Wall Street Analyst Sentiment on PDD Holdings Inc. Sponsored ADR

Investors habitually turn to Wall Street analysts for insights before committing to Buy, Sell, or Hold a stock. While alterations in ratings by these brokerage-firm experts can impact stock prices, do these recommendations hold actual weight?

Before delving into the reliability of brokerage recommendations and strategies to capitalize on them, let’s examine the sentiments of Wall Street bigwigs on PDD Holdings Inc. Sponsored ADR (PDD).

Analyzing Brokerage Recommendations for PDD Holdings Inc. Sponsored ADR

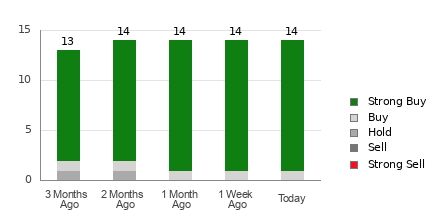

PDD Holdings Inc. Sponsored ADR currently boasts an average brokerage recommendation (ABR) of 1.04 out of 5, derived from assessments (Buy, Hold, Sell, etc.) by 14 brokerage firms. This ABR roughly aligns between Strong Buy and Buy expectations.

Of the 14 recommendations driving the ABR, 13 stand at Strong Buy, while one is rated Buy. Strong Buy and Buy collectively constitute 92.9% and 7.1% of all recommendations, respectively.

Understanding Brokerage Recommendation Trends for PDD

The ABR hints at a recommendation to Buy PDD Holdings Inc. Sponsored ADR; however, basing investment decisions solely on this metric might not be prudent. Studies indicate that brokerage recommendations have limited success in guiding investors towards stocks with significant price appreciation potential.

Why is that, you may wonder? Typically, analysts at brokerage firms exhibit a strong positive bias towards the stocks they cover, complicating their ability to offer unbiased ratings. For each “Strong Sell” recommendation, five “Strong Buy” ratings are often assigned, indicating a misalignment of interests with retail investors and a lack of clear direction on stock price movements.

A Deep Dive into the Zacks Rank

The Zacks Rank, distinguished by its independently verified track record, serves as our proprietary stock rating tool. Categorizing stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), this tool provides a dependable forecast of a stock’s near-term price performance. Thus, combining the Zacks Rank with ABR assessments can enhance investment decision-making significantly.

Clarifying the Distinction Between ABR and Zacks Rank

Although ABR and Zacks Rank appear similar on a 1 to 5 scale, they offer distinct evaluations. The ABR relies solely on brokerage recommendations, often denoted in decimals, while the Zacks Rank employs a quantitative model based on earnings estimate revisions, typically presented in whole numbers.

Unlike the optimistic tendencies of brokerage analysts, the Zacks Rank underscores trends in earnings estimate revisions to inform near-term stock price movements effectively. This empirical approach stands in stark contrast to the subjective nature of brokerage recommendations.

Moreover, the Zacks Rank is consistently updated based on analysts’ revisions to earnings estimates, ensuring timely and accurate indications of future price trends across all covered stocks.

Evaluating PDD Holdings Inc. Sponsored ADR as a Viable Investment

Examination of the earnings estimate revisions for PDD Holdings Inc. Sponsored ADR reveals an encouraging trend. The Zacks Consensus Estimate for the current year has seen a 2% uptick over the past month, settling at $12.32.

The unanimity among analysts in revising EPS estimates upwards reflects a growing optimism around the company’s earnings prospects, potentially catalyzing a surge in the stock’s value in the short term.

Given the recent consensus estimate adjustments and other favorable indicators, PDD Holdings Inc. Sponsored ADR currently holds a Zacks Rank #1 (Strong Buy), positioning it as a compelling investment option. View the complete list of today’s Zacks Rank #1 stocks here.