CNBC’s Jim Cramer suggested on Tuesday that NVIDIA Corp. NVDA may have reached a key turning point after the stock touched $127, potentially signaling a bottom for the semiconductor giant’s recent pullback.

What Happened: “We may have hit a possible crescendo for Nvidia’s stock when it hit the $127 mark. Could be a moment where everyone who wanted to sell did so,” Cramer wrote on X, formerly Twitter. This marks a shift from his Monday warning when he predicted a “vicious” and “fast” reversal for the chipmaker.

Nvidia shares closed Tuesday at $130.39, down 1.22%, before gaining 0.53% in after-hours trading. Despite recent volatility, the stock has maintained an impressive 170.69% gain year-to-date, largely fueled by artificial intelligence demand.

See Also: Nissan Stock Soar Over 20% On Merger Talks With Honda, Mitsubishi Spikes

Why It Matters: The company’s fundamental strength remains evident in its recent financial performance, with third-quarter revenue surging 94% year-over-year to $35.1 billion. Nvidia’s market capitalization stands at $3.21 trillion, with a price-to-earnings ratio of 53.

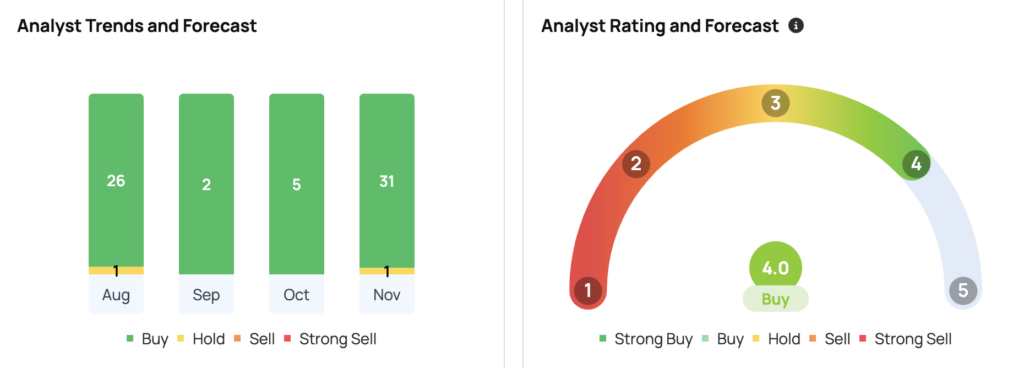

Wall Street maintains an optimistic outlook, with 40 analysts setting an average price target of $170.56. Rosenblatt Securities leads with the most bullish target of $220, while New Street Research sets a more conservative target of $120, according to Benzinga Pro data.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs