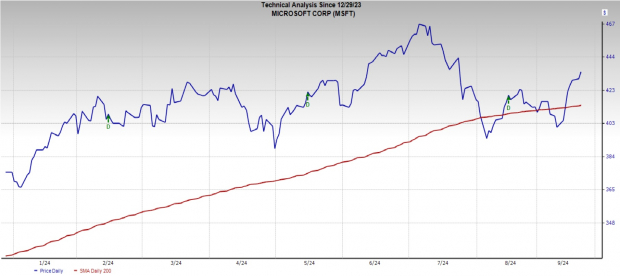

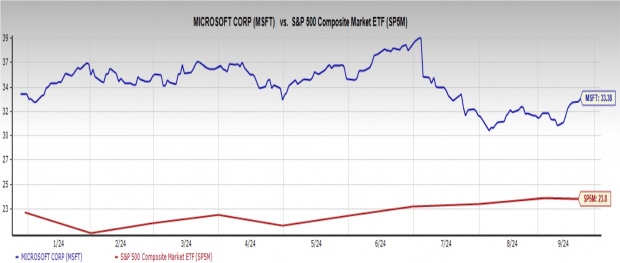

One of the magnificent 7 stocks, Microsoft Corporation MSFT, is part of the $3 trillion club as its shares have seen an impressive run over the past few years. However, after hitting a record high on July 5, the MSFT stock has underperformed the S&P 500 this year (+15.9% vs. +18.1%).

Image Source: Zacks Investment Research

But will Microsoft’s recent share repurchase program boost its stock price and provide an ideal entry point for potential buyers? Let’s see –

Microsoft Stock – Share Repurchase Plan

Microsoft recently approved a stock-buyback program, a shareholder-friendly initiative. Microsoft’s new $60 billion share repurchase program is the third largest this year after stock buyback authorizations of $100 billion and $70 billion by Apple Inc. AAPL and Amazon.com, Inc. AMZN, respectively.

NVIDIA Corporation NVDA and Meta Platforms, Inc. META had earlier approved $50 billion share repurchase programs. However, Microsoft’s new stock repurchase program matched its largest-ever buyback program (read more: NVIDIA Approves $50 Billion Stock Buyback: Time to Buy?).

Stock Buyback – A Good Sign for Microsoft

Microsoft’s share repurchases indicate that the company’s board of directors is hopeful about its future business scenarios.

The repurchase program is aimed at Microsoft acquiring its outstanding shares and reducing the numbers available in the open market. This, in turn, would increase the value of the remaining shares, a boon for Microsoft’s shareholders.

Microsoft is opting for a buyback to boost earnings per share (EPS) vis-à-vis the stock price. Microsoft stock, currently, is trading above the 200-day moving average (DMA), indicating a long-term uptrend.

Image Source: Zacks Investment Research

Key MSFT Tailwinds: Azure Growth, Strong ROE, Dividend Hike

Microsoft’s coveted Azure and cloud services business has generated a revenue growth of 29% year over year in the fiscal fourth quarter of 2024. Azure’s growth strengthened Microsoft’s position in the highly competitive cloud-computing market, mostly dominated by Amazon Web Services (AWS).

Microsoft has already spent $55.7 billion in fiscal 2024 on its cloud business and plans to increase its capital expenditures as Azure has picked up steam. The Azure cloud infrastructure unit is growing faster than AWS and if the trend persists, Azure could be the industry leader soon. In 2019, Azure was half the size of AWS, but now it’s three-quarters! As a result, the $13.04 Zacks Consensus Estimate for MSFT’s EPS is up 5% yearly.

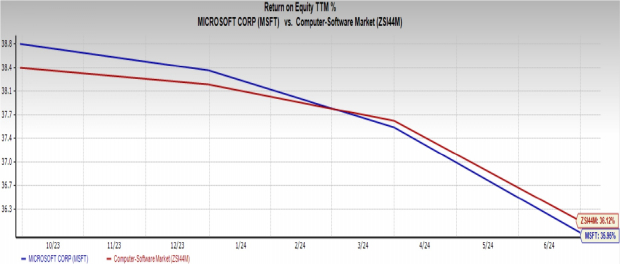

Image Source: Zacks Investment Research

Microsoft is generating profits competently and has used the capital optimally invested by shareholders. After all, Microsoft’s return on equity (ROE) is 36%, almost neck and neck with the Computer – Software industry’s 36.1%. Any reading above 20% is likely considered to be very strong.

Image Source: Zacks Investment Research

Microsoft has a strong cash balance of $75.54 billion (as of June 30, 2024), which would help it pay off its dues and boost shareholders’ wealth through dividends. Microsoft recently announced a quarterly dividend of 83 cents a share to be paid on Dec. 12, 2024, up 10% from the previous quarter’s payout. Microsoft’s dividend payout has increased by almost 10.3% in the past five years, indicating a sound business model.

Image Source: Zacks Investment Research

Buy, Hold, or Sell MSFT Stock?

Introducing a share repurchase plan, the possibility of Azure taking the lead from AWS, and generating a guaranteed income through dividends should allure anyone to buy MSFT shares.

However, the MSFT stock is expensive. Its price/earnings ratio is 33.3X forward earnings, while the broader S&P 500’s forward earnings multiple is 23.8X.

Image Source: Zacks Investment Research

Hence, it’s prudent for astute investors to wait for the opportune moment to buy MSFT stock and not burn a hole in one’s pocket. For those invested in MSFT stock, hold on to it, since Microsoft is a blue-chip company having a long track record of profitability. Currently, Microsoft has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report