The Path to Profitability on Wall Street

Because the future is uncertain and unpredictable, market participants must understand that only some trades will work out in their favor. That said, savvy investors understand that if they can cut their losers and catch a few winners, the straightforward math behind successful investing will work in their favor in the long run. Billionaire investing legend Paul Tudor Jones said it best when describing his reward-to-risk ratio:

PTJ on his 5/1 risk/reward protocol:

“Five to one means I’m risking one dollar to make five. What five to one does is allow you to have a hit ratio of 20%. I can actually be a complete imbecile. I can be wrong 80% of the time, and I’m still not going to lose.” ~Paul Tudor Jones

In other words, investors should focus on finding a few big winners each year and cut their losses when incorrect.

Want to Find Future Winners? Study Past Winners

Of course, every investor wants to find big winners. Nevertheless, most investors fail to find big winners because the fail to study the past. While the future is always uncertain, history doesn’t always repeat but tends to rhyme. That’s why famous growth investor William O’Neil kept a “Model Book” of past winners and why legendary investor Jesse Livermore said the following:

“There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in thestock market todayhas happened before and will happen again.” ~Jesse Livermore

MicroStrategy Trade Review

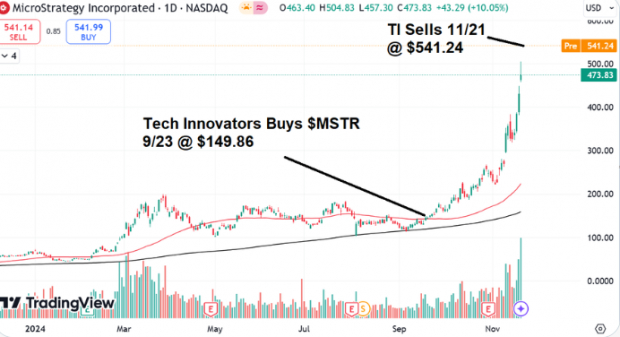

In case you don’t know, I run the “Technology Innovators” premium service for Zacks. Today, we will review my top trade of 2024. On September 23rd, I sent an alert to buy MicroStrategy (MSTR) at $149.86. We sold MSTR roughly two months later, on November 21st, at $535.63 for a gain of 257.42%.

Image Source: Zacks Investment Research

The purpose of this article is not to brag, but instead to show the thought process behind a winning trade so that it can hopefully be replicated.

About MSTR

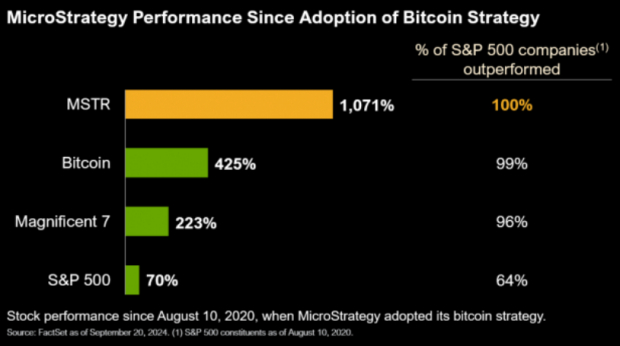

For years, Michael Saylor had been concerned that the monetary system has been expanding by approximately 7% per year while inflation tends to rise about 2% annually. In late 202, Michael Saylor, MSTR’s founder and former CEO decided to take action and adopt what he refers to as “The Bitcoin Standard.”

“What we (MSTR) were doing was that were inverting the balance sheet such that we’re floating on a Bitcoin sail, on a crypto sail if you will, and as the liquidity and the monetary system get pumped up, we want it to float, rather than sink, on that pool of liquidity.” ~Michael Saylor

Takeaway: Look for disruptors and companies doing something innovative in growing industries.

Image Source: FactSet

Bullish Catalysts for MSTR Stock

Bitcoin and MSTR had been criticized for years, but the narrative and landscape were changing. Bullish catalysts included:

· Real-world use: More international citizens in countries like Argentina and Turker are using Bitcoin to stave off hyper-inflation than ever before. At the time, Bitcoin (in dollar terms) was well off its highs, but was printing fresh highs against Argentina and Turkey’s currencies – a sign that global real-world adoptions are real.

· Institutional Adoption: Some of the world’s largest asset managers were entering the industry with ETFs. For example, Blackrock (BLK) debuted the iShares Bitcoin ETF (IBIT), and Fidelity’s Fidelity Wise Origin BTC ETF (FBTC) began trading.

· Regulatory Clarity: Industry leaders like Coinbase (COIN) began racking up legal wins in their fight with the Securities and Exchange Commission (SEC).

Takeaway: Look for industry tailwinds and catalysts that can act as rocket fuel for your stock’s price.

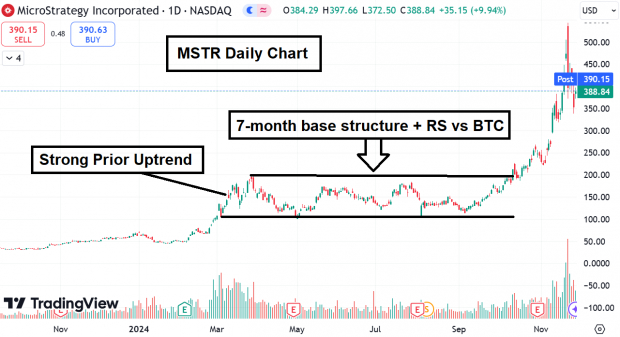

MSTR’s Bullish Technical Pattern & Relative Strength

Without bullish price action, no trade exists (in my experience). Here are three bullish attributes we had at the time we bought:

1. A Strong Prior Uptrend: The easiest way to find the next stock to double is to look for stocks that already have. MSTR shares ripped from $50 to $200 early in 2024.

2. A Long Base Structure: As the old Wall Street adage goes, “The longer the base, the higher in space.” When we bought the stock, MSTR was on the brink of breaking out from a seven-month long base.

3. Relative Price Strength: MSTR exhibited standout relative strength compared to Bitcoin. For example, in April, BTC was $66k and $MSTR was $133. In September BTC was again at $66k but MSTR shares traded at $176. Even when BTC made lower lows, MSTR made higher highs – a subtle sign of strength.

Image Source: TradingView

Blow-off Top = Sell!

Selling is usually more complex than buying, which rang true in this case. MSTR shares were increasing rapidly daily, and selling wasn’t easy. However, MSTR flashed classic signs of a blow-off top in November, including:

1. Fibonacci Extension: MSTR soared to the extreme 4.236% fib extension, which often coincides with tops.

2. Distance from 200-day MA: An excessive distance above the 200-day moving average can mean an overly frothy move. At the time we sold MSTR shares were a nosebleed 201% above the 200-day moving average.

3. Massive volume: Volume matched the excessiveness witnessed in price. Turnover exceeded the 50-day average for twelve straight sessions, and MSTR trading even exceeded that of Nvidia (NVDA) and Tesla (TSLA).

4. Larger Point Spreads: MSTR traded near $50 early in the year. By the time we sold, 50-point moves in a day were common – a sign of irrational exuberance.

Image Source: TradingView

Takeaway: Study past moves to learn sell signals, such as the climax top. Remember to sell when you can, not when you have to.

Bottom Line

Studying past stock market winners can help you to spot the next one. MicroStrategy’s 2024 move was one for the books.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.1% per year. So be sure to give these hand picked 7 your immediate attention.

BlackRock, Inc. (BLK) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report