Shifting Market Trends

Over the past three months, the stock market has witnessed a significant rotation from Tech and AI sectors to defensive industries like Utilities, Healthcare, Real Estate, and Bonds. Notably, Real Estate ETF XLRE, Treasury ETF TLT, Utilities ETF XLU, and Healthcare XLV have outperformed benchmark indices SPY and QQQ by a substantial margin since June.

As the Federal Reserve signals a shift towards a rate-cutting strategy and various economic indicators hint at a slowdown (not recession), investors are flocking towards more conservative investment options.

Rising from the Embers: Apple’s Triumph

Amidst the current market turmoil, tech giants like Apple, Meta Platforms, and Nvidia have seen their stock prices plummet to enticing levels. Today, we shine a light on three top picks—Apple (AAPL), Meta Platforms (META), and Nvidia (NVDA)—and explore key levels to monitor for tactical trading.

Image Source: TradingView

Apple’s Recent Innovations

Recently, Apple unveiled a range of new products such as the iPhone 16 series, Apple Watch Series 10, and AirPods 4. These offerings boast enhanced features like upgraded health monitoring capabilities, improved audio quality, and the introduction of the new AI system, Apple Intelligence.

Despite criticisms of incremental upgrades, the health-focused functionalities and AI enhancements in Apple’s products present a compelling narrative for investors.

Image Source: TradingView

Apple stock has demonstrated strength, outperforming its peers in the Magnificent Seven since May, despite the market’s recent volatility. A potential bull flag formation indicates a positive outlook for AAPL, with a potential breakout above $220 paving the way for new all-time highs.

Image Source: TradingView

Meta Platforms: Navigating Controversy to Continued Growth

Meta Platforms, although occasionally embroiled in controversies like political scandals and questionable investments, continues to exhibit robust growth and profitability. Amidst these cycles, astute investors have seized opportunities to acquire META shares at discounted prices.

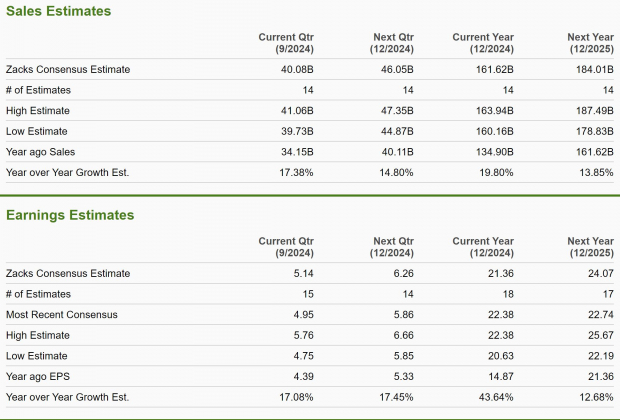

Projections indicate a substantial growth trajectory for Meta Platforms, with anticipated sales and earnings increases. Moreover, the stock’s attractive valuation relative to its growth prospects positions it favorably among its peers.

Image Source: Zacks Investment Research

Despite past controversies, Meta Platforms remains one of the top-performing stocks in the Magnificent Seven, highlighting its resilience and potential for further growth.

Exploring the Current Outlook of Prominent Tech Stocks

Meta Platforms’ Potential Upsurge

Meta Platforms’ stock exhibits a bullish pattern, featuring a bull flag within a broader consolidation. Amidst a potential breakout above the $515 mark, the stock is poised to ascend further into the upper echelons. However, a breach of the lower support at ~$465 might indicate broader market turmoil, warranting a prudent pause for another entry point.

NVIDIA’s Valuation in Focus

NVIDIA, a standout performer in recent years, faced a significant downturn in the last quarter. Despite a robust rally post-correction, the stock witnessed renewed selling pressure. Currently hovering above $100, NVIDIA presents an enticing opportunity for investors to enter near the lower end of the price range. Notably, the semiconductor giant’s valuation has also moderated, rendering it more accessible to potential buyers.

Assessment of NVIDIA’s Relative Valuation

Trading at a forward earnings multiple of 38x, NVIDIA’s valuation stands below its historical average and near a five-year low. With a projected annual EPS growth rate of 41.7% over the next few years, the stock boasts a PEG ratio of 0.9, signifying an undervalued status based on this metric. Looking ahead to FY26 earnings, NVIDIA trades at a modest 28x multiple, underscoring its potential for robust appreciation given the anticipated growth trajectory.

Opportunities in Tech Giants

With prevailing market conditions signaling a shift towards defensive sectors, leading tech players such as Apple, Meta Platforms, and NVIDIA have encountered pullbacks, offering appealing entry points at more rational valuations. Apple’s resilience and innovative edge, Meta Platforms’ exponential growth trajectory despite past controversies, and NVIDIA’s prowess in AI and semiconductor technologies position these companies favorably for prospective market trends.

For long-term investors seeking a blend of stability, innovation, and growth, these stocks present compelling prospects. Apple’s consistent performance, Meta Platforms’ soaring earnings potential, and NVIDIA’s leadership in key technological domains set the stage for future growth. Seizing the recent pullbacks, investors can capitalize on the latent potential of these firms before a resurgence in the tech sector.