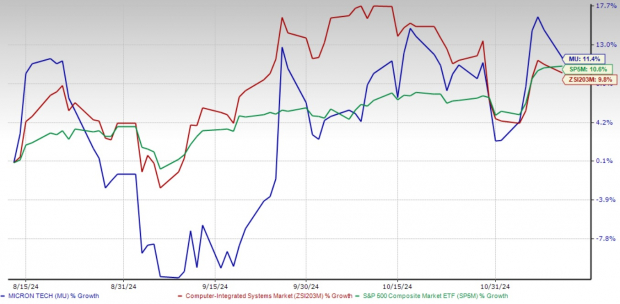

Micron Technology, Inc. MU, a leader in the semiconductor sector, has shown resilience amid turbulent market conditions. The Boise, ID-based memory chip maker has surged by 11.4% in the past three months, outperforming the Zacks Computer – Integrated System industry and the S&P 500, which rose 9.8% and 10.6%, respectively. This solid performance prompts investors to question whether it’s the right time to buy, sell or hold Micron stock.

3-Month Price Return Performance

Image Source: Zacks Investment Research

Industry Trends Boost Micron’s Prospects

Micron is strategically positioned to benefit from several industry trends, especially in memory and storage solutions like DRAM and NAND. With the surge of artificial intelligence (AI) applications, demand for high-performance memory has soared. Micron’s investments in advanced DRAM and 3D NAND technologies align seamlessly with this demand, enhancing its competitive edge and paving the way for stronger profitability in the long run.

The company’s focus extends beyond AI to high-growth areas such as automotive, industrial IoT and data centers. This diversification strategy minimizes its reliance on consumer electronics, which are prone to demand volatility, and supports more stable revenue streams. By catering to a broad spectrum of the tech industry, Micron ensures it maintains a pivotal role in the evolving semiconductor landscape.

Micron’s Strength in Product Portfolio and Key Partnerships

Micron’s diverse product lineup, including DRAM and NAND chips for PCs, servers and mobile devices, strengthens its market position and aids in winning significant deals. Its GDDR7 graphics memory is under testing by Advanced Micro Devices AMD and Cadence Design Systems CDNS. AMD aims to use this memory to boost gaming performance, while Cadence tests it for its GDDR7 PHY IP, showcasing Micron’s relevance in cutting-edge technology.

Further bolstering its market stance, Micron’s high-bandwidth memory (HBM3E) will power NVIDIA’s NVDA upcoming AI chip, the H200, which is set to replace the highly popular H100 chip. Micron has already sold out its HBM supply for 2024 and secured substantial orders for 2025. These key partnerships underline Micron’s integral role within the tech ecosystem and highlight its growth potential.

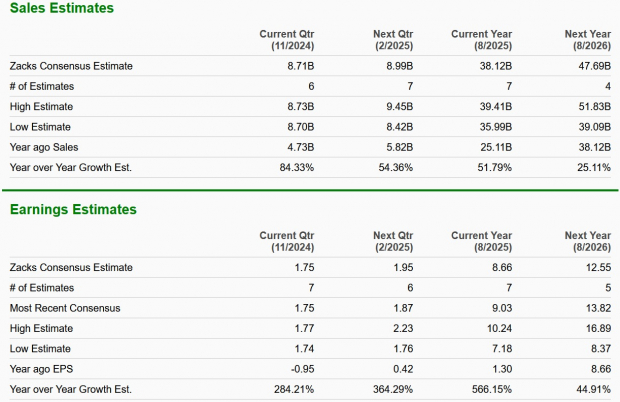

Micron’s Financial Resilience and Positive Growth Outlook

Micron’s financial performance has rebounded impressively after facing significant challenges in late 2022 and early 2023. The company has consistently beaten the Zacks Consensus Estimate for earnings over the past four quarters, with an average surprise of 72.7%. This signals a robust turnaround and underscores Micron’s capacity to adapt and recover.

Micron Technology, Inc. Price, Consensus and EPS Surprise

Micron Technology, Inc. price-consensus-eps-surprise-chart | Micron Technology, Inc. Quote

The outlook for fiscal 2025 and 2026 also points to continued growth, supported by Micron’s significant investments in memory technologies and a focus on high-growth markets. These strategies provide a strong foundation for long-term sustainability and performance.

Image Source: Zacks Investment Research

Challenges Looming on the Horizon for Micron

Despite a positive outlook, Micron faces potential headwinds that could dampen its momentum. Chief among these is the risk of oversupply in the high-bandwidth memory (HBM) market. HBM chips are critical for Micron’s revenues, especially as AI and data center demand remain strong. In fiscal 2024, HBM contributed significantly to its top line, and the company anticipates billions in revenues from this segment in 2025.

However, an oversupply of HBM chips could lead to a decline in average selling prices (ASPs), pressuring profit margins. Since Micron’s growth strategy is heavily dependent on AI-driven demand for memory solutions, a sudden dip in ASPs could impact future earnings and create uncertainty around its growth trajectory.

Conclusion: Hold MU Stock for Now

Micron’s solid market positioning, diversified product lineup and strong partnerships underscore its growth potential. However, near-term risks, including the potential for HBM oversupply and pricing pressures, suggest caution.

Given the balance between its robust fundamentals and these looming challenges, holding Micron stock appears to be the most prudent move for now. Investors should watch for developments in the memory market to reassess their positions on this Zacks Rank #3 (Hold) stock as conditions evolve. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report