Meta Platforms Inc. META is ablaze, recently achieving a remarkable 52-week peak of $588.80 on Oct. 4, 2024. With a year-to-date leap of 68.65% and a striking 91.12% surge over the past year, the stock dwells in the buoyant limelight.

The Ascendancy of Zuckerberg Over Bezos and Meta’s Stock

While Meta ascends, its CEO Mark Zuckerberg also scales heights, outstripping Amazon.com Inc. AMZN founder Jeff Bezos to claim the position of the world’s second-richest individual, boasting a net worth of $206.2 billion. A double triumph indeed!

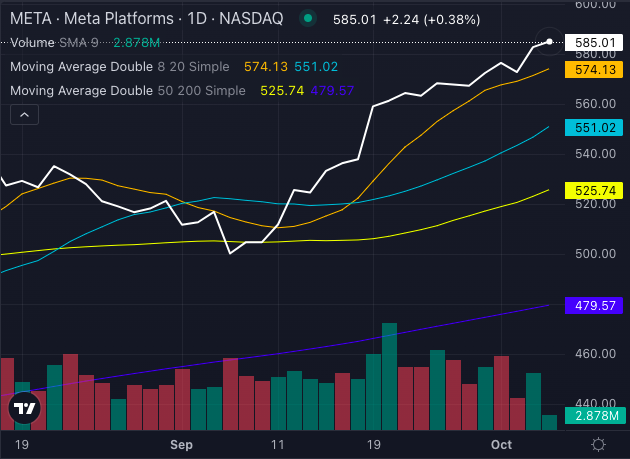

The technical signs stand firmly in Meta’s favor.

Chart created using Benzinga Pro

Presently trading around $585.01, the stock comfortably surpasses its five-, 20- and 50-day exponential moving averages, denoting a robustly bullish trajectory. The eight-day simple moving average stands at $574.13, while the 20-day and 50-day SMAs are at $551.02 and $525.74, correspondingly.

Even the 200-day SMA at $479.57 contributes to this bullish storyline.

Chart created using Benzinga Pro

The Moving Average Convergence Divergence (MACD) indicator, standing at a sturdy 16.69, further buttresses this momentum.

Yet, the Relative Strength Index (RSI) perches at 75.72, hinting that the stock might be overbought, potentially inviting a brief pullback.

Meta’s Future: AI Focus and Promising Ventures

Beyond the technical prowess, Meta captures attention with its ambitious pivot towards artificial intelligence. Pledging substantial investments for 2024, the firm strives to enrich user interactions and refine ad targeting across its platforms.

With escalating ad impressions and deepening user involvement, Meta isn’t merely tailing the AI trend; it stands among the vanguards. This strategic direction poises Meta to dominate the digital advertising sphere, heralding an enticing trajectory for investors.

As Zuckerberg’s wealth climbs and Meta’s shares scale new peaks, the fusion of robust technical cues and innovative strategies paints a radiant vista for the future.

Venture forth, investors; the trajectory with Meta Platforms promises an exhilarating voyage!