The recent turbulence in the stock market has left many investors pondering – is this a mere correction following a powerful uptrend since November, or are we witnessing the downfall of the bull market? The prevailing sentiment seems to suggest the latter, as highlighted by a recent MarketWatch article.

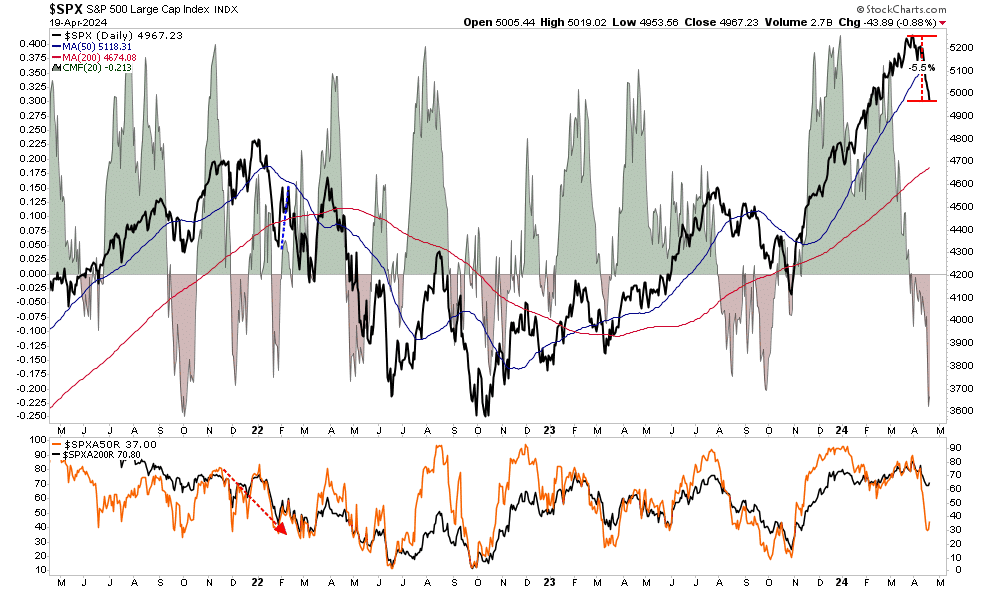

“For the first time since early November 2023, less than 30% of stocks are trading above their 50-day moving average – a clear sign of the current market’s poor breadth. This stark decline from the 85% level in late March and 92% in January underlines a significant shift in market dynamics,” pointed out the publication.

“The 50-day moving average is often viewed as an indicator of short-term stock health. A widespread fall below this level implies that a large segment of the market is under downward pressure. This change comes amidst rising geopolitical tensions in the Middle East and renewed worries about inflation, prompting investors to adopt a more cautious stance in April,” it continued.

The market fluctuations can be attributed to various factors, including geopolitical uncertainties between Israel and Iran and unexpectedly high inflation rates that halted Fed rate adjustments. However, these occurrences shouldn’t catch us off guard, as we previously highlighted in a recent piece.

“Since 2009, and notably escalating from 2012, the increase in buybacks has significantly outpaced the rise in asset values. This isn’t merely a coincidence, and the upcoming blackout period may bear more significance on the rally than anticipated,” we remarked earlier this year.

Furthermore, the correlation between the blackout of corporate buybacks and an overly bullish investor sentiment has played a crucial role in the current market correction.

“Historically, when retail investor sentiment is excessively bullish alongside low volatility, it has usually aligned with short-term market peaks,” we noted, pointing to a reference chart.

This analysis underscores the vital role of corporate buybacks in shaping market dynamics and sets the stage for the upcoming market trajectory.

Navigating Buyer-Seller Realm

Understanding market pricing dynamics involves grasping the interplay between buyers and sellers. As the market evolves, buyers and sellers constantly engage in negotiations to facilitate transactions, with each party seeking favorable price points.

“In the current bullish phase, sellers are reluctant, compelling buyers to bid higher prices to strike a deal. As long as this imbalance persists, buyers will continue to push prices up, driven by exuberance rather than rationale. This situation epitomizes the ‘greater fool’ theory,” we shed light on the prevailing sentiment.

At a certain juncture, this equilibrium may shift, with buyers becoming scarce and reluctant to pay inflated prices, leading to a scenario where sellers rush to offload their positions amid a dwindling pool of buyers. This chain reaction could result in panic selling as prices plummet.

Simply put, “Sellers live higher. Buyers live lower,” encapsulating the essence of market fluctuations.

Visualizing these principles, a chart delineating the distribution of buyers and sellers reveals the predominant volume regions.

The ongoing correction, appearing increasingly oversold, may herald a potential rebound towards the 50-day moving average. Reflecting on the correction from the previous year, where a similar oversold scenario paved the way for risk mitigation and portfolio hedging, investors might find an opportune moment to recalibrate their positions.

