Investors often flock to GE Aerospace, formerly General Electric, for its cutting-edge aviation technologies and diverse business offerings. Similarly, General Mills, a global leader in consumer food manufacturing, presents a compelling investment opportunity.

This year, GE Aerospace’s stock has surged by an impressive 23%, while General Mills’ shares have seen a respectable 8% uptick. Given these developments, it’s wise to assess whether now is the opportune moment for investors to consider these iconic companies for further growth.

Image Source: Zacks Investment Research

Growth Trajectories

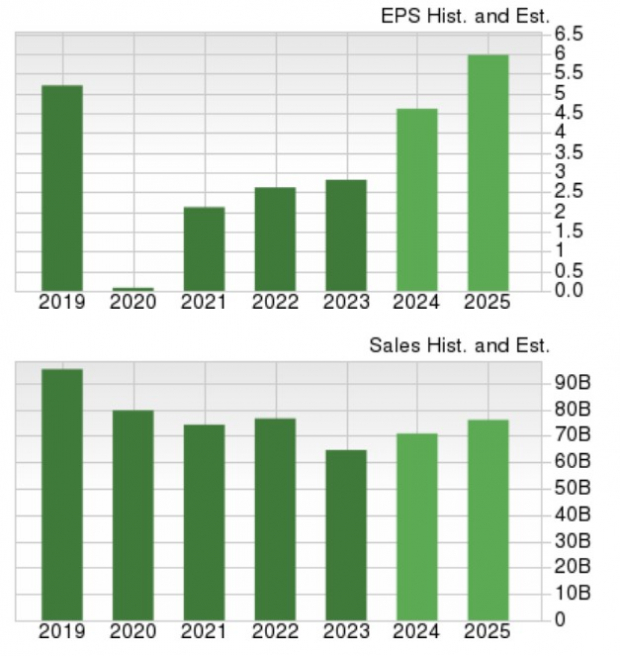

GE Aerospace’s remarkable year-to-date rally is backed by optimistic projections for its annual earnings. Forecasts predict a staggering 64% surge in fiscal 2024 to $4.61 per share from $2.81 per share in the previous year. Moreover, expectations for FY25 indicate a further 29% earnings growth to $5.97 per share. On the revenue front, total sales are anticipated to climb 8% this year and another 7% in FY25, reaching $76.02 billion.

Image Source: Zacks Investment Research

Comparatively, General Mills is expected to witness 5% EPS growth in FY24, with FY25 earnings projected to rise 3% to $4.65 per share. While total sales might experience a slight decline in FY24 to $20.04 billion, FY25 forecasts suggest a 1% increase to $20.24 billion.

Image Source: Zacks Investment Research

P/E Valuations

GE Aerospace’s stock, trading around $155 a share, commands a forward earnings multiple of 33.9X, notably higher than the Zack’s Diversified Operations Industry average of 21.3X and the S&P 500’s 21.9X. Despite this premium valuation, GE Aerospace shines among its conglomerate peers, which include notable companies like Honeywell International and 3M.

Image Source: Zacks Investment Research

On the other hand, General Mills’ stock is priced at $70 per share, boasting a more attractive 15.4X forward earnings multiple. This valuation is notably lower than the benchmark and the Zacks Food-Miscellaneous Industry average of 17.1X. Competitors like Kraft Heinz and Conagra Brands operate in the same sphere.

Image Source: Zacks Investment Research

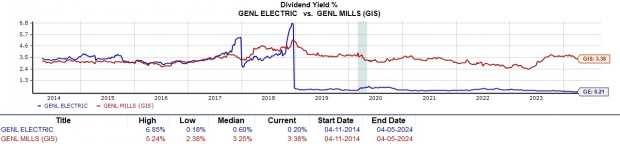

Dividend Comparison

General Mills stands out with a 3.38% annual dividend yield, surpassing the S&P 500’s 1.3%. In contrast, GE Aerospace’s dividend yield remains modest at 0.2% after scaling back payouts post-pandemic.

Image Source: Zacks Investment Research

Bottom Line

The remarkable upturn in GE Aerospace’s financial performance has undoubtedly captured investors’ interest, coupled with the stellar price performance of its stock this year. However, General Mills’ reasonable valuation and attractive dividend yield are equally compelling. Currently, both stocks hold a Zacks Rank #3 (Hold), indicating a cautiously optimistic outlook.

Curious about potentially high-growth stocks? Check out Zacks’ picks that have the potential to double in 2024!

Many of the stocks in the report are flying under the radar, offering a unique opportunity for early investment.