MongoDB MDB is laying the groundwork for sustained subscription growth through a focused, long-term approach. The company is doubling down on the enterprise segment, where it sees the biggest potential, while also scaling its self-serve channel, which it calls a powerful engine for future growth. Many of the new users signing up for Atlas are first-time MongoDB customers, and the company is investing in onboarding and developer education to ensure they get the most out of the platform.

A major part of MongoDB’s strategy involves AI. The company is combining real-time data, search and retrieval into a single platform to make it easier for developers to build intelligent applications. With its Voyage AI acquisition, MongoDB has added advanced embedding and reranking models. The latest version, Voyage 3.5, improves accuracy while significantly lowering storage costs. MongoDB also plans to roll out a new feature that allows developers to generate embeddings directly from data within its platform.

To expand global adoption, MongoDB is reaching out to developers in multiple languages and ecosystems. It has added documentation in Mandarin, Portuguese, Korean and Japanese. At the same time, it is targeting relational developers with certifications, training and self-serve courses to help them transition into modern app development.

In the first quarter of fiscal 2026, MongoDB’s Subscription revenues were $531.5 million (96.8% of total revenues), which increased 21.6% year over year. Total customer count increased 16.05% year over year to 57,100. MDB is seeing solid growth in its subscriptions, and the ongoing, as well as the planned initiatives, are going to drive further growth in the coming quarters. The Zacks Consensus Estimate for second-quarter 2025 Subscription revenues is pegged at $537.49 million.

MDB Competes for Subscriptions in the Database Market

MongoDB competes with tech behemoths, such as Amazon AMZN and Microsoft MSFT, providing subscription-based services for its cloud databases.

Amazon is enhancing its AWS database services by adding serverless options that automatically scale based on demand, removing the need for manual capacity management, making it easier for customers. Amazon is also integrating AI capabilities into its database offerings to support more advanced and dynamic application workloads.

Microsoft is doing something similar by enhancing Azure’s database services by rolling out serverless capabilities, like autoscaling and per???second billing in Azure Cosmos DB and Azure SQL, to make usage more flexible and cost-effective. Microsoft is also embedding AI directly into its databases, with features like vector search, semantic queries in SQL Server???2025 Preview, and deep integrations between Cosmos DB and the Azure AI ecosystem.

MDB’s Share Price Performance, Valuation and Estimates

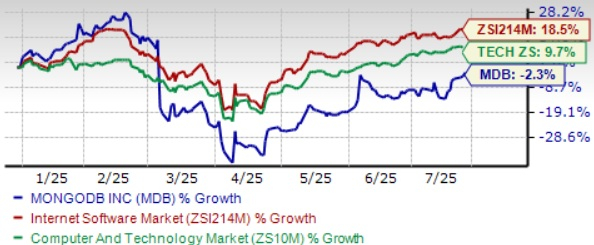

MDB shares have lost 2.3% in the year-to-date (YTD) period, underperforming the Zacks Internet – Software industry’s growth of 18.5% and the Zacks Computer and Technology sector’s return of 9.7%.

MDB’s YTD Price Performance

Image Source: Zacks Investment Research

From a valuation standpoint, MongoDB stock is currently trading at a forward 12-month Price/Sales ratio of 7.50X compared with the industry’s 5.85X. MDB has a Value Score of F.

MDB Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for second-quarter fiscal 2026 earnings is pegged at 64 cents per share, which has remained unchanged over the past 30 days, indicating an 8.57% year-over-year decline.

MongoDB, Inc. Price and Consensus

MongoDB, Inc. price-consensus-chart | MongoDB, Inc. Quote

MongoDB currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

MongoDB, Inc. (MDB) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).