Fluctuating Sentiment Landscape

Revisiting the sentiment index, the recent swift reversal of bullish investor sentiment across various domains warrants attention. The amalgamated net bullish sentiment index among retail and professional investors juxtaposed with the volatility index signals concerning trends.

Typically, in the face of a market correction, the sentiment index tends to bottom out within the range of 0 to -20. With the latest reading at 4.15, down from 25.99 a mere fortnight ago, a substantial reversal in bullish sentiment is evident.

Moreover, professional investors, historically prone to entering the market at its zenith, witnessed a sharp decline in equity allocations from 103.88% to 62.98% within a short span, reflecting changing market dynamics.

Market Correction Signals Potential Rebound

Decrease in Buy Signals and Stock Performance

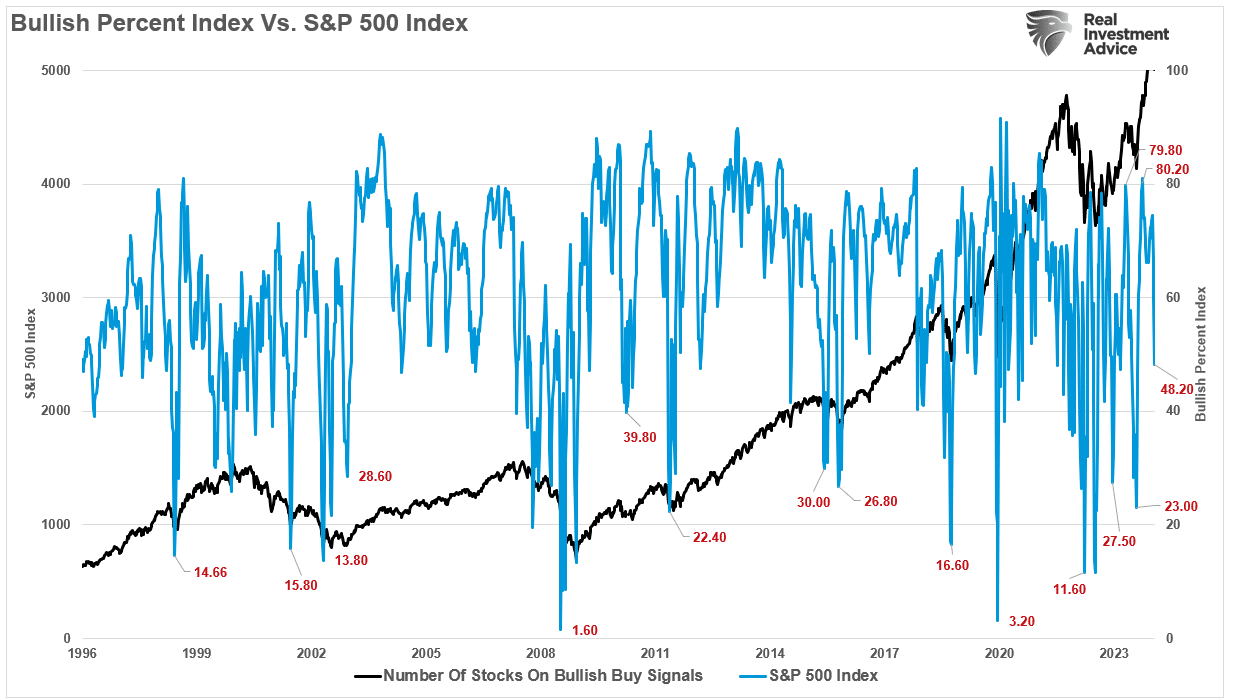

Amidst market volatility, the number of stocks on bullish “buy signals” has plummeted from 80.2 to 48.2. The decrease is further accentuated by the decline in stocks trading above the 50-day moving average, dropping from over 80% to 37%. Money flows have also hit levels lower than previous market bottoms, indicating a significant shift in market sentiment.

Foreseeable Market Movement

Despite the recent downturn, there is anticipation for a reflexive rally in the markets due to short-term oversold conditions. However, caution is advised as numerous bullish investors are caught in the selloff, potentially leading to further selling pressure in response to any market rebounds.

Observing the current “panic” in media headlines, it is essential to recognize the correction as a transient phase within an overarching bullish market. The imminent resumption of corporate share buybacks in May is poised to provide indispensable market support through the upcoming summer months.

Considering historical trends, while the current correction signifies a bumpy road ahead, it may not mark the final turbulence for the year. Precedent dictates the possibility of additional market fluctuations, particularly leading up to what promises to be a hotly contested election cycle.

However, detailed analysis of such future events is best reserved for their respective times.