mark will largely depend on broader markets stabilizing and finding a bottom.

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).