We are traversing the Q4 earnings season, observing a plethora of companies unveiling their quarterly results each day. Many firms have pleasantly surprised investors, with significant margin expansion evident across multiple sectors.

Specifically, Netflix NFLX, Procter & Gamble PG, and Meta Platforms META have all experienced uplifting profitability trends, presenting favorable results that have resonated with shareholders. For those keen on delving into this earning momentum, a closer examination of each company is warranted.

The Netflix Phenomenon

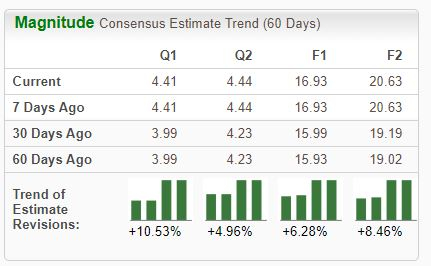

Behemoth streaming service Netflix basks in positive earnings estimate revisions across the board, securing a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The latest period witnessed a substantial improvement in profitability, with operating income soaring to $1.5 billion from $0.5 billion, and the operating margin climbing to 17% from 7% compared to the same period last year.

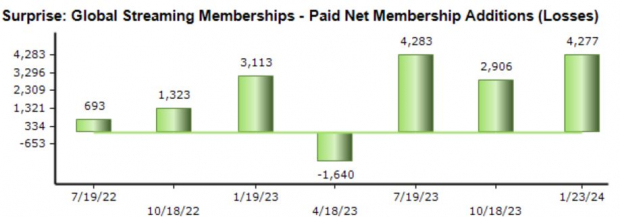

The addition of 13.1 million subscribers during the period far exceeded our consensus estimate of 8.8 million. Moreover, the company has consistently surpassed subscriber expectations, as depicted below.

Image Source: Zacks Investment Research

The Ascendancy of Meta Platforms

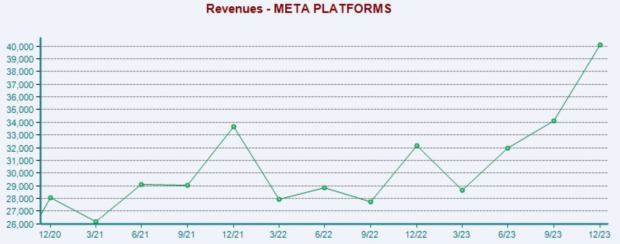

Meta Platforms has been consistently delivering robust earnings results, surpassing our consensus EPS projections by an average of 20% over the past four releases. Notably, the company’s operating margin surged to 41%, triumphing over the figure of 20% from the previous year’s quarter.

In its most recent report, the tech giant recorded a 25% year-over-year revenue increase, coupled with a staggering 77% leap in EPS. The 25% revenue surge marked the highest year-over-year growth rate in eight quarters.

Image Source: Zacks Investment Research

To cap off its impressive results, the company announced its inaugural dividend, slated to be paid on March 26th to stockholders of record as of the close of business on February 22nd.

Procter & Gamble’s Prosperity

Procter & Gamble outperformed the Zacks Consensus EPS estimate by 8% and slightly missed revenue expectations, with both metrics exceeding their year-ago levels. The company registered a gross margin of 52.7%, surpassing the 47.5% from the previous year.

Following these results, the company raised its FY24 core net EPS growth forecast to a range of 8% – 9%, up from the previously anticipated range of 6% – 9%. The stock has witnessed bullish activity subsequent to the release, infusing a sense of optimism.

Image Source: Zacks Investment Research

Concluding Thoughts

A favorable operating environment has underpinned enhanced profitability for numerous companies, prompting a surge in share values post-earnings during the Q4 2023 cycle thus far. For investors interested in companies experiencing margin expansion, Netflix NFLX, Procter & Gamble PG, and Meta Platforms META have all seen substantial improvements in their profitability profiles.