More than a decade after Snap Inc. SNAP turned down a multibillion-dollar buyout from Facebook, the failed deal is back in the spotlight as Mark Zuckerberg testifies in Meta Platforms Inc.’s META high-stakes antitrust trial.

What Happened: On Tuesday, during his second day on the witness stand, Zuckerberg addressed a 2013 email in which he offered $6 billion to acquire Snapchat—double the $3 billion previously reported, according to a report by Business Insider.

“I delivered the offer to Evan and he seemed to take it well,” Zuckerberg wrote in the email, referencing Snap CEO Evan Spiegel. “He told me he thought he could get it done and that he’d call me back quickly.”

The deal never materialized. Zuckerberg told the court he believed Snapchat “wasn’t growing at the potential that it could” and added, “If we would have bought them, we would have accelerated their growth, but that’s just speculation.”

See Also: Netflix Debuts OpenAI-Backed Search Engine That Lets You Discover Movies And TV Shows Based On Emotions, Not Just Titles

The Federal Trade Commission introduced the email as part of its argument that Meta pursued acquisitions like Instagram and WhatsApp to eliminate competition and maintain dominance in the social media space.

Snap spokesperson Monique Bellamy told the publication, “Anticompetitive behavior can often slow and thwart growth for smaller companies… Meta’s attempt to buy Snap, and then egregiously copy its features, was an attempt to do just that.”

While testifying, Zuckerberg acknowledged that Snapchat was and continues to be a significant competitor.

Why It’s Important: The FTC’s lawsuit could reshape the tech landscape. It accuses Meta of using a “buy or bury” strategy to suppress rivals, potentially forcing the company to divest Instagram and WhatsApp.

Meta denies wrongdoing, arguing it faces strong competition from platforms like TikTok and YouTube, the platform owned by Alphabet Inc.’s GOOG GOOGL Google.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

The trial is expected to last eight weeks.

On Monday, the trial revealed internal strategies, such as Zuckerberg’s unexecuted plan to reset all Facebook users’ connections in 2022, aimed at keeping the platform culturally relevant.

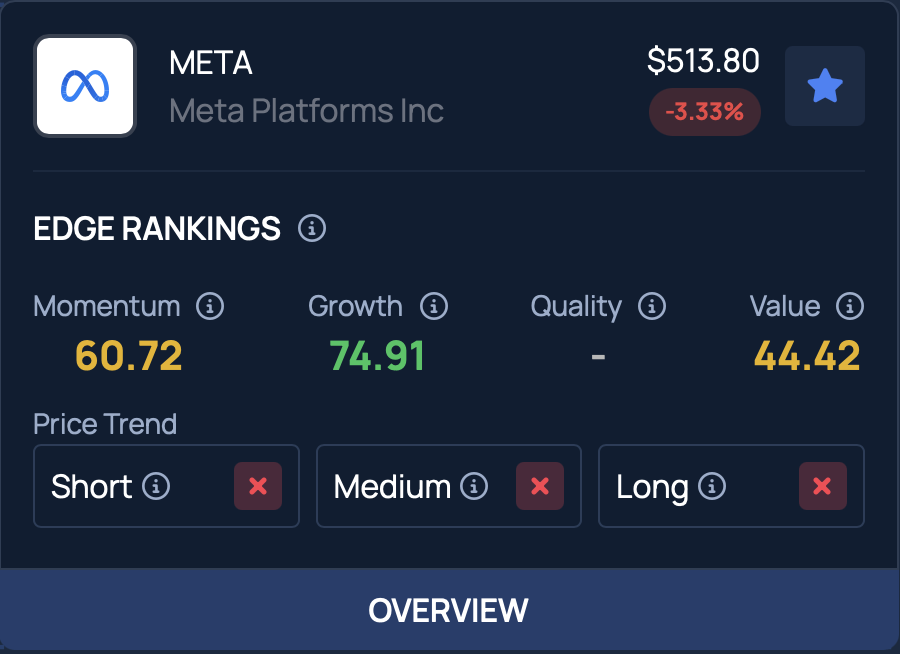

Price Action: On Tuesday, Meta’s stock fell by 1.87%, closing at $521.51, according to Benzinga Pro data.

META holds a momentum rating of 60.72% and a growth rating of 74.91%, based on Benzinga’s proprietary Edge Rankings.

The Benzinga Growth score measures a stock’s past earnings and revenue growth over various timeframes, emphasizing both consistent long-term performance and recent trends.

Click here to see how it compares to Snapchat, Alphabet, and other major companies.

Read More:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Poetra.RH / Shutterstock.com

Market News and Data brought to you by Benzinga APIs